Before you can pay bills, get paid, or run a business in Korea, you’ll need a bank account.

Whether you’re settling in for personal life or setting up a business, the steps are pretty straightforward once you know what to expect.

In this guide, we’ll break down everything you need to know about how to open a bank account in Korea. We’ll also disclose a little tip at the end to help you make the right choice.

Let’s dive in!

Table of Contents

Key Takeaways

- Many Korean banks require that you have an ARC (Alien Registration Card) before you can open an account. In cases where it’s not a requirement for the desired bank, you’ll find out later that the account is ineffective without it.

- To open a bank account in Korea, you have to physically visit a bank branch.

- There are numerous factors to consider before you can fully understand how to open a bank account in Korea. Language barrier, for example, is one of the most important factors to review.

- As a foreigner in Korea, you can decide to open a physical or digital account, the latter bearing more advantages than the former.

How to Open a Bank Account in Korea as a Foreigner

There are several methods when it comes to opening a bank account in Korea. This section gives a step-by-step direction on how to go about it.

Step 1: Choose a Bank

South Korea has a highly developed banking system, but not all banks are foreigner-friendly.

To open a bank account in Korea, choose a bank that supports non-Korean speakers, offers services you need (like international transfers or debit cards), and provides clear account policies.

To help you decide, here’s a comparison of some of the most popular banks in Korea for foreigners:

Step 2: Prepare the Required Documents

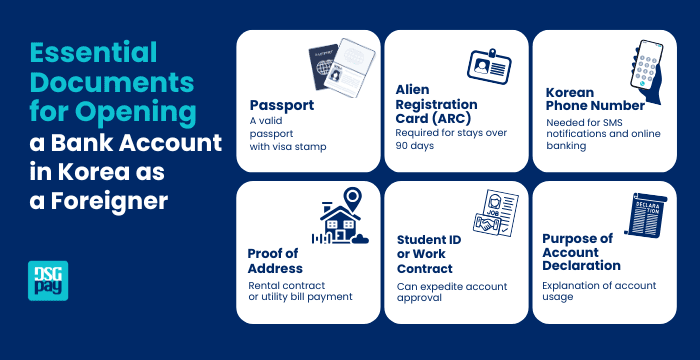

Once you’ve chosen a bank, make sure you have all the necessary paperwork. Here are some details that banks typically request.

- Passport: A valid passport with your visa stamp is mandatory.

- Alien Registration Card (ARC): Most banks will not allow you to open a bank account without an ARC. You’ll need to apply for one if you’re staying in Korea for more than 90 days.

- Korean Phone Number: This is required for SMS notifications and online banking registration.

- Proof of Address: You may be required to provide proof of address, a rental contract, or a utility bill payment.

- Student ID or Work Contract: If applicable, this can sometimes help expedite your account approval.

- Purpose of Account Declaration: You may be asked why you’re opening an account (e.g., to receive salary, pay rent, etc.).

Without an ARC, some banks may offer a limited-usage account (for example, a low transfer/withdrawal limit). However, this also depends on the desired bank branch and visa status.

Step 3: Visit the Branch

Opening a bank account online is still quite challenging for foreigners in Korea. It’s important that you visit a bank branch to open an account.

Here’s how to go about it. First, you need to

- Visit a branch popular among expatriates, tourists, foreigners, etc. You’ll find a lot of them in the universities, embassies, and expat communities.

- Take a number and wait for your turn. You may typically find a queue and wait in line for your turn.

- Let the banker know you want to open a new account. Speaking simple English is usually fine. If not, try to have a friend/tourist guide who is fluent in the language accompany you. If that’s not possible, you can use a translation app for guidance.

- Provide your documents. Be prepared to make multiple photocopies and sign multiple times.

Most bank staff are helpful, and major branches will often have English-speaking representatives or translation services.

Step 4: Choose an Account Type

As a foreigner, you can either open a savings account or a deposit account.

Here are some guides to help you fully understand how to open a bank account in Korea.

- Standard Savings Account: This account comes with normal basic banking capabilities, an ATM card, and mobile banking features.

- Salary Account: These accounts are for workers receiving monthly wages. It may also come with some other perks on the side, depending on whether your bank offers them.

- Foreign Currency Account: If you’re receiving money in USD or other currencies, this is the type of account you ought to sign up for.

- Global Account: This type of account is available at banks like Woori. They offer built-in foreign remittance and multiple languages.

You should let the banker know what you need the account for, and they’ll help match the right account type for you.

For example, you may need a Korean bank account for seamless business transactions, school payment transparency, and more. You may also need an account to manage your Korean wholesale suppliers or other business ventures.

Step 5: Register for Online and Mobile Banking

Korean banks are highly digital, but getting access to mobile apps and online banking features often requires extra steps as a foreigner. You might need the following:

- Mobile Number Verification: You’ll need a phone number under your own name.

- Digital Certificate Installation: Korea uses security certificates for online banking. The setup can be complex and often requires Korean input.

Once your account is active, you’ll likely receive a:

- ATM/Debit Card

- Account Passbook

- Instructions for mobile banking setup

Although many online banking apps are automatically translated into Korean, some banks, like Shinhan and KEB Hana, have a solid English interface. Regardless, this is something a good translator tool or tourist guide can help with.

Tip: Ask the bank staff to help you download and register for the app before leaving the branch.

Step 6: Make Your First Deposit

Deposit your initial funds into the account to properly activate it. Ask the bank for the minimum and maximum limits on your account to get a better understanding of your account.

Virtual Account: The Alternative to a Bank Account in Korea

Wondering how to open a bank account in Korea but not currently in the country? Here’s how to go about it.

Opening a physical account in Korea is challenging, especially for a foreigner. However, opening a virtual account for domestic and international transfers is the best option.

Virtual accounts are digital accounts that allow you to send and receive money across borders without any interference. DSGPay is one of the best ways to streamline payment transactions in Korea for foreign founders, tourists, expatriates, students, and more.

With features like real-time transfers, low fees, and seamless integration with online payment platforms, virtual accounts are becoming the preferred choice for modern banking needs.

Why is DSGPay the Best Alternative to a Bank Account in Korea

- Open a KRW Account in Your Name: Whether you’re a freelancer, digital nomad, or business owner, you can get a locally named KRW virtual account with no need to visit Korea or deal with complicated bank paperwork.

- Collect and Send Payments Like a Local: Get paid by Korean clients or transfer money to Korea with ease. Your DSGPay account works just like a Korean bank account, only faster and more flexible.

- Use Over 30 Currencies in One Account: Not just KRW, DSGPay supports USD, EUR, GBP, HKD, SGD, and more. Perfect for individuals or businesses dealing with global clients or suppliers.

- Save on Fees, Boost Your Margins: Forget high bank charges. DSGPay offers low transaction fees and competitive FX rates, helping you keep more of what you earn.

- Send and Receive Money in Real Time: No more waiting around. Transfers happen quickly and securely, so your payments stay on track, whether for personal or business use.

- Stay Compliant with Global Regulations: DSGPay is a licensed Money Service Operator (MSO) in Hong Kong and follows strict AML and compliance standards, keeping your money safe and your operations worry-free.

Traditional Bank vs. Virtual Account: Which One Suits You Best?

There are several reasons why you need a virtual payment account.

In the table below, we’ll divulge the clear differences between traditional payment systems and virtual accounts in Korea, using DSGPay as a formidable example.

DSGPay offers a faster, more flexible way to enjoy banking capabilities without the hurdles, especially if you typically receive payments from abroad, prefer making online payments, are a digital nomad, or are a freelancer dealing with global clients.

Final Thoughts on How to Open a Bank Account in Korea

Understanding how to open a bank account in Korea as a foreigner can seem daunting at first, but with the right guidance, it’s straightforward. Whether you’re a student, expat, freelancer, or business owner, having access to a Korean bank account is key to managing your local finances efficiently.

By following the step-by-step process in this guide, you’re already on the right path. But remember, traditional banking isn’t the only solution. If you’re looking for a faster, easier way to manage cross-border payments or local collections, DSGPay’s virtual accounts offer a powerful alternative with fewer barriers and more flexibility.

FAQs on How to Open a Bank Account in Korea

Can I open an account without an ARC?

Depends on the bank. Some banks offer limited account capabilities to foreigners without an ARC, especially students. But most will require it for a full account.

Do I need a Korean phone number?

Yes. Without one, you cannot register for mobile banking or receive transaction notifications.

Is Korean online banking available in English?

Some banks offer full English online platforms, while others are limited. Woori, and KEB Hana are best for English-speaking users.