30 Currencies, 30 Countries,

Global Transfers Made Easy

Enjoy seamless transfers across 30 currencies and countries. Send or receive payments effortlessly with our fast, secure, and cost-effective mobile app.

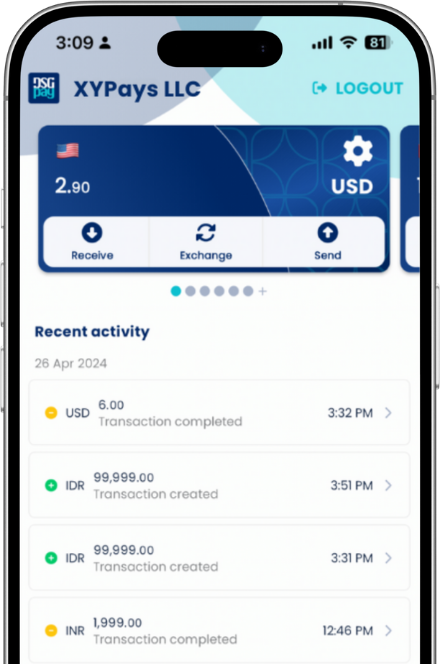

Your Accounts,

Your Business Name

for Credibility

Collecting payments is easy with DSGPay. Our secure platform helps you get paid quickly while keeping your business name front and center, building trust and credibility with your clients.

Manage

Multiple Currencies in One Account

DSGPay makes collecting payments in various currencies easy, allowing you to manage them all in one account without the hassle of multiple setups or complex processes.

Seamless SME

Transactions Tailored

for Different Industries

Send Money with Confidence Backed by

MSO License

Enjoy peace of mind with every transaction, knowing that our services are regulated and compliant under the MSO license.

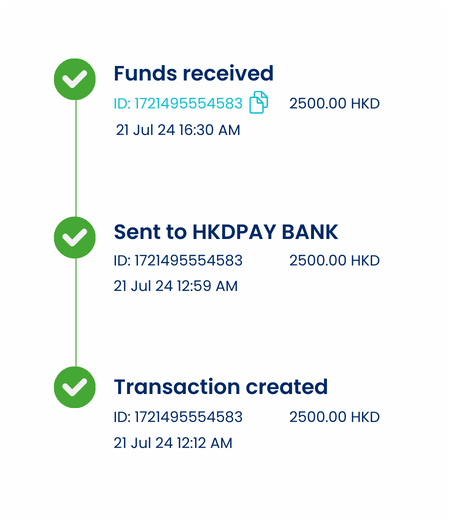

Instant Updates

with Real-Time Notifications

Frequently Asked Questions

Answers at Your Fingertips

Find quick, clear responses to common questions DSGPay users have about using our platform,

from transfer limits to account management features.

To top up your account on DSGPay via SWIFT, simply follow the step-by-step instructions in our tutorial video.

To send money via SWIFT, simply follow the step-by-step instructions in our tutorial video.

For Business Account

For Individual Account

To start using DSGPay, you need to register an account through the mobile app. This step-by-step guide will show you how to download the app, create an account, and set up your profile for a seamless payment experience.

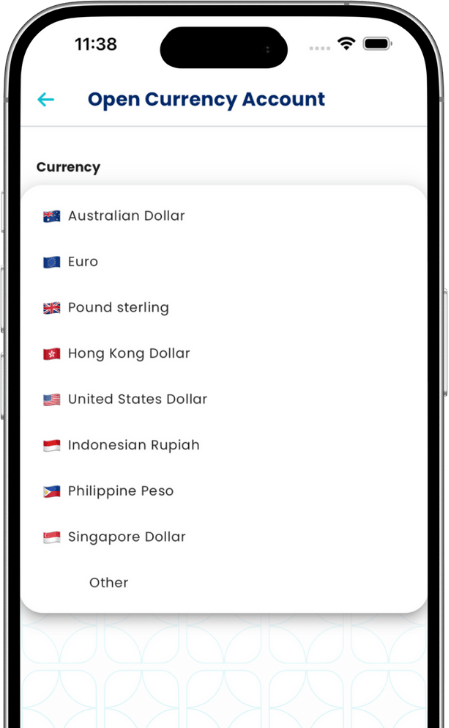

You have the flexibility to maintain multiple currency accounts on DSGPay, as long as they are compatible with the platform. To incorporate additional currency accounts, simply follow these steps:

- Log in to your DSGPay account.

- Go to the ‘Account’ tab.

- Explore the ‘Account’ section to find the option for adding a new currency account.

By following these straightforward steps, you can seamlessly integrate multiple currency accounts into your DSGPay profile, ensuring they align with the platform’s supported currencies.

- Log in and go to the profile page.

- In the ‘Account’ section, click ‘Change my password.’ Verify with your current password.

- Create a new password meeting the criteria.

- Confirm and save by clicking ‘Confirm.’

To receive money locally to a Fixed Account, simply follow the step-by-step instructions in our tutorial video.

To send money locally from your account, simply follow the step-by-step instructions in our tutorial video.

For Business Account

For Individual Account

To verify your DSGPay Business account, start by signing up and providing essential business details. Then, verify your identity with personal information and required documents. Our streamlined online process ensures efficiency, and verification is typically completed within 1-3 working days.

To submit KYC for your business account, simply follow the step-by-step instructions in our tutorial video.

For Business Account

For Individual Account

- Log in to your account.

- Click on your name, navigate to ‘Beneficiary,’ and select ‘Settle Account.’ Choose ‘Add new account.’

- Input bank details and click ‘Save.’

- Confirm the new account in the pop-up.

Note: DSGPay reviews new accounts for security. Check the beneficiary section for status updates. After verification, your account will be ready for use, with a notification from DSGPay.

Cross-Border Payments. Made in Asia.

We are fully licensed by The Hong Kong government. please check our licence. and search for “DollarSmart Global”

Get DSGPay’s latest news

We are fully licensed by The Hong Kong government. please check our licence. and search for “DollarSmart Global”

DOLLARSMART GLOBAL PTE. LTD., A registered money service operator in Hong Kong

(License number: 15-08-01682)

Copyright @2025 DollarSmart Global Pte Ltd. All rights reserved