Are you a local or foreigner looking for the easiest bank to open an account with online? Whether you’re doing this for school, business, or other personal reasons, I have just the right solution for you.

In this blog, we’ll explore the 8 easiest banks to open an account with online in Australia.

Let’s dive right in!

Table of Contents

Easiest Bank to Open an Account With Online – Why You Need to Know

Opening a bank account isn’t just about convenience anymore, it’s a necessity in an increasingly paperless world.

Whether you’re trying to get paid as a freelancer, set up for college funds, or manage day-to-day expenses, the ease and speed of opening an account can affect your overall experience.

For locals, it’s about avoiding red tape. For foreigners, it’s often the first financial step toward settling in Australia. Choosing the easiest bank to open an account with online offers seamless onboarding, minimal documentation, and accessibility.

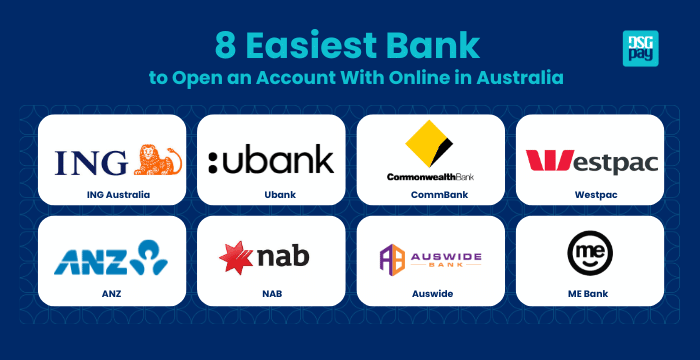

8 Easiest Banks to Open an Account With Online in Australia

Here are some of the easiest banks to open an account with online in Australia:

1. ING Australia

ING is a digital-first bank known for its easy online onboarding. They offer zero monthly fees, high-interest savings accounts, and intuitive digital tools. To be a member, Australian residents can sign up using a local ID like a driver’s license, passport, or a Medicare card. If you’re a foreigner, you’ll have to be present in Australia to open an account here.

- Perks: Supports contactless payment services and has great customer service.

- Cons: It’s not easily accessible to foreigners, doesn’t support international bank-to-bank transfer, and has no physical branch.

2. Ubank

Ubank is a fully digital neobank (a subsidiary of NAB). However, they don’t support international or non-resident applications. This digital bank is best for tech-savvy locals seeking a fast and fee-free banking experience. To be a member, all you have to do is follow the prompts on the app, and you’ll have a functional account within minutes. Remember you have to be an Australian resident to qualify. They’ll also request documents such as a Medicare card or a driver’s license.

- Perks: Low fees, high interest rate, insured by the Australian government’s Financial Claims Scheme.

- Cons: No physical brand and limited banking services.

3. Commonwealth Bank (CommBank)

One of the easiest banks to open an account with online, CommBank offers an easy-to-navigate online account setup for both locals and foreigners. If you’re a local, use a standard Australian ID to create an account, while foreigners can start their applications overseas using a passport and visa. However, you’ll have to do an in-person ID verification once you arrive in Australia. Additionally, the bank caters well to students and immigrants, with dedicated support and no-fee student accounts.

- Perks: Australia’s largest ATM network, offers full-banking service, supports sign-ups in and outside Australia.

- Cons: High fees compared to competitors and limited savings capabilities.

4. Westpac

Westpac allows international customers to open an account online up to 12 months before arriving in Australia. You’ll need a passport, a visa, and an Australian address to make this happen. However, final ID verification must take place in a physical branch. This is an ideal bank for new immigrants and students, plus it offers extensive customer support and a wide ATM network.

- Perks: Offers student-friendly accounts and supports international transfers.

- Cons: High Fees compared to competitors.

5. ANZ

ANZ supports international account openings through an immigrant banking program. Foreigners can open accounts before arriving in Australia with a passport and visa. Like others, in-person verification is needed upon arrival. The bank is known for its reliability, and its mobile banking features are easy to navigate.

- Perks: Well-rounded services, secure mobile banking, and multilingual support.

- Cons: Less competitive interest rates.

6. NAB (National Australia Bank)

NAB supports both local and foreign registration. If you’re a local resident in Australia, you’ll can open an account instantly using an Australian ID. But as a foreigner, you can register days ahead of your date of arrival in Australia. The bank has no monthly fees on selected accounts and is known for its strong digital tools and customer service.

- Perks: No monthly fees on basic accounts, user-friendly app, and speedy setup.

- Cons: High international transaction fees and limited interest rates.

7. Auswide Bank

Auswide is a small regional bank that offers online account opening mainly for locals. To register, you’ll need proof of Australian residency and a utility bill or ID. While not an ideal option for foreigners, they offer adequate banking services for their target customers.

- Perks: Personalised customer service, competitive interest rates, and user-friendly applications.

- Cons: Limited physical presence and a zero-reward program.

8. ME Bank

ME Bank is an online-only bank geared toward Australian residents. It’s also one of the easiest banks to open an account with online. Applicants need a Medicare card, a driver’s license, or utility bills to complete registration. There’s no branch network, but it provides fee-free banking, solid savings options, and one of the smoothest digital banking experiences in Australia.

- Perks: No account fees, competitive savings interest, and a simple app interface.

- Cons: Limited access to foreigners

Comparing the Easiest Bank to Open an Account With Online

Choosing a bank depends on what you need: ease, speed, expat accessibility, and more.

Top Picks by Use Case

- Best for expats/newcomers: Commonwealth Bank, ANZ, Westpac

- Best for locals who want no fees: ING, Ubank, ME Bank

- Best for digital nomads: Westpac

- Best overall experience: NAB

Below are some of the qualities of the easiest bank to open an account with online in Australia.

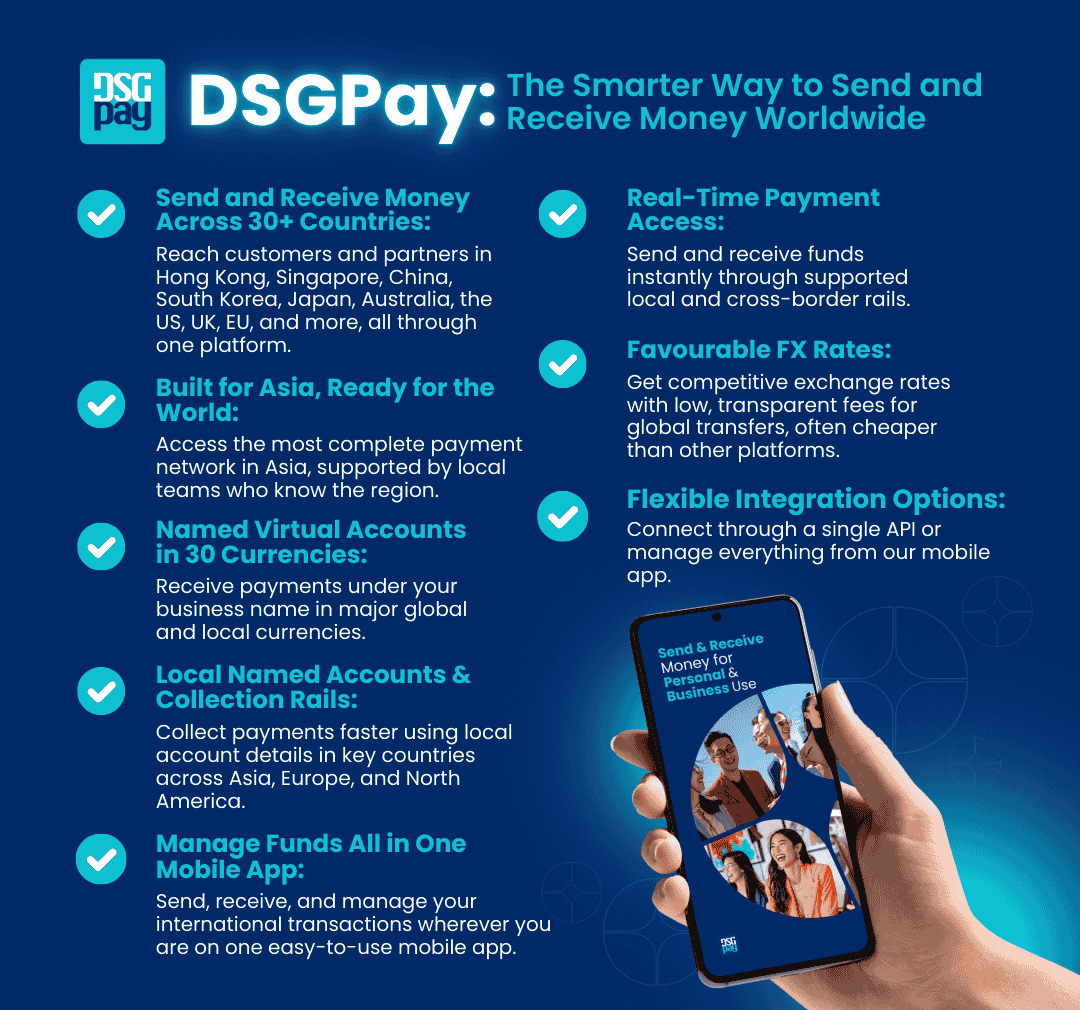

DSGPay: An Easier Way to Open an AUD Account Online

While many Australian banks offer great online account opening options, the process can still be difficult for some individuals, particularly non-residents or those applying from abroad.

With DSGPay, you can open an AUD virtual account in your own name entirely online. Even better, DSGPay supports PayID, allowing you to receive payments from Australia in real time using just your email address, phone number, or business name.

PayID is a widely used payment method in Australia that eliminates the need to share long bank account numbers. It allows fast, secure, and convenient transfers between banks.

Why Choose DSGPay?

- PayID supports real-time and simplified local payments.

- Named virtual accounts for AUD collections.

- Multi-currency access (30+ currencies including AUD, USD, GBP, HKD, and more).

- Competitive FX rates and low international transfer fees.

- Easy account management via mobile app.

- Fully online onboarding from anywhere in the world.

- No Australian address or branch visit required.

It’s ideal for freelancers, remote workers, startups, and global businesses that need to collect or send payments in Australian dollars and beyond. DSGPay offers the flexibility of a modern payment platform with the key benefits of local infrastructure.

FAQs: Easiest Bank to Open an Account With Online in Australia

Q: Can foreigners open a bank account online in Australia?

Yes, several major Australian banks, such as CommBank, Westpac, ANZ, and NAB, allow foreigners to open an account online before arriving in the country.

If you’re not planning to arrive soon or need a faster alternative, DSGPay offers a fully online solution with no branch visits.

Q: Do I Need an Australian Address to Open an Account?

Some banks require it, while DSGPay allows you to register with your overseas address.

Q: Which online bank in Australia offers the fastest sign-up?

For Australian residents, Ubank is among the fastest, offering account setup in under five minutes through its app. ME Bank and ING also offer fast digital onboarding for locals.

Q: Can I receive international payments with an Australian bank account?

Yes, but traditional banks may charge high FX fees or delays.

DSGPay offers faster and lower-cost international transfers in 30+ currencies, making it a smart option for freelancers, remote workers, or business owners.

Final Thoughts: Choosing the Easiest Online Bank in Australia

Opening a bank account online in Australia has never been more accessible, whether you’re a local seeking low fees and fast onboarding, or a foreigner planning your move.

From digital-first banks like Ubank and ME Bank to full-service institutions like NAB, CommBank, and Westpac, there’s an option for nearly every use case.

However, if you’re outside Australia, lack local documentation and can’t open an Australian bank account, or simply want a faster, more flexible alternative, DSGPay offers a practical solution. With named virtual accounts, multi-currency support, and no requirement for an Australian address or in-person visit, it’s built for freelancers, business owners, and digital nomads who need global access with local efficiency.