It’s no secret that online payment solutions are essential to the success of any modern business. Hong Kong being the business hub of Asia, offers significant opportunities for businesses looking to expand in the country and the rest of the region.

Are you looking for different options to collect and send payments through a payment gateway? We’ve put together a list of the top 11 payment gateways that businesses in Hong Kong can use.

Table of Contents

What is a Payment Gateway?

To put it simply, a payment gateway is like a middleman that connects businesses and customers, allowing businesses to accept online payments securely. A payment gateway encrypts sensitive information, such as credit card numbers, to ensure secure transactions.

It’s important for business owners to offer a variety of payment options to their customers to remain competitive in the market. With a range of options, customers have more flexibility in doing business with you, increasing the chances of a sale.

11 Best Hong Kong Payment Gateways

Stripe

Stripe is one of the popular payment gateways used by businesses globally. With its easy integration process and simple user interface, Stripe is a top choice for businesses in Hong Kong. Stripe is also known for its strong security measures, making it a trusted payment solution for both customers and businesses. Especially for small business owners, Stripe offers an easy way to process payments, allowing SMEs to customise their customers’ checkout experience and providing extensive point-of-sale (POS) tools.

Features

- Payments for business

- Instant payment processing

- Accepts all major credit and debit cards

- Multicurrency support of over 135 currencies

- No code payment links

- Fraud protection

Fees

| Transaction Type | Fee Structure (in HKD) |

| Online Cards and Digital Wallets | 2.9% + HKD 2.34 per transaction |

| Manually Entered Cards | 3.4% + HKD 2.34 per transaction |

| International Cards | 4.4% + HKD 2.34 per transaction |

| ACH Direct Debit | 0.8% (HKD 39 max) per transaction |

| Stripe Terminal (In-Person Cards and Wallets) | 2.7% + HKD 0.39 per transaction |

| Tap to Pay | HKD 0.78 per authorisation |

| Currency Conversion | 1% per transaction |

Pros

- Seamless integration and user-friendly interface

- Effortless invoicing and enhanced security

- Versatile integrations and customisation

- Real-time notifications and speedy deposits

- Efficiency in credit card refunds and chargebacks

Cons

- Limited data input options for external payments

- Inability to provide discounted rates at lower thresholds

- Complex reporting and reconciliation glitches

PayPal

PayPal is a payment processing solution used by millions of e-commerce businesses, including those in Hong Kong, to facilitate transactions. One of its key advantages is its versatility, making it accessible and easily integrated for businesses of any size. Over the years, PayPal has gained a reputation as a trustworthy and reliable payment processing company. This is due to its advanced security measures, such as strong data encryption and real-time monitoring, as well as its buyer and seller protection policies.

Features

- Debit and credit card transactions

- PayPal risk management

- Comprehensive finance loans

- Efficient invoicing tools

- PayPal Pay Later

- Built-in POS system

- Multi-currency mass payments

- Online checkout solution

Fees

| Customer Location | Transaction Fee |

| Local (Hong Kong) | 3.9% + HKD 2.35 per transaction |

| Overseas | 4.4% + Fixed fees Variable (Currency-based) |

Pros

- Easy setup and user-friendly interface

- Familiarity with clients/customers

- Swift integration with websites

- Compatibility with plug-ins, shopping platforms, and apps

- Robust financial reporting in-app

Cons

- Higher fees compared to standard merchant accounts

- Account suspension due to T&C violations

- Delayed fund of 2 business days

- Difficulties reaching customer service

Braintree

Braintree Payment Solutions is an online payment gateway that allows businesses to accept payments on their apps or websites. Braintree is one of the most used providers in the eCommerce and mobile processing industries due to its simple and easy-to-use interface. Being part of the PayPal family, Braintree now shares both the strengths and weaknesses of the PayPal ecosystem.

Features

- Braintree Marketplace

- ACH payment processing

- Invoicing & billing

- Fraud protection

- Third-party integration

Fees

Transaction Fees

| Payment Type | Transaction Fee |

| Credit/Debit Cards & Digital Wallets | 2.59% + HKD 0.49 per transaction |

| Venmo (U.S. only) | 3.49% + HKD 0.49 per transaction |

| ACH (Maximum Fee: HKD 5) | 0.75% (Discounts for enterprise businesses) |

Braintree Gateway Fees

| Fee Type | Amount (in HKD) |

| Monthly Fee | HKD 0 |

| Transaction Fee | 0.75% (Discounts for enterprise businesses) |

Third-Party Merchant Account Fees

| Fee Type | Amount (in HKD) |

| Monthly Fee | HKD 49 |

| Transaction Fee (Additional fees may apply based on the merchant account provider) | HKD 0.10 per transaction |

Pros

- Comprehensive payment type support

- Excellent developer tools

- Predictable flat-rate pricing

- Multicurrency options

- Extensive integrations available

Cons

- Costly gateway-only option

- Not for high-risk industries

- Takes a long time to set up accounts

- Reports of closed accounts and held funds

Adyen

Adyen is a global payment company that allows businesses to accept, process, and settle payments in multiple currencies. They offer a contemporary, complete infrastructure that links directly to Visa, Mastercard, and globally preferred payment methods of consumers, Adyen ensures smooth transactions across online, mobile, and in-store platforms.

Features

- Unified commerce

- Merchant accounts

- Integrate digital payment solutions

- Point of Sale (POS) solutions

- Global acquiring

- Risk management

- Revenue optimisation

Fees

| Payment Method | Transaction Fee Structure |

| Visa, Mastercard®, Maestro | USD 0.13 + Interchange++* (Flexible rates, e.g., 0.3-0.4% in Europe, 2% in the US) |

| American Express | Global: 3.95% North America: 3.3% + USD 0.10 Australia: 3.30% + AUD 0.10 Plus USD 0.13 processing fees |

| JCB | USD 0.13 + 3.75% or Interchange++ |

| Discover and Diners | USD 0.13 + 3.95% |

| UnionPay, Alipay, WeChat Pay | USD 0.13 + 3% |

| Google Pay, Apple Pay, Samsung Pay | USD 0.13 + Determined by card use |

| ACH Direct Debit | USD 0.13 + 0.27 |

Pros

- Multiple merchant accounts and comprehensive payment processing control

- Sub-merchant accounts for third parties

- Highly customisable user interface (UI) and checkout platform in Adyen payment gateway

- Support for international payments in 37 countries and 37 currencies

- Unified commerce for enhanced omnichannel payment solutions

- Wide range of PCI compliant and fully customisable point of sale (POS) solutions

Cons

- Minimum monthly invoice

- Application requirement for opening a merchant account

- Complex and predictive pricing system

Alipay

Alipay is one of the largest 3rd party mobile and online payment platforms. Its popularity in Hong Kong is attributed to its strong connection with the vast Chinese consumer market. Additionally, the platform offers and provides a seamless checkout experience for customers. Alipay is a widely used payment method in China, so it is an advantageous option for businesses with Chinese clients or partners.

Features

- Multi-currency support

- QR code and scan-to-link functionality

- Auto debit with pre-authorisation and auto-renewing user access tokens

- Combined payment feature

- In-store payment capabilities

- Payment marketing and Alipay+ rewards

- Compatibility with various devices

- API and SDK availability

Fees

| Fee Type | Description |

| Merchant Transaction Fee | Businesses are typically charged a fee of 0.55% of the transaction value when using Alipay. |

| Withdrawal Fee | A 0.1% fee applies when withdrawing over 20,000 Chinese renminbi (RMB). |

| Overseas Card Payment Fee | Alipay charges a transaction fee of 3% of the transaction value for using overseas credit cards. Transactions under 200 RMB are exempt from this fee. |

Pros

- Extensive partner merchant network

- Wide range of additional services

- User-friendly interface

- Advanced security measures

- Great for local payments in mainland China

Cons

- Requires a separate app for payments.

- Less widely used outside China.

- Not compatible with non-Chinese mobile numbers.

- Limited functionality beyond Hong Kong and mainland China.

- Sending money overseas is not easy with Alipay.

- Possible fees, especially when using cards for transactions.

WeChat Pay

WeChat Pay is a hugely popular mobile payment method in China and is owned by the Chinese tech giant Tencent. It offers a secure and seamless payment process through WeChat’s in-app payment feature, making it convenient for both customers and businesses. WeChat Pay is widely accepted in Hong Kong, offering businesses a great option for serving Chinese customers.

Features

- Robust security

- Access to customer insights

- Multi-platform integration

- Streamlined operations

- Support for marketing and loyalty initiatives

- Real-time customer engagement

Fees

| Fee Type | Details |

| Transaction Fees | WeChat Pay employs a percentage-based transaction fee structure, varying based on factors like industry, transaction volume, and specific agreement terms. Rates for domestic transactions are standard, with negotiable options for specific cases. |

| Monthly and Annual Maintenance | Operating a WeChat Pay merchant account may involve recurring fees, covering monthly maintenance for system usage and potential annual fees. |

| Settlement and Withdrawal Fees | Transferring funds from WeChat Pay to a business bank account may incur settlement fees, outlined in the service agreement and subject to variations based on withdrawal amount and frequency. |

| Integration and Technical Service Fees | Businesses requiring advanced integration of WeChat Pay into existing systems (e.g., POS or online shopfronts) may face additional costs related to integration and technical services. |

Pros

- Effortless inclusion within the WeChat application

- Comprehensive WeChat environment

- Social functionalities such as the transfer of digital red envelopes

- Convenience for current WeChat users

Cons

- Restricted assistance for users outside China

- It necessitates a WeChat account for entry

- Slightly smaller partner merchant network compared to Alipay

AsiaPay

AsiaPay is a company in Hong Kong that offers adaptable electronic payment solutions to banks, businesses, organisations, charities, and merchants globally. They comprehend the specific payment requirements of your group and customers, delivering dependable solutions to enhance customer experiences and boost business productivity and growth.

Features

- Multiple Banks, Processors, & Payment Methods

- Credit/Debit Card Payment

- POS Terminal Support

- Flexible Payment Solutions & Services

- Payment Links

- QR Codes

- Recurring Payment

Fees

AsiaPay utilises a pricing model comprising a setup fee, monthly fee, transaction fee, and percentage. For comprehensive pricing details, reach out to the company directly.

Pros

- Streamlined payment processing

- Fraud detection and prevention

- Competitive rates

Cons

- Limited customisation options

- No free trial

Eway

Based in Australia, Eway is another popular payment gateway used by businesses in Hong Kong since 2009. It offers a range of features and tools for businesses to manage online transactions, including recurring billing, fraud protection, and easy integration.

Features

- Quick and easy to setup

- Low transaction fees

- Powered by the Rapid API

- Flexibility at checkout

Fees

| Transaction Fees (including GST) | 1.5% of purchase value + HKD 1.25 for both domestic and international cards |

| Set-up Fees | HKD 0.00 |

| Monthly Fees | HKD 0.00 |

Pros

- Easily accept credit cards, debit cards, and digital wallets.

- Streamlined procedures for quick and easy refunds.

- Over 250 integrations for seamless E-commerce operations.

- Utilise advanced online security and cutting-edge payment tech.

- Accept pre-authorised recurring payments for convenience.

- Tools for clear insights, simplified reporting, and efficient transaction management.

Cons

- Technical glitches due to a high daily capacity may occur.

JETCO Pay

JETCO Pay is a Hong Kong-based payment gateway that supports various payment methods, including credit cards, mobile wallets, and various online banking options. Its wide range of payment options makes it a preferred choice for businesses operating in Hong Kong. JETCO Pay also offers a secure and efficient payment process, making it a popular option for local businesses.

Features

- Multiple payment options

- Local customer support

- Multi-currency support

- Secure transaction process (HKD, USD, JPY, MOP, GBP, and CNY(RMB))

- Branding customisation

Fees

For comprehensive JETCO Pay pricing details, reach out to the company directly.

Pros

- Local support and reputation

- Multiple payment options

- User-friendly interface

- Secure transaction process

- Branding customisation

Cons

- Limited pricing information

Octopus App for Business

Octopus is another popular payment platform in Hong Kong, first introduced in 1997 as a contactless smart card used for public transportation. It has since expanded to include a wide range of payment options such as online B2B payments, retail purchases, and even donations.

Features

- Multiple payment options

- Fast transaction process

- Integration with different shopping platforms

- Mobile app for convenient payments

- Faster Payment Service (FPS)

- QR code payments

- All-in-one taxi payment for locals and tourists.

- Retailers benefit from in-app payments in a video shopping platform.

Fees

| Type of Business Industry | Bank Account Fund Transfer Fee |

| Non-transport business | 1.5% of the amount or HK$1 if 1.5% of the amount is less than HK$1 |

| Transport business | 1% of the amount or HK$1 if 1% of the amount is less than HK$1 |

Pros

- Provides a secure, efficient, flexible, and reliable means to collect revenue.

- Shortens transaction time.

- Minimises fraud

- User-friendly platform

- Accommodates complex payment collection

Cons

- May not be suitable for businesses without a local customer base

- Limited support for international transactions

Checkout.com

Checkout.com is a top provider of global online payment solutions, using its own technology to handle every part of the payment process. They support 150+ currencies and allow businesses to accept various international cards and local payments through one setup.

Features

- Processes 150+ currencies globally.

- Tailored for large enterprises.

- Facilitates one-time or subscription payments across channels.

- Supports various local payment methods.

- Easy integration with Mobile SDKs and APIs.

- Enables efficient payout management.

Fees

To get personalised flat-rate details for your business, reach out to Checkout.com directly.

Pros

- Acceptance rates for cards

- Transparency pricing

- Friendly and helpful support

- Risk Assessment

- User-friendly interface

Cons

- The dashboard and reports lack certain functionalities.

- Instability during peak times

- Not available in some regions

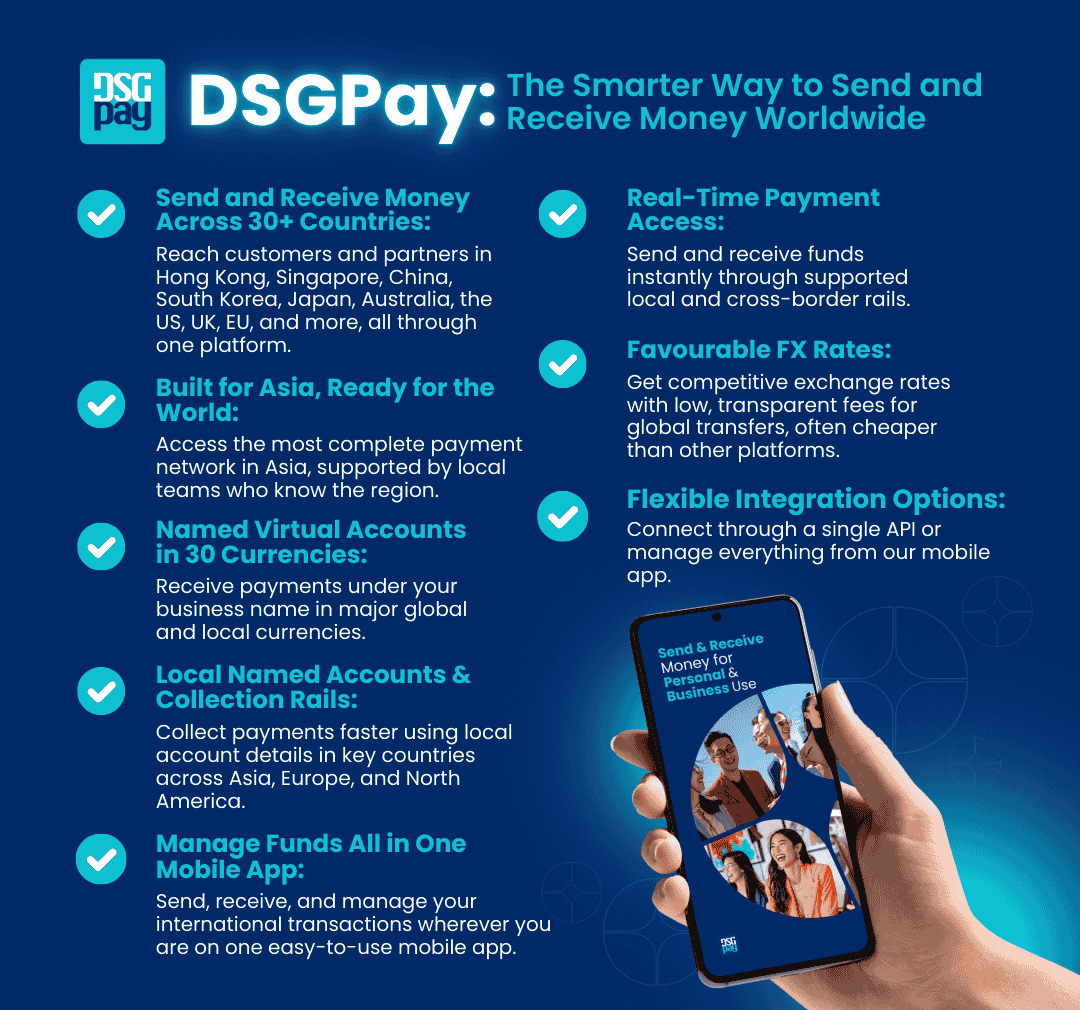

DSGPay: Your Global Alternative to a Hong Kong Payment Gateway

Looking for the right way to accept and manage payments for your business? Choosing the best payment solution depends on your business model, transaction needs, and how you want to serve customers, especially if you’re working with clients across borders.

Traditional Hong Kong payment gateways may suit some businesses, but if you’re looking for something more flexible, DSGPay offers a powerful alternative. We provide multi-currency virtual accounts through our global partners, enabling you to collect and send payments across 30+ countries — all without the limitations of a card-based gateway.

DSGPay is built for non-financial businesses that want:

- Local collection in key markets like the UK, EU, Southeast Asia, and beyond

- Transparent fees and competitive FX rates

- Named virtual accounts to enhance trust with clients

- Real-time transaction tracking and easy integration via API or app

Whether you’re paying vendors, collecting from clients, or managing business funds in multiple currencies, DSGPay simplifies the entire process with one flexible platform.

If your business is growing beyond borders, it may be time to move beyond traditional gateways. DSGPay is here to help.