Local payment rails are the infrastructure and system used to facilitate payment transfers within a country or region.

In essence, it’s designed to handle local money transfers, thereby providing a faster and more stable payment system.

If you conduct business within a locality, local payment rails are an opportunity to reduce remittance fees and boost efficiency. In this article, we’ll be exploring what it means and how you can take advantage of it for your business.

Table of Contents

What Are Local Payment Rails?

A payment rail is a digital way, or path, that facilitates the movement of funds from one financial institution to another.

Hence, Local payment rails are domestic or regional digital ways, or paths, designed to process money transfers within a specific country, region, or currency zone. They are unlike global systems such as SWIFT. These rails directly connect local banks to payment institutions, enabling faster and lower-cost transactions.

By leveraging these rails, businesses can avoid the multiple layers of fees and delays associated with traditional cross-border payments.

Importance of Local Payment Rails for Modern Businesses

If you’re running a business, relying solely on global cross-border rails can be slow or expensive. In fact, did you know global businesses lose upwards of $120 billion because of high transaction fees and banking inefficiencies each year?

Therefore, using local payment rails, which are faster and cheaper, is a better alternative.

Here’s how local payment rails can optimise a business’s operations:

- Lower Transaction Costs: There are fewer intermediary banks. This means smaller fees and better margins per transaction.

- Faster Settlements: Many local rails clear transactions within seconds or hours.

- Seamless Control on Working Business Capital: Instant access to funds enables smoother business operations and faster reinvestments.

- Improved Compliance: Local rails are often aligned with domestic financial regulations, reducing legal and reporting risks.

- Streamlined Customer/Supplier Experience: Businesses can guarantee reliable, quick payouts to their suppliers/customers.

- Automation and Integration: Many modern rails connect directly to business systems through APIs, making reconciliation effortless.

As a business expands across its borders, using local payment rails not only helps in cost efficiency but also helps in operational efficiency.

Types of Local Payment Rails

Multiple types of local payment rails are available for various applications. They are:

- Real-Time Domestic Payment Rails: These rails are designed for same-currency, same-country transfers with near-instant settlements (e.g., NIBSS, FedNow).

- Regional Clearing Networks: These rails can cover multiple countries but work in only one currency zone (e.g., SEPA in the Eurozone).

- Local Currency Business or Virtual Accounts: These rails are accessible through platforms that offer a local bank-like account in a region. This enables businesses to pay/receive funds locally by using the relevant payment rail without opening a traditional bank account.

- Alternative & Emerging Rails: This type includes peer-to-peer rails, mobile wallet rails, or even blockchain-based rails for specialist scenarios. These rails offer very low-cost settlement, albeit with some trade-offs. (e.g., cryptocurrency exchange platforms)

How Modern Businesses Can Save Fees and Work Smarter Using Local Payment Rails

By understanding which local payment rails to use when and routing payments intelligently, a business can transform payments from a cost headache into a competitive advantage.

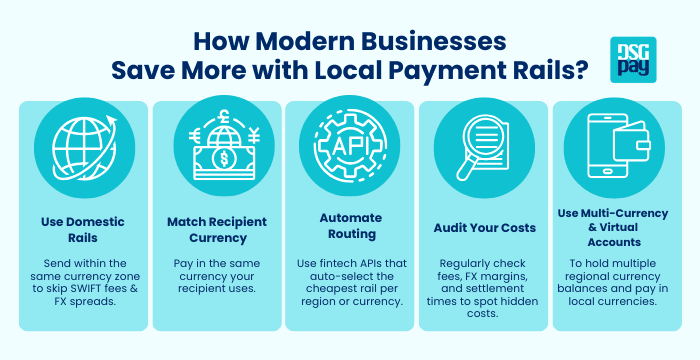

Here are some best practices that businesses can use to save fees and work smarter:

- Use domestic rails where available: Select domestic or regional rails when you’re sending in the same currency zone. This removes the fees of intermediary banks and FX spreads.

- Match currencies with your recipient: Ensure you’re sending in the same currency as your recipient. Matching the sender and receiver currencies avoids conversion losses.

- Embed routing logic in payment flows: That is, use fintech platforms or API settings that automatically pick the lowest-cost rail for each transaction based on region, currency, and volume.

- Review your fees and FX margins regularly: Check each payment channel’s fees, conversion spreads, and settlement times regularly. Many businesses discover hidden costs when they analyse their payment data.

- Leverage multi-currency accounts and virtual accounts: Holding multiple regional currency balances when using local payment rails enables you to receive and pay in local currencies. This helps you avoid costly cross-currency transfers.

By making these practices part of your payment routines, businesses can optimise payment processes and reduce transaction costs.

Global Examples of Local Payment Rails

Here are some examples of local payment rails that drive efficiency worldwide, based on the country or region:

| Region | Local Payment Rail | Type of Local Payment Rail | Description |

|---|---|---|---|

| United Kingdom | Faster Payments | Real-time domestic rails | Processes domestic transactions in seconds, available 24/7. |

| United States | FedNow and RTP | Real-time domestic rails | Provides instant payments between banks and businesses. |

| India | UPI (Unified Payments Interface) | Real-time domestic rails | Allows seamless real-time payments between accounts using a phone number or QR code. |

| Singapore | FAST (Fast and Secure Transfers) | Real-time domestic rails | Enables instant interbank transfers for individuals and businesses. |

| Nigeria | NIBSS Instant Payment (NIP) | Real-time domestic rails | Offers instant fund transfers between banks. Widely used for business payroll. |

| EU Region | SEPA and SCT Instant Credit Transfer | Regional clearing networks | SEPA is the regional Euro network, while SCT Inst enables instant transfers. |

| Australia | NPP (New Payments Platform) | Real-time domestic rails | Enables real-time clearing and settlement of payments. |

| Canada | EFT (Electronic Funds Transfer) and RTR (Real-Time Rail, upcoming) | Batch/Deferred rails (regional or emerging rails) | Used for payroll, bill payments, and business transactions; RTR to enhance instant payments. |

| Japan | Zengin System | Real-time domestic rails | A domestic interbank transfer system for corporate and retail banking customers. |

| Brazil | PIX | Real-time domestic rails | An instant payment platform by the Central Bank, operating 24/7. |

| Hong Kong |

– FPS (Faster Payment System) – CHATS (Clearing House Automated Transfer System) |

Real-time domestic rails |

FPS: instant payments for HKD and RMB, connecting banks and e-wallets. CHATS: supports large-value interbank payments in HKD, USD, EUR, and RMB. |

| Malaysia | DuitNow | Real-time domestic rails | Offers QR-based instant payments and transfers in MYR. |

| Thailand | PromptPay | Real-time domestic rails | Instant fund transfer system using mobile, national ID, or company tax ID for P2P and B2B transactions. |

Apart from these examples, local payment rails are available in countries with an advanced payment network or infrastructure.

Case Study: How Pom&Co Cut Payment Costs By 60%

To help you better understand how businesses can benefit from integrating local payment rails into their payment structure, let’s take a case study using Pom&Co, a manufacturing company.

Since its inception, this European-based business has gotten its materials from several vendors in West Africa and Asia.

Early on, when making payments, its finance departments used international wires that added significant charges to the transaction. They also had to account for a three to five-business-day settlement time. Then they would appeal to their suppliers for more time if payment doesn’t happen within those days.

Later on, they switched to region-specific virtual accounts through a fintech provider. Then they were able to hold local currency balances in West Africa and Asia, the countries of their suppliers. Enabled by these accounts, they began routing payments through the local payment rails in each region.

The result? In the next quarter, Pom&Co saved 60% on total transaction fees. Reduce their settlement times to instant or same-day transactions, and improve their supplier satisfaction.

Long-Term Effects of Local Payment Rails on Business Growth

Taking advantage of local payment rails usually means a business sees future gains like:

- Reduced Operation Expenses: Using local payment rails removes many intermediary bank fees. Fewer intermediary fees and improved automation mean lower business expenses.

- Faster Recycling of the Working Capital: Due to faster settlements, the company’s capital can be freed up to make day-to-day operations run smoother or for other reinvestment purposes.

- Scalability: As a business grows and expands to serve new countries and regions, it is easy to add new local payout methods to the already existing connections.

In the business landscape, optimising payments isn’t just about gaining savings; it is a necessary step to push business growth.

Final Thoughts

Local payment rails have transformed the way businesses move money by making the process smoother, cheaper, and more customer-friendly.

By using modern platforms, companies can access these local payment rails on a global level, which helps them save on fees and strengthen their operation for future growth and expansion.

Whether you’re a startup, SME, or large enterprise, you can bring benefits by reviewing your business to leverage the full potential of local payment rails.

DSGPay: One Platform, Global Access

While local payment rails operate within their own countries or regions, managing them individually can be complex for businesses operating across borders. Each rail has its own rules, settlement times, and compliance requirements.

DSGPay bridges this gap by providing a single platform that connects businesses to multiple local payment systems worldwide.

Why Use DSGPay?

- Local and Global Named Accounts: Build trust with accounts in your business name for easy payments.

- Multi-Currency Access: Hold, send, convert, and receive over 30 currencies from one dashboard.

- Transparent FX Rates: Enjoy real-time, competitive exchange rates with no hidden charges.

- Use Local Payment Rails: DSGPay settles local and cross-border transactions rapidly by leveraging the best local payment rails based on your transaction details.

- Easy Integration: Automate payments and reconciliation through a single API connection.

- Licensed & Secure: Operates under a Hong Kong MSO license, backed by strict AML and security standards.

If you’re managing cross-border payments, DSGPay can help you save time, reduce costs, and improve your business’s efficiency while preparing you for a financial expansion.