In our last article, we discussed what a virtual account is, while highlighting its key benefits and features for freelancers, entrepreneurs, founders, and more.

Now, let’s take a closer look at the virtual account opening process in more detail, including the different types of virtual accounts available and how they can serve both personal and business needs.

Let’s dive right in!

Table of Contents

Key Takeaways

- Although virtual account opening depends on the provider involved, it’s fairly easy and fast to complete.

- With a virtual account, you can simplify your financial operations by automating reconciliation, enabling transfers across borders, and more.

- It’s important to choose an authentic and reputable virtual account provider to protect your account details and foster a simple virtual account opening process.

- DSGPay offers Named, Dynamic, and Static virtual accounts for individuals and businesses in Asia, Europe, and other regions.

What is a Virtual Account?

A virtual account is a non-physical financial account which can be used to send and receive funds.

It acts like a “digital account” allowing businesses or individuals to receive or organise payments without opening multiple bank accounts. For instance, when someone sends money to the A’s virtual account, A actually receives the money in his main real account.

Virtual accounts are typically used for tracking, segmenting, or reconciling transactions efficiently.

In essence, they are often used for:

- Receiving payments to businesses or individual accounts.

- Holding funds in multiple currencies.

- Simplifying treasury operations.

- Separating revenue streams for a clearer report.

- Streamlining vendor and supplier payments.

- Managing subscription billings.

Why Virtual Account Opening Is Essential for Modern Finance

Virtual accounts have become essential tools in the digital economy. They offer a level of financial flexibility and control that traditional banking struggles to match.

Whether you are a freelancer, small business owner, or multinational enterprise, opening a virtual account can bring strategic advantages that directly impact your career.

Here are reasons why virtual account opening matters for you:

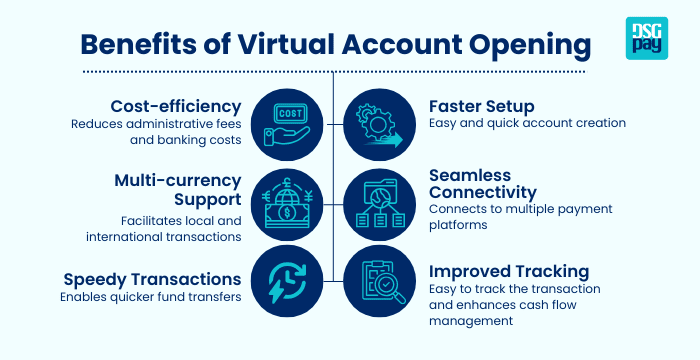

- Cost-efficiency: Virtual accounts eliminate the need to own multiple traditional bank accounts, reducing administrative fees, currency conversion charges, and banking costs. You can centralise your transactions in one low-cost digital account.

- Speedy Transactions: Virtual accounts enable quicker fund transfers than traditional banking methods and card-based payments.

- Multi-currency Support: Virtual accounts can be used for local and international transactions. With the right provider, the funds will be available in your main account without any hassle. For example, if you are a freelancer or business owner working with international clients, you can receive payments in multiple currencies without opening separate bank accounts in each country.

- Faster Setup: Virtual accounts are easy to set up. It takes within ten minutes to set up a virtual account on the desired provider. Additionally, the virtual account opening can be done fully online, eliminating the need to visit a physical bank.

- Seamless Connectivity: Virtual accounts can be connected to multiple payment platforms such as Upwork, Fiverr, Etsy, and more.

- Improved Tracking: It’s easy to track the transaction timeline and process between the sender and receiver. This also enhances better cash flow management, an important necessity for small and large-scale businesses.

Key Factors to Consider Before Opening a Virtual Account

To ensure a smooth virtual account opening, here are a few things to consider before opening a virtual account.

- Regulatory Compliance: Ensure the provider is licensed and follows local financial regulations. This helps guarantee that your funds are safe and that the provider operates under proper legal frameworks.

- Currency Availability: Make sure the provider accepts your preferred currencies to avoid paying additional currency conversion fees or experiencing further complications.

- Ease of Use: A user-friendly platform saves you time and effort. Look for providers offering intuitive dashboards, simple account management, and strong customer support.

- Integration Options: Make sure the virtual account can be linked with your invoicing, payroll, e-commerce, and accounting systems. Integration simplifies financial operations and reporting.

- Fee Structure: Study the fee schedule carefully. Some providers might have hidden charges for things like account maintenance, incoming transactions, or currency exchanges. Look for providers with transparent and competitive fees.

- Security Measures: Ensure the platform uses strong encryption, two-factor authentication (2FA), and complies with international security standards to protect your financial data.

Taking these considerations into account will help you select a reliable virtual account provider that supports your business goals or personal financial needs.

DSGPay: Seamless Solution for Virtual Account Opening

DSGPay is a trusted payment platform that offers virtual account functionality tailored specifically for businesses and individuals.

They automate local and cross-border transactions in and across Asia, the US, the UK, and more.

DSGPay has numerous types of virtual accounts. These are:

1. Named Virtual Accounts

These types of virtual accounts are personalised in the user’s or business’s name, making it ideal for building credibility with clients and partners. They help businesses establish a reputable and professional appearance, especially when it comes to international clients.

DSGPay offers two types of named virtual accounts: a Global named account and a local named account.

2. Dynamic Virtual Accounts

These types of virtual accounts are perfect for high-volume business transactions. Dynamic accounts can be created and managed based on business needs, such as for a specific transaction, customer groups, or payment types. It enhances transaction tracking, simplifies reconciliation, and improves reporting accuracy.

3. Static Virtual Accounts

Static accounts use the same virtual account number for ongoing transactions. They are ideal for businesses dealing with recurring clients or subscription-based services. This simplifies the payment process and reduces confusion for every party.

DSGPay provides the best virtual account opening process for individuals and businesses looking to streamline payment transactions.

In essence, DSGPay offers:

- Competitive exchange rates and low transaction fees.

- Capabilities to manage funds over 30 currencies, including USD, HKD, EUR, GBP, and more.

- Fast and simple onboarding and registration process.

- Easy fund withdrawal to local bank accounts.

- Seamless integration to several platforms, including e-commerce, freelancers, and more.

In the next section, we’ll go over how to easily migrate and verify your account on DSGPay. Once you have an account with DSGPay, getting a virtual account is easy.

How to Set Up and Use DSGPay’s Virtual Account

To use a DSGPay virtual account, you have to start out by creating an account on the DSGPay app and then linking it to the payment platform in which you’d like to receive money.

Here’s a step-by-step instruction on how to go about it:

- Register DSGPay Account

- Download the DSGPay Mobile App to create an individual or business account.

- You can follow our registration tutorial for a full walkthrough.

- Complete KYC Verification

- The verification process is quick and typically completed within 1–2 business days.

- Activate Your Virtual Account

- Once verified, your virtual account details will be available in your dashboard.

- Start Receiving and Sending Payments

- You can now:

- Receive payments from global clients.

- Send payouts to vendors or employees.

- Hold and manage multiple currencies.

- Withdraw funds to your linked local bank account.

- We also offer video tutorials that guide you through how to send money using DSGPay’s mobile app.

- You can now:

- Link to Third-Party Platforms Like Upwork, Etsy, and More

Final Thoughts on ‘Virtual Account Opening’

Virtual accounts are transforming how individuals and businesses manage funds across borders. They offer a smart, digital-first solution that enables users to operate internationally with greater speed, flexibility, and control. For many, they serve as a gateway to more efficient financial operations, whether through faster client payments, multi-currency support, or streamlined reconciliation.

But the benefits go beyond convenience. Choosing the right provider is essential to unlocking the full potential of virtual accounts. A reliable virtual account provider should empower users to move funds with confidence, reduce manual work, and scale effortlessly across markets.

DSGPay delivers on all fronts with a comprehensive virtual account solution and a fast, transparent, and intuitive onboarding experience. Whether you’re a business looking to streamline international transactions or an individual seeking better financial control, DSGPay makes virtual account opening simple, secure, and built for growth.