There are several virtual account examples for individuals and business owners looking for a convenient way to purchase goods or send money securely across towns or countries.

In our last blog, we discussed the steps for opening a virtual account and gave lots of tips on how to navigate this setup as a foreigner in a new country.

Here, we’ll go over a virtual account example, how it works, and why it’s important for your growth and business.

Let’s get right into it.

Table of Contents

Key Takeaways

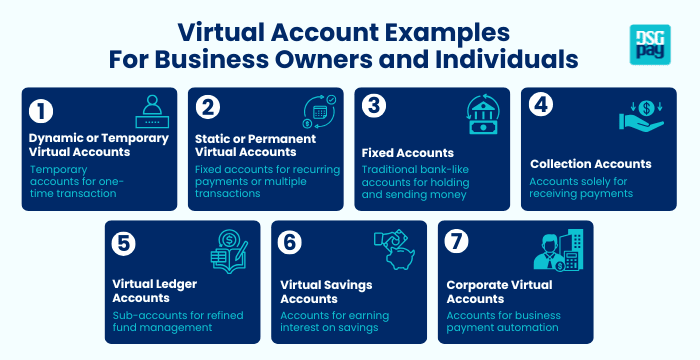

- A virtual account example refers to different types of virtual accounts. These include: Dynamic, Static, Fixed, Collection, Virtual Ledger, Virtual Savings, and Corporate Virtual Accounts.

- Usually, every virtual account provider offers at least two virtual account examples as a service.

- Virtual accounts are important for business owners, students, and other individuals looking to experience seamless cross-border and local transactions without hassle.

How Virtual Accounts Work

For Businesses

As a business owner, when you open a virtual account, you’d receive unique account numbers to share with your clients, vendors, or partners. These account numbers are tied to your master account.

Doing this will allow your business to:

- Accept payments from multiple regions in local currencies.

- Assign customer-specific accounts for simplified reconciliation.

- Monitor transaction status in real time.

For instance, a Korean company or supplier selling products to customers in Europe could generate virtual EUR accounts for each customer and get paid in their preferred currency, all while collecting and converting the money back to KRW on their end.

For Individuals

Freelancers, digital nomads, and remote workers are the primary people who benefit from individual virtual account usage. They can use virtual accounts to receive payments from platforms like Fiverr, Upwork, or Freelancer.com.

Having these accounts makes it easier for them to:

- Get paid in USD, GBP, EUR, etc., without a local bank account in that region.

- Convert currencies at fair rates.

- Send or withdraw funds to local banks or mobile wallets.

For example, an Indonesian freelancer using DSGPay can receive payments in USD through a virtual account and withdraw in IDR to a local bank.

Virtual Account Examples For Business Owners and Individuals in 2025

A virtual account example includes the following:

1. Dynamic or Temporary Virtual Accounts

This type of virtual account is created for a specific, one-time transaction. They are built to expire after a set period of time or after the transaction is complete. Dynamic virtual accounts are ideal for times when you want to make quick payments or need a simplified method of recording them.

2. Static or Permanent Virtual Accounts

This virtual account example has a fixed account number that remains active for an indefinite period of time. They are built to allow recurring payments or multiple transactions. Their best use cases are for scenarios like subscription payments, recurring invoices, or tracking payments over time.

3. Fixed Accounts

These accounts function just like traditional bank accounts. They enable account holders to receive, hold, and send money. This function can also come in multiple currencies.

4. Collection Accounts

This virtual account example is used only to receive payments from customers. It doesn’t have a balance, and money cannot be sent out of it.

5. Virtual Ledger Accounts

This virtual account example consists of multiple sub-accounts that operate in sync with the main account. This type of virtual account is usually used when you require more refined or stringent management and tracking of funds within a single banking relationship.

6. Virtual Savings Accounts

These accounts are designed to hold funds and earn interest. The virtual savings account provides a way for individuals to manage and grow savings online. This type of account is responsible for creating online savings accounts to grow users’ savings monthly or annually on various banking platforms.

7. Corporate Virtual Account

These accounts are specifically designed for businesses. They can be used for automating payment collections and tracking cash flow.

Example of Virtual Account Providers

Among the types, many digital payment providers can not offer all virtual account examples. They typically provide at least two or more of them.

Here, we will go over some of the most popular virtual account providers and the types of virtual account examples they provide.

1. DSGPay

DSGPay offers three main types of virtual accounts: Named, Dynamic, and Static Accounts.

- Named accounts are personalised for the user or businesses, looking to build credibility.

- Dynamic accounts are designed for high-volume transactions and offer features like real-time payment tracking and flexible solutions.

- Static accounts use a fixed account number for ongoing transactions, which are suitable for recurring clients or subscription services.

2. Wise (formerly TransferWise)

Wise provides two main types of virtual accounts, namely, Personal Accounts and Business Accounts.

Both account types offer multi-currency capabilities, but business accounts are designed for businesses needing more advanced features like mass payments and integrations with accounting software.

3. Payoneer

Like Wise, Payoneer also offers two main types of virtual accounts: Local Receiving Accounts and SWIFT (Wire) Receiving Accounts.

- Local receiving accounts provide you with bank details in specific currencies and countries; it works as if you had a local bank account there.

- SWIFT receiving accounts allow you to receive payments via wire transfer worldwide. They can also be useful when local receiving accounts are not supported in a specific country.

4. Airwallex

Airwallex offers several types of virtual accounts, but they primarily focus on global financial operations for businesses.

Examples of their virtual accounts are their Global Accounts, Multi-Currency Accounts, and International Transfer Accounts.

Airwallex goes a step further by providing its clients with Virtual Cards. The virtual cards are digital versions of physical credit or debit cards, enabling secure online payments.

5. Revolut Business

Revolut Business offers Multi-Currency Virtual Accounts within its tiered business account plans.

Similar to Payoneer, Revolut Business can also provide local account details for specific currencies, facilitating more convenient and efficient international payments.

Although they have not specified that they have a Swift virtual account, access to SWIFT details is a key feature of Revolut Business, enabling international payments.

Virtual Account Provider Comparison

Among the five providers we’ve listed above, we’ve created a table to compare the general capabilities of their virtual accounts against one another, to help you make the best decision.

Why Do I Need a Virtual Account?

Now that we’ve looked at some virtual account examples, let’s go over specific reasons why you need them in your business and personal finances.

- Simplified Reconciliation: Virtual accounts generate 10-16 numeric digits as a way of marking each transaction. This number is referred to as a unique customer ID. This ID links that specific customer to that particular transaction and can’t be used by another person.

- Faster Settlements: Virtual accounts often come with the capability of tracking transactions in real time. Such features mean individuals and businesses can monitor the progress of their transaction status easily. This eliminates the delays typically associated with using traditional methods.

- Lower Costs: Having virtual accounts also removes the need to own and manage multiple bank accounts since all of them are under one primary account. For example, on DSGPay, you can customise your virtual account to carry your business name. This can foster trust and credibility between the business and the client.

- Cross-Border Efficiency: Normally, virtual accounts were developed to support transactions in multiple currencies. This means you don’t have to create or open another account for international transactions.

- Enhanced Transparency: Another primary feature the development of virtual accounts brings is its ability to display the records of all the streamlined transactions carried out under one primary account. With a feature like this, you can easily make deductions and inferences to let your books be as transparent as possible.

- Platform Integration: With the advent of virtual payments, virtual accounts were built to sync with payment gateways, account software, ERP systems, and other automated financial processes. This leads to easier and more efficient payment processing. You can even sync them up with payroll systems and accounting tools, which will reduce the workload on your bursary staff.

Simplify Your Global Payments with DSGPay Virtual Accounts

DSGPay is a modern fintech solution that offers secure, scalable, and fully digital virtual account services to individuals and businesses across the globe.

Whether you’re a freelancer managing income from multiple platforms or a growing business processing international payments, DSGPay virtual accounts provide the flexibility and transparency you need.

DSGPay offers three varying virtual accounts

- Named Virtual Accounts: The Account is designed in the name of the user/business

- Dynamic Virtual Accounts: Perfect for business payment operations

- Static Virtual Accounts: Best for subscription or utility-based payment options

Unique Features of DSGPay Virtual Accounts

- Named Global Virtual Accounts: With DSGPay, you can create a virtual account with your name or your business’s name. This fosters trust among your clients or partners.

- Global Capabilities Across Over 30 Countries: With DSGPay’s virtual accounts, you can hold, send, and receive money in many currencies, such as USD, GBP, HKG, EUR, KRW, etc.

- Favourable FX Spreads: DSGPay has also earned a reputation for providing favourable foreign exchange rates for its clients.

- Swift and Concise Payment Tracking: DSGPay provides its clients with various tools to allow them to streamline real-time reconciliation and payment settlement.

- Easy to Use: DSGPay is also built to be accessible using a single API system or the Android or iOS mobile application.

Final Thoughts

From simplifying global payments to improving accounting clarity, virtual accounts are redefining how money flows in the digital era. Whether you’re scaling a business or working remotely, virtual accounts offer unmatched speed, security, and financial control.

As we’ve seen from the examples above, not all virtual accounts are the same. From dynamic accounts for one-time payments to named accounts that build trust with your customers, the right provider can make a world of difference in how smoothly your financial operations run.

If you’re ready to take control of your global payments and streamline your financial processes, now is the time to explore the right virtual account solution for you.