If you’ve ever tried sending euros across Europe, you know the struggle: slow transfers, high fees, and refund delays that cut into profits.

That’s exactly what SEPA was built to solve. The Single Euro Payments Area connects 40+ countries through one framework, making cross-border euro transfers as simple as local payments. For fintechs, SaaS firms, and SMEs, it means lower costs, faster settlements, and smoother recurring billing, all under one secure and compliant network.

This guide explains how SEPA payments work and how they help businesses simplify operations, speed up cash flow, and scale across Europe.

Table of Contents

Key Takeaways

- SEPA Payments make euro transfers easy across 40+ European countries, turning cross-border payments into simple local transactions.

- Businesses save time and money with faster settlements, lower fees, and predictable processing compared to traditional methods.

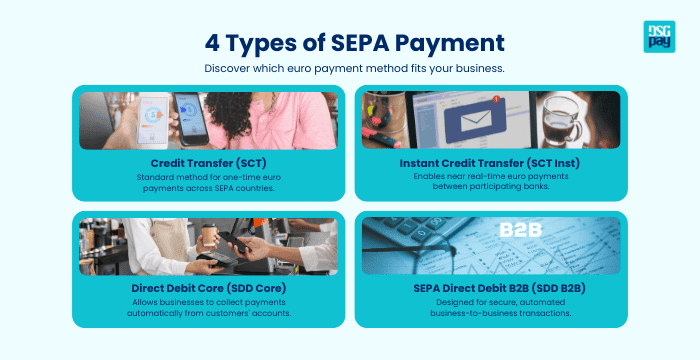

- Four main SEPA schemes include Credit Transfer, Instant Credit Transfer, Direct Debit Core, and Direct Debit B2B.

- Strong compliance under PSD2 and GDPR ensures all SEPA payments remain secure, transparent, and audit-ready.

- Businesses can scale faster by integrating SEPA with trusted payment providers for seamless euro collections and better cash flow control.

What is SEPA

The Single Euro Payments Area (SEPA) is a Europe-wide framework that enables individuals, businesses, and banks to send and receive euro payments as easily as domestic transfers. It was established to streamline electronic payments across the continent by replacing multiple national systems with one standardised and efficient network.

In practice, SEPA enables cashless euro transfers between more than 40 participating countries using shared technical formats, legal rules, and banking standards.

Whether you’re paying a supplier in Germany or collecting customer payments from France, SEPA ensures the process follows the same structure, speed, and cost as a local payment.

Key Features of SEPA

- Unified Payment Rules: Every SEPA transaction follows one set of standards and formats, keeping transfers consistent across all participating countries.

- Euro-Focused Transfers: All payments are made in euros, even in countries that use other local currencies.

- Standardised Account Details: SEPA uses IBAN and BIC codes to ensure payments reach the correct destination without errors.

- Flexible Payment Options: Supports Credit Transfers, Instant Payments, and Direct Debits for both individual and ongoing payments.

- Strict Regulation: Operates under EU laws like PSD2 and GDPR to protect customer data and prevent fraud.

- Wide Coverage: Includes 27 EU countries plus EEA and non-EU members such as the UK, Switzerland, and Monaco.

Why SEPA Payments Are Faster and Cheaper

Unlike SWIFT, SEPA payments move through a shared European network that connects banks directly. That means:

- Payments are processed quickly, often in a day or less.

- Fees are low, similar to local transfers.

- You can track payments easily and get clear updates from your bank.

In fact, according to the European Central Bank, instant credit transfers already make up 15% of all euro credit transfer transactions within the SEPA area as of mid-2024, reflecting how fast European businesses are adopting real-time payments.

SEPA Countries (as of May 2025)

The list below shows all 41 countries and territories that currently participate in SEPA, grouped by their membership type. This includes all EU and EEA member states, as well as several non-EU participants that have adopted SEPA standards for euro payments.

| Category | Countries Included |

| EU Member States (27) | Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden |

| EFTA Members (4) | Iceland, Liechtenstein, Norway, Switzerland |

| Non-EU Participants and Microstates (10) | Andorra, Monaco, San Marino, Vatican City (Holy See), United Kingdom, Gibraltar, Guernsey, Jersey, Isle of Man, Mayotte |

| EU Candidate and Recent Members (5) | Albania, Moldova, Montenegro, North Macedonia, Serbia |

How Do SEPA Payments Work?

SEPA payments operate on shared clearing systems and standardised formats overseen by the European Payments Council (EPC). Using the ISO 20022 XML standard, it enables structured data exchange between banks for faster, automated, and more accurate euro transactions.

Let’s take a closer look at how the process works.

- Payment Initiation: The sender provides the recipient’s account details, including their IBAN, and submits the payment through their bank or payment service provider.

- Verification: The bank checks the account information, confirms there are enough funds, and ensures the transaction complies with European payment regulations.

- Clearing and Routing: Once verified, the payment is sent through the SEPA network for processing. The system ensures the funds move securely between the sending and receiving banks.

- Settlement: The money is transferred between the two banks, usually within one business day for standard payments or instantly for SEPA Instant transfers.

- Funds Received: The recipient’s account is credited, and both parties receive confirmation that the payment has been successfully completed.

What Are the Different Types of SEPA Payment Schemes?

SEPA includes four schemes, each designed for specific payment needs, from one-time transfers and instant settlements to automated collections.

1. SEPA Credit Transfer (SCT)

A SEPA Credit Transfer (SCT) is the standard method for sending euros between bank accounts across SEPA countries. Commonly used for one-off payments like bills, salaries, or supplier invoices, it allows funds to move securely and efficiently within a single business day.

The sender initiates the transfer using the recipient’s IBAN (and sometimes BIC), after which the bank verifies and processes the payment through the SEPA network before crediting the recipient’s account.

Key Points:

- Simple and reliable for one-time euro payments.

- Low-cost and fully automated processing.

- Usually completed within one business day.

- Both banks must be connected to the SEPA network.

2. SEPA Instant Credit Transfer (SCT Inst)

A SEPA Instant Credit Transfer (SCT Inst) enables near real-time euro payments between SEPA-participating banks. Designed for speed and convenience, it allows individuals and businesses to send and receive funds within seconds, operating 24/7, including weekends and holidays.

When a transfer is initiated, the sender’s bank verifies network connectivity and processes the payment instantly. If a delay occurs, the transaction automatically cancels to ensure accuracy and reliability.

Key Points:

- Transfers complete in around 10 seconds.

- Available every day of the year, including holidays.

- Maximum limit of €100,000 per transaction.

- Best suited for urgent transfers and online purchases.

- Operates as a one-way “push” payment initiated by the sender.

3. SEPA Direct Debit Core (SDD Core)

A SEPA Direct Debit Core (SDD Core) allows businesses to collect payments automatically from customers’ euro accounts across SEPA countries. Commonly used for scheduled payments such as subscriptions, rent, or utilities, it requires only one initial authorisation from the customer, after which funds are automatically collected on the agreed dates without manual input.

The process starts when a customer signs a mandate permitting the business to debit their account. The business then submits a payment request through its bank, and once approved, the customer’s account is charged automatically on the scheduled date.

Key Points:

- Gives businesses an easy way to collect regular or occasional payments.

- Customers keep control through a clear pre-notification and refund process.

- Authorised payments can be refunded within eight weeks of collection.

- Unauthorised payments can be disputed and refunded for up to 13 months.

4. SEPA Direct Debit B2B (SDD B2B)

The SEPA Direct Debit B2B (SDD B2B) scheme is built for business-to-business transactions within the SEPA region. It offers a secure, automated way for companies to collect payments from other registered businesses.

The process starts when the payer signs a mandate authorising the creditor to debit their account, which the payer’s bank verifies before any payment occurs. Once approved, funds are transferred automatically on the due date.

As mandates are pre-validated, authorised payments cannot be reversed, ensuring reliability and predictable cash flow for businesses.

Key Points:

- Only available for transactions between registered businesses.

- Mandates are checked and confirmed by the payer’s bank before activation.

- No refund rights apply once a payment has been authorised.

- Designed for regular or high-value business payments such as supplier invoices or tax obligations.

- Reduces administrative effort by automating collections and ensuring faster settlements.

Let’s take a quick look at how each SEPA payment scheme compares to help businesses choose the one that best fits their payment needs.

| SEPA Scheme | Purpose | Settlement Time | Refund Rights | Best For |

| SEPA Credit Transfer (SCT) | One-off euro transfers between SEPA bank accounts | Within one business day | No | Paying suppliers, invoices, or salaries |

| SEPA Instant Credit Transfer (SCT Inst) | Real-time euro transfers available 24/7 | Around 10 seconds | No | Urgent transfers, e-commerce payments, or immediate settlements |

| SEPA Direct Debit Core (SDD Core) | Automated payments from customer accounts | On the scheduled billing date | Yes. 8 weeks for authorised, 13 months for unauthorised | Subscriptions, utilities, rent, or recurring bills |

| SEPA Direct Debit B2B (SDD B2B) | Business-to-business direct debit collections | On agreed due date | No refund after authorisation | Corporate billing, supplier payments, or tax collections |

How Can Businesses Set Up SEPA Payments?

Getting started with SEPA payments is simpler than most businesses expect. Any euro-enabled account in a SEPA-participating country can send or receive transfers; there’s no need to open a special SEPA account.

The main requirement is that your bank or payment provider supports SEPA processing and uses the correct standards for euro transactions.

Steps for Businesses:

- Work with a SEPA-compliant provider: Partner with a bank or licensed payment platform that supports SEPA Credit Transfers, Instant Transfers, or Direct Debits.

- Collect accurate payment details: Gather your customer’s International Bank Account Number (IBAN) and, where applicable, their Bank Identifier Code (BIC) to ensure smooth transfers.

- Secure customer authorisation: For Direct Debit payments, obtain a signed or electronic mandate that gives permission to collect funds on specific dates.

- Submit payment requests: Once authorised, payment instructions are sent through your provider’s platform or API to initiate transfers or collections.

- Track and reconcile transactions: Use your provider’s dashboard to confirm payments, process refunds, and keep transaction records for compliance and auditing.

What Compliance and Security Rules Govern SEPA?

SEPA’s reliability comes from its strong regulatory and technical foundation. Every participant, from banks to fintechs, must follow strict European laws that ensure payments are secure, transparent, and fully compliant.

Key frameworks and standards include:

- Payment Services Directive 2 (PSD2): Requires Strong Customer Authentication (SCA) for all electronic payments, helping to prevent fraud and unauthorised access.

- General Data Protection Regulation (GDPR): Protects customer data by enforcing strict privacy and consent rules for processing, storing, and sharing personal information.

- ISO 20022 Messaging Standard: Introduces structured data formats that improve accuracy, automation, and traceability in every SEPA transaction.

- Mandate Management: Businesses using SEPA Direct Debit must keep signed mandates securely, manage authorisations responsibly, and ensure every payment process remains traceable and compliant.

- Fraud Prevention Measures: Banks and payment providers must implement real-time monitoring and identity verification to detect suspicious transactions early.

What’s Next for SEPA? Future Trends in European Payments

SEPA is entering a new phase as Europe prepares for the rollout of instant payments in 2025. The goal is to make euro transfers faster, safer, and easier for both individuals and businesses.

Here’s what to expect:

- Full launch of SEPA Instant: By 2025, all European banks will need to send and receive instant euro payments at any time of day, including weekends and holidays.

- Equal pricing and no limits: Instant payments will cost the same as regular SEPA transfers, and the previous €100,000 cap per transaction will be removed.

- Enhanced Security: Verification of Payee (VoP) checks that the recipient’s name matches their IBAN before sending money, helping prevent fraud.

- Upgraded systems: Banks will update their technology to handle continuous, high-volume transactions.

- More digital options: Tools like mobile wallets, embedded finance, and Wero will make SEPA payments faster and more convenient.

SEPA vs SWIFT: Which One Should Your Business Use?

Both SEPA and SWIFT enable cross-border payments, but they serve different purposes.

SEPA is built for fast, low-cost euro transfers across Europe, while SWIFT powers international payments in multiple currencies through a global network.

If your business operates mainly in Europe, SEPA offers predictable fees and faster settlements. For global transactions involving other currencies, SWIFT remains the standard choice. Many fintechs and SMEs use both SEPA for efficiency within Europe and SWIFT for worldwide reach.

| Feature | SEPA | SWIFT |

| Region Covered | 40+ European countries | 200+ countries worldwide |

| Currencies Supported | Euro (€) only | Multiple currencies |

| Processing Speed | 1 day (standard) or instant (SCT Inst) | 2–5 business days |

| Transfer Fees | Low and transparent | Higher, with intermediary fees |

| Refund/Tracking | Standardised and traceable | Varies by intermediary banks |

| Ideal For | Euro payments within Europe | Global, multi-currency transfers |

Conclusion

SEPA payments are no longer just about compliance; they are a growth driver for businesses expanding across Europe. By unifying how euros move between countries, SEPA helps fintechs and SMEs lower transaction costs, speed up settlements, and automate cash flow management.

The real value lies in choosing the right SEPA scheme. Credit transfers bring predictability, Instant payments deliver real-time speed, and Direct Debits make recurring revenue seamless. As Europe moves toward instant transfers and open banking, businesses that integrate SEPA today will move money faster, scale smarter, and stay ahead in the digital economy.

Receive Payments from Europe Seamlessly with DSGPay

DSGPay helps your business receive euro payments as easily as local transfers.

With DSGPay, you can connect to Europe’s trusted payment network and start receiving euro transfers from customers, partners, or marketplaces, all from a single platform.

Here’s how DSGPay makes it simple:

- Global Named Virtual Accounts: Open EUR virtual accounts in your business name that build trust with clients and simplify reconciliation.

- Collect Euro Payments Instantly: Accept transfers from European countries through trusted local rails.

- Multi-Currency Access: Hold, send, and receive over 30 currencies, including EUR, GBP, and USD, all within one secure account.

- Competitive FX Rates and Low Fees: Each transfer is processed through the most cost-efficient route, cutting down on conversion and transaction costs.

- Quick Settlements and Tracking: Receive funds faster and monitor every payment in real time for better cash flow visibility.

- Seamless API Integration: Connect DSGPay to your existing systems through a single, developer-friendly API for smooth operations.

- Licensed and Regulated: Operating under a Hong Kong MSO licence, DSGPay meets strict AML and security standards to protect every transaction.

With DSGPay, managing SEPA payments becomes effortless. You can collect euros like a local, settle funds quickly, and scale your European operations confidently, without hidden fees or complex banking hurdles.