Looking for the smartest way to send money to Hong Kong?

Whether you’re paying suppliers, freelancers, or family, choosing the right method for sending money to Hong Kong can help you save on fees, get faster delivery, and enjoy better exchange rates.

This guide breaks down the most reliable options for sending money to Hong Kong, and learn how to make your transactions smooth, safe, and affordable.

1. Online Money Transfer Services

Online money transfer services are the most popular and affordable options for sending money to Hong Kong. These platforms use mid-market exchange rates and charge transparent, low fees.

Popular Online Money Transfer Services Comparison

🔔 Note: Transaction limits can vary based on country, verification level, payment method, and regulatory requirements.

Why It’s Affordable:

- Low and flat fees, typically less than 1% of the transfer amount.

- No hidden charges, and exchange rates are competitive.

Ideal For:

- Small to medium transfers.

- Quick transfers to bank accounts or mobile wallets.

What to Watch Out For:

- Limits on the amount you can transfer in a single transaction.

- Delivery times may vary depending on the transfer destination.

2. Bank Transfers

Traditional bank transfers remain a reliable option for sending money to Hong Kong, especially for large transfers. Some banks have partnerships with Hong Kong financial institutions, which can help lower fees. Opting for a direct bank-to-bank transfer may also eliminate intermediary fees, depending on the institutions involved.

Popular Banks That Support Transfers to Hong Kong

🔔 Note: Fees and processing speeds are subject to change and vary based on your specific account tier, the country of origin, and individual bank compliance reviews.

Why It’s Affordable:

- Partner banks or global networks (e.g., HSBC) may reduce fees for frequent corridors.

- No need for third-party services, reducing overall complexity.

Ideal For:

- Large transfers require robust security.

- Users with existing banking relationships in Hong Kong.

What to Watch Out For:

- Exchange rates offered by banks are usually less favourable than online services.

- Intermediary or SWIFT network fees can increase the cost of transfers involving multiple banks.

3. Mobile Wallet Transfers

Mobile wallets like PayMe (by HSBC) and AliPayHK are revolutionising money transfers in Hong Kong. These wallets are widely used for both personal and business transactions. They allow instant money transfers to wallet holders at very low costs, often free for local users.

Popular Mobile Wallets for Transfers to Hong Kong

🔔 Note: Limits, fees, and supported payout methods can vary depending on the sender’s country, wallet balance, verification level, and local regulations.

Why It’s Affordable:

- Low to no fees for wallet-to-wallet transactions.

- Fast processing times for smaller amounts.

Ideal For:

- Small personal transactions, such as sending money to family members.

- Transactions with recipients already using these wallets.

What to Watch Out For:

- Both sender and recipient may need to have the app or compatible wallets.

- Limits on the amount that can be transferred at once.

4. FX Brokers

FX brokers are a powerful option for businesses handling large or frequent international payments. FX brokers specialise in currency conversion and cross-border transfers, which means they can often offer better rates and lower fees.

Popular FX Brokers for Transfers to Hong Kong

🔔 Note: Processing times, fees, and available currencies may vary depending on the transfer size, corridor, and market conditions.

Why It’s Affordable:

- Access to near mid-market FX rates with minimal markup.

- Lower or negotiable transfer fees for high-volume clients.

Ideal For:

- Businesses that make regular payments to suppliers or partners.

- Companies managing import/export transactions or overseas payroll.

What to Watch Out For:

- Some brokers have minimum transfer amounts.

Key Insights to Save More When Sending Money to Hong Kong

- Compare Fees and Exchange Rates: Even a small difference in exchange rates or fees can save you significant amounts, especially for larger transfers.

- Choose Specialised Providers: Services tailored for Hong Kong transfers often offer better rates and faster processing times.

- Leverage Promotions: Many platforms offer discounts or fee waivers for first-time users or specific transfer corridors.

- Plan Your Transfer Timing: Exchange rates fluctuate; transferring when rates are favourable can save you more.

FAQs

1. What is the best way to send money to Hong Kong?

The best way for sending money to Hong Kong depends on the amount, speed, and purpose of the transfer. Online transfer services suit smaller payments, while banks or FX brokers are often used for larger transfers.

2. How long does it take to send money to Hong Kong?

Transfers to Hong Kong can take from minutes to several business days, depending on the method used. Online services are usually faster, while bank transfers may take one to three business days.

3. How to transfer money to Hong Kong bank account?

You need the recipient’s bank details, such as the bank name, account number, and SWIFT code. Alternatively, platforms like DSGPay offer virtual accounts that can send funds to Hong Kong bank accounts, simplifying international transfers.

4. How do foreigners pay in Hong Kong?

Foreigners commonly pay using international cards, mobile wallets, and bank transfers. QR payments and e-wallets are widely accepted, especially in major cities.

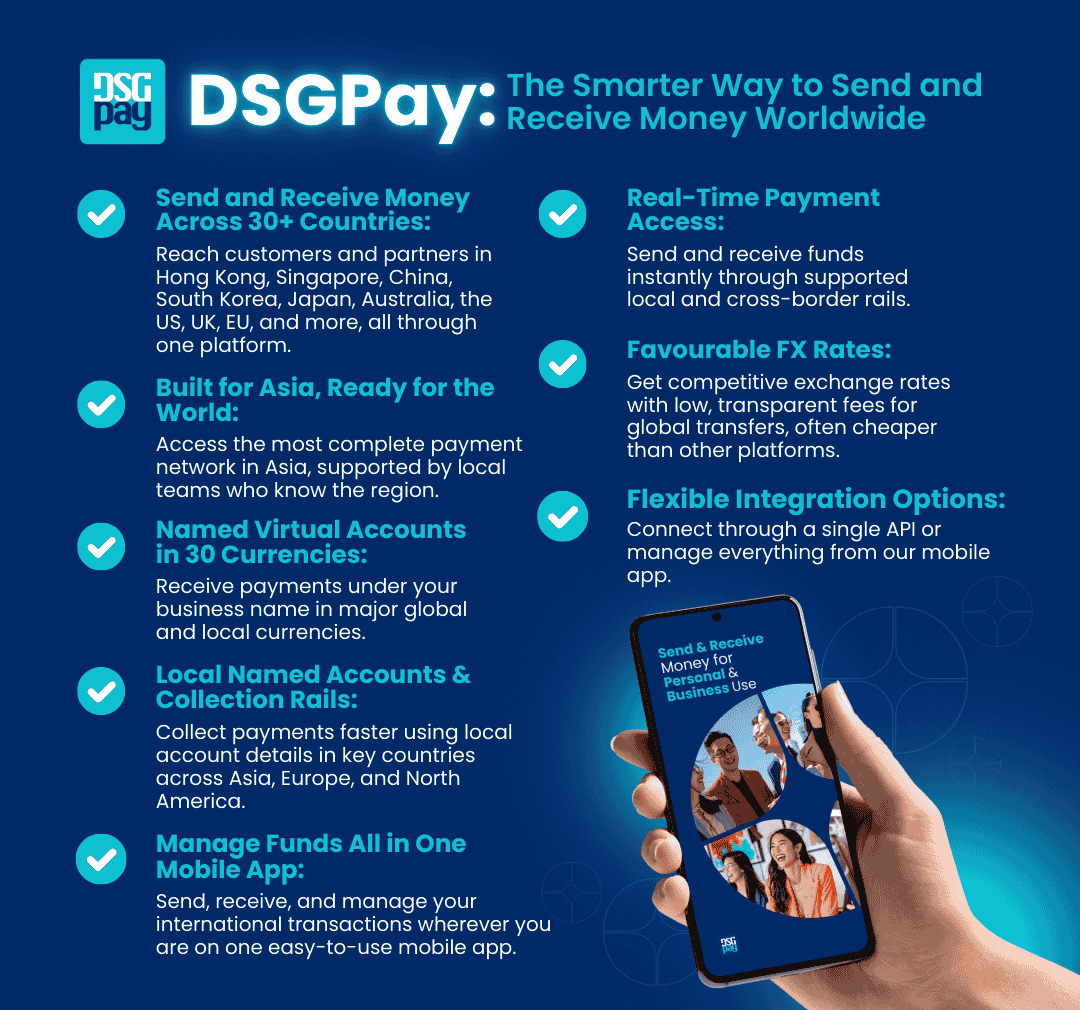

DSGPay: A Flexible Alternative for Sending Money to Hong Kong

While DSGPay serves both personal and business uses, it’s the ideal partner for businesses seeking secure, efficient, and cost-effective solutions to send money to Hong Kong.

As a licensed Money Service Operator (MSO) in Hong Kong, DSGPay is committed to the highest regulatory standards, providing businesses with confidence and reliability for every transaction.

What Sets DSGPay Apart?

- Global and Local Named Accounts: Non-financial institution businesses can open accounts in their business name in Hong Kong to manage collections and payouts to Hong Kong more efficiently.

- Support for B2B, C2B, and B2C Transactions: DSGPay enables seamless transactions for Business-to-Business (B2B), Consumer-to-Business (C2B), and Business-to-Consumer (B2C) models, ensuring flexibility and adaptability for diverse business needs for your money transfers in Hong Kong.

- Competitive Fees and Transparent Pricing: DSGPay offers businesses clear, upfront pricing with no hidden charges, enabling better financial planning and cost control.

- Extensive Currency Options: With support for major currencies like USD and EUR, as well as exotic Asian currencies, DSGPay provides the flexibility needed to meet the demands of diverse markets.

- Comprehensive Local and International Solutions: DSGPay supports a wide range of financial needs, from local payouts and collections to seamless cross-border transactions, empowering businesses to expand and operate globally.

Talk to our team to explore alternative ways to send money to Hong Kong with DSGPay.