In 2023, New Zealand received roughly US $816 million in remittances, slightly up from US $577 million in 2022.

This steady growth highlights the importance of international money transfers, as families, businesses, and individuals continue to rely on secure, affordable, and efficient channels to send money to NZ.

Our guide compares the best services to help international clients send money to NZ, with a focus on speed, reliability, and affordability.

Table of Contents

Key Takeaways

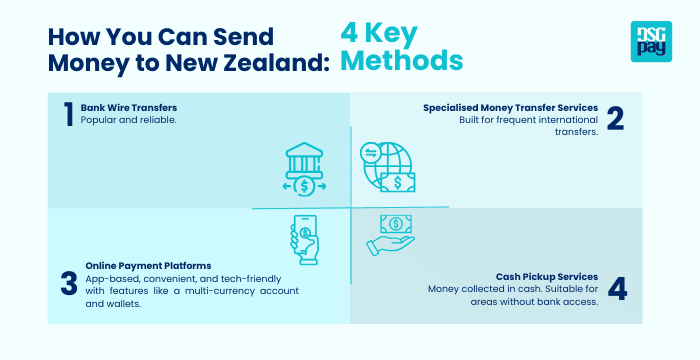

- There are four main ways to send money to NZ in 2025. From bank wire transfers, specialised transfer services, online payment platforms, and cash pickup services, each with different costs, speeds, and convenience levels.

- Top providers like Wise, Revolut, OFX, Western Union, Xoom, XE, and WorldRemit offer reliable options to send money to NZ, with fees, exchange rates, and transfer times varying widely.

- Choosing the right service to send money to NZ depends on your needs, speed for urgent transfers, affordability for frequent payments, or advanced features like multi-currency accounts and business tools.

Common Methods to Send Money to NZ in 2025

To send money to NZ, there are several reliable methods available.

Consider using any of the following options to ensure a secure, seamless, and efficient transaction experience.

- Bank Wire Transfers: This is an older and more traditional method of sending money internationally. Although it can be slow and costly, people still use it because of its popularity and reliability.

- Specialised Money Transfer Services: This method focuses more on speed and low-cost transfers across international borders. They usually provide lower fees, better exchange rates, and dedicated support. They are designed for people who regularly send or receive money across borders.

- Online Payment Platforms: Digital-first platforms and mobile apps that make it easy to send money abroad. Beyond simple transfers, they often include features such as multi-currency accounts, wallets and seamless app-based management, making them a convenient choice for tech-savvy users.

- Cash Pickup Services: Designed for situations where recipients may not have bank accounts. Funds can be sent for collection at designated pickup locations, often within minutes. While fees can be higher, this method ensures accessibility in areas with limited banking infrastructure.

7 Best Service Providers to Send Money to NZ in 2025

Here are the top services you can use to send money to New Zealand in 2025:

1. Wise

Wise is known for its transparency and offering the real mid-market rate with no hidden markups. Transfers to NZ typically take less than a day, and the fees usually start around 0.6% of the transfer amount. It is an affordable choice for those sending larger amounts, where small savings add up.

Best For: Individuals and businesses that want transparent pricing and low fees.

2. Revolut

Revolut offers quick and affordable transfers to NZ, often delivering within minutes to a few hours. The costs for these transfers depend on the user’s subscribed plan: standard users pay a small markup on exchange rates, while premium users enjoy lower fees. Revolut also offers multi-currency accounts, which make it easy to hold and exchange NZD directly.

Best For: Frequent travellers or freelancers who need fast and flexible transfers.

3. OFX

OFX specialises in large transfers, with no transfer fees but a margin added to the exchange rate. Delivery to NZ usually takes 1 to 3 days. While it is not the cheapest for smaller transfers, its 24/7 dealer support and risk management tools make it the ideal choice for large amounts.

Best For: Businesses and individuals sending large sums securely.

4. Western Union

Western Union is one of the most widely available services. It supports both bank transfers and cash pickup in NZ. Depending on the payment method, transfer times can range from a few minutes to a couple of days. Its fees are often higher, especially for small amounts, but its vast global network is unmatched.

Best For: Individuals who require multiple payout options or need services with global coverage.

5. Xoom

Xoom (a PayPal Service) allows you to send money directly to all major banks in New Zealand, with transfers typically arriving in around 2 business days. However, that convenience comes at a cost. Their fees start around $5, depending on your payment method, plus a markup on exchange rates. Still, the ability to send money for bank deposits or cash pickups makes it useful for urgent needs.

Best For: Users who already have a PayPal account and want a straightforward way to send money to NZ.

6. XE Money Transfer

XE is a widely trusted method for cross-border individual and business transfers. They offer competitive exchange rates and no transfer fees. Money sent to NZ usually arrives within 1-2 days. The platform also supports forward contracts and market orders for businesses.

Best For: Reliable, fee-free transfers with global coverage.

7. WorldRemit

WorldRemit allows transfers to NZ within minutes to bank accounts or mobile wallets. Their fees are usually competitive, at a rate of $3 – $15 for every $1000. Their exchange rates also include a small margin.

Best For: Individuals looking for fast and affordable digital transfers.

Comparing the Top Money Service Providers to Send Money to NZ

Each of the options to send money to NZ has its own pros and cons. To help you know the best option for your needs, we’ll weigh all the providers against each other. We’ll also calculate the fees required to send money to NZ using each of the services.

Let’s use a standard fee of $1000 as our prime example:

| Service | Service Methods | Transfer Speed | Exchange Rate Type | Fees for sending $1000 to NZ | Special Features of the Service | Payment & Delivery Options |

| Wise | Online payment platform | 1-2 business days | Mid-market rate | ~$7.50 to $12.00 | Multi-currency accounts, Transparent fees |

App transfers, Bank transfer, Debit/credit cards, Wise account |

| Revolut | Online payment platform | 1-2 business days | Mid-market with margin | ~$10-$30 | Business tools, Payroll management |

App transfers, Bank transfer, Debit cards, Revolut account |

| OFX | Specialised money transfer service | 1-3 business days | Margin on the exchange rate | 0% flat fee, 0.5%-1% margin | Best for large transactions, 24/7 support, Risk management tools |

Bank transfer |

| Western Union | Specialised transfer service, Cash pickup |

Minutes (cash) / 1-3 days (bank) | Markup on rate | ~$10-$40+ | Widest global reach, Instant cash pickup |

App transfers, Bank transfer, Cash pickup |

| XE | Specialised money transfer service | 1-2 business days | Competitive rates with margin | No Transfer fee | Market orders, Forward contracts |

Bank transfer |

| Remitly | Specialised transfer service, Cash pickup |

Express: Instant – Minutes Economy: 2-5 days |

Slight markup | $0-$4+ | Flexible transfer speeds, Limited free transfers |

App transfers, Bank transfer, Mobile wallet, Debit/credit cards, Cash pickup |

| WorldRemit | Specialised transfer service, Cash pickup |

Minutes to Hours | Markup on the exchange rate | ~$3-$15 | User-friendly mobile app, Low fees |

Bank transfer, Cash pickup |

Note: The above fees are estimates based on the exchange rates at the time. You’re advised to confirm fees before initiating a transaction.

Key Factors to Consider When Choosing a Service

When choosing a service or platform to send money to NZ, it is crucial to consider the following factors. These are:

- Transfer Speed: Can it get there in the time I need it to?

- Exchange Rates: What type of exchange rates are they using? Is it the mid-market rate or a marked-up rate?

- Fees: Are these transaction fees cheap, competitive, or high? Is it a fixed fee, a percentage-based fee, or hidden in the exchange rate markup?

- Convenience: Can the platform be used on mobile devices, and is it user-friendly?

- Security and Reliability: Is the service licensed and insured? Do they have a track record for their settlements?

Based on these questions, you can choose a preferred service provider to help send money to NZ.

Send Money to New Zealand Quickly and Affordably with DSGPay

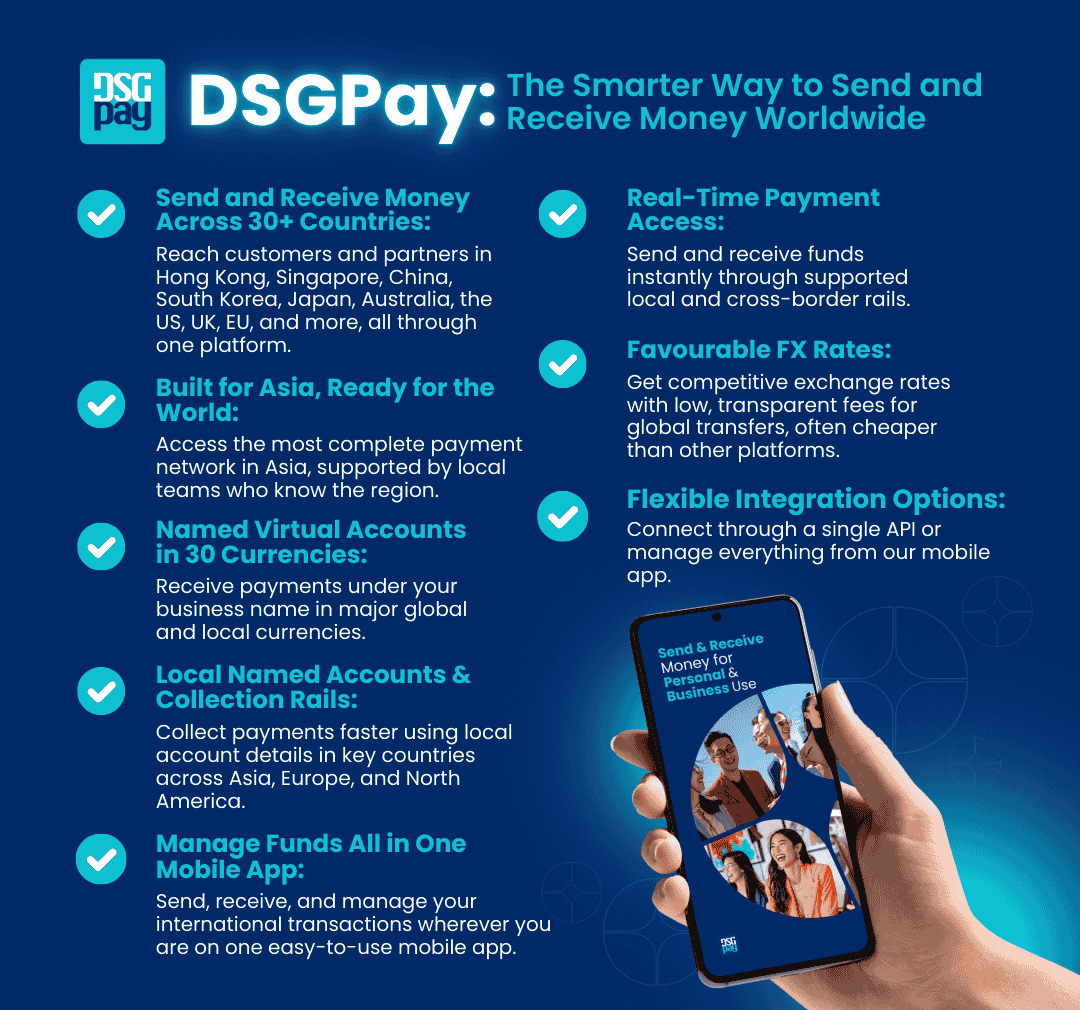

DSGPay makes it easy to send money to New Zealand with speed, transparency, and cost-efficiency.

Whether you’re an individual supporting a family or a business handling cross-border payments, DSGPay provides a reliable way to move money seamlessly.

Why Choose DSGPay?

Here are the key reasons to choose DSGPay when sending money to New Zealand:

- Global and Local Named Accounts: Collect NZD payments under your business name, enhancing trust with clients and partners while simplifying reconciliation.

- Payout to New Zealand: Designed to support a wide range of business models, including B2C, B2B, C2B, and C2C, ensuring your money movement fits your specific needs.

- Multi-currency access: Send, receive, and hold NZD along with 30+ global currencies, giving you flexibility to manage international transactions without unnecessary conversions.

- Fast Payout Settlement: Receive funds into New Zealand bank accounts within the same business day, helping you maintain steady cash flow and meet urgent payment deadlines.

- Scalable for businesses: Integrate DSGPay’s API to automate recurring or high-volume transfers, reducing manual work and enabling your business to scale across borders.

- Secure and compliant: Every transaction is protected by robust AML/KYC standards, ensuring your payments are processed safely and in line with New Zealand and international regulations.

- Mobile Dashboard Access: With the DSGPay mobile app, users can monitor their transactions, convert funds, and manage their transfers all from their dashboard.

All of these features and more are part of what makes DSGPay capable of sending money to NZ easily.

How to Send Money to New Zealand Using DSGPay

You can use DSGPay to send money to NZ by following a few steps:

- Open the app, sign up, verify, and fund your account.

- Go to the currency account you wish to send money from.

- Could be your USD/NZD account, then tap Send > New Beneficiary > Payment Methods > Local Bank Payment.

- Select the Beneficiary’s country, in this case, New Zealand.

- Then select the Beneficiary Type. I.e., customer or business account

- Select their institution, i.e, beneficiary’s bank name. Then add the beneficiary account name, account number, and address, and then hit Next.

- Enter the amount you wish to send in either the Receiving or Sending column, then hit Next.

- Enter the purpose of the remittance (reason you’re sending money), review the details of the transaction, enter your PIN to confirm, and the recipient in New Zealand should receive an alert in minutes.

Final Thoughts

The best way to send money to New Zealand depends on what matters most to you: speed, cost, or flexibility. While traditional banks remain an option, digital providers like Wise, Revolut, Remitly, and others often deliver faster and cheaper transfers.

For a balance of transparency, low fees, and same-day settlement, DSGPay offers a seamless solution for both individuals and businesses. By comparing features and costs, you can choose the service that makes your transfers to New Zealand simple and affordable.