There are several ways to send money to Australia from New Zealand, from traditional bank transfers to online payment providers, and more. Cross-border transactions can get a bit overwhelming without the right knowledge or tools.

This guide explores the best way to send money to Australia from New Zealand without paying expensive fees or getting sidetracked. We’ll also compare several options, highlighting their pros and cons to help you make the right decision.

Table of Contents

4 Best Ways to Send Money to Australia from New Zealand in 2025

1. Bank Transfers

Bank transfers are the traditional way of conducting international remittances. While reliable and globally accepted, they’re typically slower and more expensive. To use it, a customer has to initiate a cross-border payment from their New Zealand bank to an Australian account via SWIFT or internal routing.

Some reliable and popular banks in New Zealand that offer Australian transfers are ANZ Bank (operates in both NZ and AU), Westpac New Zealand, ASB Bank, and Bank of New Zealand (BNZ).

Pros:

- It is a familiar and trusted option.

- It is a good option for one-time, large transfers.

- This method can be initiated online or inside a physical branch.

Cons:

- Expensive fees.

- Some banks have poor exchange rates with hidden markups.

- Transfer can take up to 3 business days.

2. Money Transfer Platforms

Several fintech platforms are designed to reduce costs and simplify international money transfers. They’re widely used for personal, freelance, and business transactions.

To use this method, one typically has to sign up, fund their account via card or bank, initiate an outgoing transfer, input the recipient details, and hit send. When using this method, funds are typically converted at mid-market rates.

Here are some widely accepted and praised money transfer platforms in New Zealand:

- Wise: They use the mid-market rate, offer transparent fees, and have a relatively fast delivery time.

- OFX: They are a better choice for larger or huge amounts, and they charge no fees if a certain minimum amount is initiated.

- WorldRemit: They receive deposits for cash pickups to recipients in local or rural areas.

- Remitly: They offer a speed-focused delivery and a variety of service packages for varying client classes.

Pros:

- They have low fees and good exchange rates.

- They deliver transfers within minutes or more.

- They are easy to use on mobiles and desktops.

Cons:

- Requires account opening.

3. Cryptocurrency

Cryptocurrency is an alternative for tech-savvy users or businesses that are willing to accept digital currencies. With the use of stablecoins, like USDT, you can bypass the slow speeds of bank systems entirely.

However, using this method requires you to convert money to crypto assets (like BTC or USDT) and send it to the receiver’s wallet, then the receiver converts it to AUD using a crypto exchange platform.

Popular Crypto platforms that offer withdrawals in AUD:

- Binance: They offer AUD withdrawals via PayID.

- Coinbase: They are a trusted exchange with a very user-friendly UI.

- Kraken: They also support AUD withdrawals.

Pros:

- Transfers with crypto are often instant.

- There are no intermediary banking fees.

- It has a transparent method of transaction tracking.

Cons:

- Crypto coins can be quite volatile.

- Regulatory restrictions vary for each platform or by location, or for the sender or receiver.

- It requires both the sender and the receiver to understand crypto wallets and exchanges.

4. Virtual Account Providers

Virtual accounts have proven to be the perfect method for cross-border businesses, freelancers, or frequent senders.

So, what is a virtual account? Virtual accounts are digital accounts that allow users to send and receive money across multiple currencies without opening a traditional bank account in the recipient’s country.

Popular Virtual Account Providers:

- DSGPay: They offer personal and business-named virtual accounts in over 30 countries, including Australia, New Zealand, and more.

- Airwallex: They are an Asia-Pacific region-focused digital banking platform.

- Payoneer: This is a global payment solution that caters to freelancers, remote workers, e-shops, etc.

Pros:

- They offer better FX rates than banks.

- They offer lower transfer fees.

- This method is ideal for business and e-commerce.

Cons:

- Using virtual accounts requires registration and verification that might take a while to complete.

Comparing the Best Ways to Send Money to Australia from New Zealand

Each method has its own pros and cons. On that note, let’s compare which method might be the best way for you to send money to Australia from New Zealand.

Among the mentioned options, online digital payment and virtual accounts are one of the best ways to send money to Australia from New Zealand. Before making your decision, be sure to do your research and compare features to get the best advantage.

Factors to Consider When Choosing a Transfer Method

When you want to send money to Australia from New Zealand, here are some of the factors you may need to consider before choosing a preferred method.

- Transfer Fees: This is the fee/charges incurred on every transaction. It is calculated either in flat rates or as a percentage of the total amount to be sent. It is either added to the total sum to be sent, or it is directly deducted from the amount to be sent.

- Exchange Rates: This entails the value of one currency against the other. Banks and other providers use this to convert currencies between each other. It can either be at a mid-market rate or a marked-up rate by the bank or provider you choose to use.

- Transfer Speed: This is the average time of completion or delivery time of the transaction. It could be in minutes, hours, or days.

- Transfer Limits: Every legal means of money transfer has a limit on how much it can send at a time. There are often minimum and maximum amounts for each transaction, and they can be tallied in days, weeks, months, or years.

- Accessibility: There are many ways a recipient should be able to receive money. Does the method the sender chooses fit with the method the receiver has access to? Is it possible the person could need a local bank account or mobile app to receive the incoming transfer?

- Reliability: Does the provider have a system to assist their customers? i.e., customer support, dispute resolution teams, and user reviews. This could be necessary in the event that you wish to speak with the banks or the provider representative to iron out a few issues.

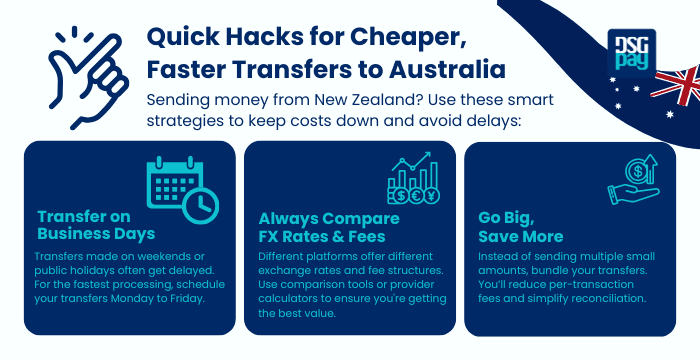

Tips on How to Send Money to Australia from New Zealand

Here are a few tips to help you save money and time while transferring across borders:

- Activate, send, or create your transaction during business days. This will help you avoid delays or lag. If your transfer is initiated during the holiday or weekends, you might have to wait till the next business day before it can be processed, thereby causing delays.

- Compare the FX rates and fees of various providers against each other. This helps you confirm which platform has the best rates. Hence, you’ll avoid losing money on avoidable occurrences.

- Make big transfers rather than initiating multiple small ones. Making one large transfer often helps reduce the price of accumulated transaction charges over time. The charges on a huge payment transfer are often less than the incurred charges on twenty smaller payments added together.

Send Money to Australia from New Zealand Seamlessly with DSGPay

DSGPay is one of the best, direct, and secure payment platforms to initiate cross-border payments between Australia and New Zealand. Their virtual account offers a flexible and seamless option for you to send money securely to Australia from New Zealand.

With DSGPay, you can send money seamlessly to several continents. If paying suppliers, managing business expenses, or receiving earnings from platforms like Upwork or Fiverr, you can easily conduct your business within the DSGPay mobile application from anywhere.

Why DSGPay is the best means to send money to Australia from New Zealand:

- Instant AUD Transfers via PayID: Enjoy fast, real-time payouts to Australian bank accounts using PayID, the most widely adopted payment method in Australia. No delays, no complications.

- Get AUD or NZD Virtual Accounts in Your Name: Open a dedicated virtual account to send or receive AUD or NZD under your business name. This makes it easier to build trust, streamline reconciliation, and transact locally with partners in Australia and New Zealand.

- Multi-Currency Flexibility: Easily manage, convert, and transfer funds in over 30 currencies, including AUD, NZD, USD, EUR, and more

- Clear Fees & Competitive FX Rates: DSGPay shows you exact costs upfront before sending. What you see is what arrives, no surprise deductions or hidden markups.

- Compliant & Secure Transfers: Fully regulated with robust security protocols, DSGPay ensures every transfer from New Zealand to Australia meets compliance standards across regions.

- Easy Integration With Various Payment Portals: DSGPay’s single API system is built to be able to connect with all types of payment platforms or portals.

- Mobile & Web Dashboard Access: Monitor every transaction, convert funds, and manage your transfers through a user-friendly dashboard available on the mobile app.

How to Send Money to Australia from New Zealand Using DSGPay

To send money to Australia from New Zealand, start by downloading the DSGPay app. Then;

- Open the app to sign up and verify your identity.

- Go to your AUD or NZD account and tap on Send > New Beneficiary >Payment Method > Local Bank Payment.

- Select the country of your beneficiary, i.e., Australia, then select beneficiary type, then hit Next.

- Note: Customer account = Personal or Individual Accounts, Business accounts = Businesses

- Select institution, i.e, beneficiary’s bank name. Then add the beneficiary account name, account number, and address, then hit Next.

- Enter the amount you wish to send in either the Receiving or Sending column, then hit Next.

- Enter the purpose of the remittance, review the details of the transaction, enter your PIN to confirm, and your money is on its way to Australia.

Note: You can also convert your money on DSGPay and send a different currency to the recipient in Australia. For example, from NZD to USD, EUR, HKG, etc., there are a lot of options to choose from.

Final Thoughts

When it comes to sending money to Australia from New Zealand, the most cost-effective options in 2025 are no longer traditional banks.

Platforms like Wise, OFX, and especially DSGPay offer lower fees, better exchange rates, and faster delivery times. DSGPay goes a step further by offering named virtual accounts, PayID integration, and a seamless, cost-effective experience, making it a smart alternative not just in New Zealand but also for users across Asia and Europe.

Are you ready to try a smarter transfer solution? Try out DSGPay today!