Opening a foreign bank account has always been a smart move for those managing money across borders. With the rise of remote work and a global lifestyle, it’s now a practical option for anyone working internationally, earning in multiple currencies, or frequently on the move.

Whether you’re one of the 1.57 billion freelancers worldwide working with overseas clients or simply aiming to avoid conversion fees while overseas, this guide will walk you through opening a foreign bank account, comparing many options and selecting the best solution for your financial goals in 2025.

Table of Contents

Key Takeaways

- Opening a foreign bank account has never been easier. Most platforms allow full online onboarding.

- Choose between fintechs for speed or traditional banks for reliability, especially for large transfers.

- Know your fees, that is, exchange rates, transaction fees, and support quality all impact long-term value.

- Look for banks regulated in stable financial markets when you open a foreign bank account for peace of mind.

- Prefer multi-currency support to spend and receive money globally.

What’s a Foreign Bank Account, and Why You Might Actually Need One

A foreign bank account is a bank account opened in a country other than where you or your business is legally based.

It can be used to hold money in a different currency, make international payments, or manage overseas income and expenses. For businesses, it helps simplify cross-border transactions and can support global growth.

How to Open a Foreign Bank Account

Opening a foreign bank account can be a straightforward process if you know the right steps to take. Here’s how to get started.

Step 1: Choose Your Provider

Selecting a provider should begin with a clear understanding of your specific financial needs. This is not a one-size-fits-all decision.

- Freelancers managing multiple currencies should prioritise speed, low fees, and flexibility. Digital-first banking platforms are typically the best fit.

- Businesses handling high-volume transactions may benefit more from established institutions. Traditional banks like HSBC or Citibank offer a reliable international infrastructure and comprehensive support.

- Remote professionals living abroad long-term often require a combination of services. A fintech account can manage everyday expenses, while a local or traditional account can handle recurring payments such as rent or salary deposits.

Step 2: Gather the Essentials (Documents Required)

Being prepared with the right documents can help speed things up and ensure a smooth setup.

Here’s what most banks (digital or traditional) will ask for when opening a foreign bank account:

- Passport or National ID: A valid form of identification to confirm your identity.

- Proof of Address: A document like a utility bill or bank statement to verify your residence.

- Tax Identification Number: A unique number for tax purposes, especially for cross-border compliance.

- Business registration documents: Official paperwork to confirm the legitimacy of your business if opening a business account.

Pro tip: Digitise everything before you start. Screenshots and PDFS are accepted by most digital platforms.

Step 3: Go Online or In-Person

Each provider has its own approach to onboarding

- Revolut, Wise, N26: Fully digital. You can open a foreign bank account in 15 minutes.

- HSBC, Citibank: Expect a mix of online forms, phone calls, and physical branch visits. Some may require you to visit a branch in your home country or a new country.

Step 4: Submit Documents and Complete Verification

Every provider has its own process and timeline for verifying your information.

- Fintech banks approve your application in minutes to hours. You’ll be up and running the same day, often with a virtual card ready to use instantly.

- Traditional banks can take days to weeks, especially if compliance flags anything for manual review.

If time is money, this alone could justify going digital.

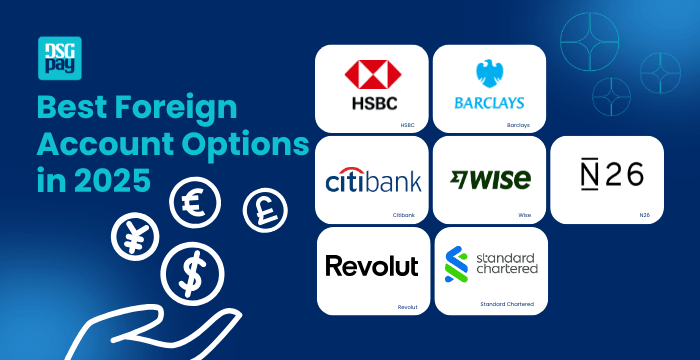

Best Foreign Account Options in 2025

HSBC

HSBC is a popular choice for people looking to open a foreign bank account. It has long been the gold standard for international banking. With operations in over 60 countries, it provides a wide array of services, from personal banking to corporate financing. It’s built for stability, not speed.

Pros:

- Global recognition: Trusted and recognised by institutions and governments worldwide.

- Ideal for large transactions: Good infrastructure for transferring large amounts across borders.

- Strong local presence: Especially useful if you move frequently or have long stays in places like Hong Kong, the UK, or the UAE.

Cons:

- High monthly fees: Fees apply if you don’t meet the required balance.

- Limited global features: Services like Global View are only available to certain clients.

- Tax considerations: Offshore accounts may require professional tax advice.

- Limited security coverage: Some accounts are not protected by the FSCS.

Best For:

Expats with long-term plans, high-net-worth individuals, and entrepreneurs running global businesses with serious capital movement.

Citibank

If you need to move large sums of money globally or access premium banking services, Citi remains a top choice. While it may not be as sleek as some fintech options, its global presence and expertise in cross-border banking make the process of opening a foreign account much easier.

Pros:

- Wide international reach: Operates in over 100 countries, great for global mobility.

- Built for big money: Strong infrastructure for large international transfers.

- Full-service banking: Wealth management, credit, loans, all under one roof.

Cons:

- High fees and minimum balance: International accounts may require a high balance and come with fees.

- Limited services for non-high-net-worth clients: Full international services are often available only to high-net-worth individuals.

- High ATM fees: ATM withdrawals abroad can be expensive.

Best For:

Expats, investors, and businesses moving large sums internationally who need serious financial infrastructure over fancy interfaces.

Barclays

Barclays is a well-established UK bank with extensive coverage across Europe. Known for its reliability and strong regulatory standards, it offers excellent customer service. While its account setup may take a little longer compared to fintech options, it provides a secure and trusted banking experience with a solid reputation.

Pros:

- Strong UK and EU footprint: Great for locals and regional businesses.

- Secure and compliant: Excellent reputation for safety and regulation.

- Dependable support: Known for handling large accounts and transactions with care.

Cons:

- Account closures for non-residents: Accounts may be closed if you move abroad, even if you’re a UK citizen.

- High fees: Expensive fees for international card use and transfers, especially outside Europe.

- Limited account options: Fewer account choices and higher balance requirements for international accounts.

- Basic services: Limited tax advice and fewer international banking options

Best For:

UK/EU-based pros who prefer a stable way to open a foreign bank account for business or travel.

Standard Chartered

Standard Chartered thrives in Asia, Africa, and the Middle East, regions often underserved by other banks. If you’re building or managing the cross-border business in developing economies, it’s a smart pick.

Pros:

- Reputation & Stability: Well-regulated and trusted, especially in volatile emerging markets.

- Multi-currency accounts: Ideal for expats and businesses managing global payments.

- Wealth management options: Strong private banking for high-net-worth clients in emerging regions.

- Local insights, global compliance: Regional expertise with solid international standards.

- Business-friendly onboarding: Easier setup for international entrepreneurs and SMEs.

Cons:

- High remittance fees: Standard Chartered’s remittance fees can be higher than those of other banks.

- Inconsistent customer service: Customer service experiences can vary, leading to mixed reviews.

- Branch-based account opening: Opening an account may require a visit to a branch in person, despite online banking availability.

Best For:

Entrepreneurs, expats, and global teams operating in emerging markets who need deep local expertise.

Revolut

Revolut is redefining what it means to have a global wallet. It’s fast, user-friendly, and tailored for people who live digitally and move often.

Pros:

- Rapid setup: Open an account in minutes from your phone.

- Hold and exchange 25+ currencies: At interbank rates, no middlemen gouging you.

- Feature-rich: Virtual cards, crypto, stocks, budgeting tools, and more.

- Excellent user experience: Clean interface and customizable features.

Cons:

- Availability gaps: Revolut is still expanding its services and is not yet fully available in certain regions, such as parts of Africa or South America.

- Customer support: While customer support is generally effective, response times and service quality may vary in certain instances.

Best For:

Digital nomads and remote workers looking to open a foreign bank account instantly.

Wise

Formerly TransferWise, Wise is laser-focused on low-cost, high-transparency money movement. It’s not a full bank, but for currency conversion and multi-currency holding, it’s a good option.

Pros:

- Incredibly low fees: You see what you pay, and you pay less.

- Multi-currency account: Store 40+ currencies with local account details in key regions.

- Speedy transfers: Often faster than traditional SWIFT-based banks.

Cons:

- Limited banking services: No loans, no credit cards, no interest-earning accounts.

- Regulatory limitations: Not a bank in the full legal sense in many countries.

Best For:

People who receive/send money internationally often, including freelancers, consultants, and small business owners focused on international payments.

N26

N26 is a neobank with a mobile-first design and an EU-centred approach. It’s great for Eurozone users who want something smarter and more modern.

Pros:

- User-friendly mobile interface: Intuitive, clean, and easy to use.

- Transparent pricing: No hidden fees or surprise charges.

- EU compliance: Fully regulated bank under German law.

Cons:

- Geographically limited: Primarily serves Europe; no North America, Latin America, or parts of Asia.

- Fewer features than Revolut: Less crypto, fewer investment options, and less innovation.

Best For:

Eurozone residents who are looking to open a foreign bank account with a modern and app-first approach.

Where to Open a Foreign Bank Account: A Quick Comparison

Benefits and Drawbacks of Opening a Foreign Bank Account

For most remote workers and global businesses, opening a foreign bank account delivers more benefits than drawbacks, especially when done through trusted platforms.

What to Look for Before You Open a Foreign Bank Account

Most people see a nice app, read a Reddit thread, and open an account because “someone said it was easy.” A month later, they’re stuck with terrible FX fees, frozen transactions, or a support team that ghosts them mid-crisis.

So before you open a foreign bank account, it’s a good idea to double-check these four things to make sure everything goes smoothly.

1. Is Your Money Safe?

We understand that convenience is crucial, but if your provider isn’t regulated in a major financial market (such as the UK, EU, US, or Singapore), you may be taking unnecessary risks with your funds.

Look for clear statements about financial oversight, deposit protections, and where the company is licensed. “Startup cool” doesn’t protect your funds in a crisis. Regulatory compliance does.

2. What’s the FX Fee?

Some apps boast “no fees” until you realise you’re getting crushed on the conversion rate.

Even a 1% spread on a $5,000 invoice is $50. Multiply that over monthly payments, and it adds up to serious margin erosion.

Use comparison tools to check the real mid-market rate, then assess how your provider measures up. If their rates are unclear or vague, it’s a sign to reconsider.

3. What Happens When It Breaks?

Your app might be visually appealing, but if your account is flagged for “suspicious activity” or your funds are stuck, waiting four days for a chatbot to escalate your issue is far from ideal.

Test their support before you need it. Send a small amount. Ask a question. See if a human answers.

4. Can You Store and Spend in Multiple Currencies?

This is where the real value lies.

You don’t simply want to hold foreign currencies; you need the ability to receive, store, convert, and spend them seamlessly. This is true multi-currency banking, and not all providers get it right.

Some may only support incoming payments, while others let you hold 20+ currencies but only allow you to spend three. It’s essential to look beyond the label and ensure the provider offers full functionality.

5. Is There a Minimum Deposit or Balance Requirement?

Some accounts look free and easy until you read the fine print. A few providers ask for minimum deposits to open or maintain the account, and falling below that threshold could trigger monthly fees.

Make sure the account fits your current cash flow, not just your future plans.

Final Thoughts

Opening a foreign bank account in 2025 isn’t just a financial upgrade; it’s a strategic move for anyone living, working, or earning across borders.

Whether you’re a business owner scaling internationally, a freelancer or remote worker getting paid in foreign currencies, or someone living abroad, the right account can unlock smoother transactions, lower fees, and more control over your money.

There’s no shortage of great options. Whether you want to open a foreign bank account online for speed or go with a trusted traditional bank for long-term reliability, there’s a solution to match your needs.

DSGPay: A Smarter, Simpler Way to Bank Internationally

Looking for a more flexible solution for managing international payments and global business needs? DSGPay offers a smarter, hassle-free alternative that goes beyond the challenges of traditional banking, providing you with greater ease and efficiency.

Why Choose DSGPay

- Open a virtual account in your name that functions like a local bank account, without needing physical bank accounts in each country.

- Send, receive, and hold funds in 30+ currencies, such as USD, EUR, GBP, HKD, SGD, and more.

- Enjoy low-cost FX rates and transparent fees.

- No minimum balance requirements.

- Fully licensed MSO in Hong Kong, meeting strict regulatory standards for compliance and security

- Dedicated customer support.

DSGPay offers the perfect banking alternative, helping you manage currencies, payments, and reduce fees, all in one powerful platform.