If you’re freelancing on Freelancer.com or thinking about starting, finding the right way to get paid can make a big difference.

With over 60 million users on the platform, knowing how to set up fast, low-cost, and reliable payments isn’t just helpful, it’s essential.

Let’s review some of the best ways to use Freelancer.com payment methods without spending too much money on fees or encountering technical difficulties.

Table of Contents

Key Takeaways:

- Freelancer.com offers a range of withdrawal payment methods, some of which include PayPal, Bank Transfers, Skrill, Payoneer, and Wire Transfers.

- Choosing the wrong method can lead to unnecessary losses, making matching your choice with your needs very important.

- First-time users are required to complete a one-time verification process and may experience a 15-day security hold on their first withdrawal.

- There’s an alternative payment method that allows freelancers to withdraw from Freelancer.com and convert funds to their local currency with lower fees.

Overview of Freelancer.com Payment Methods

Freelancer.com offers several payment solutions from credit cards to payment providers, and more.

Here’s a breakdown of the available Freelancer.com payment methods, as well as their pros and cons.

1. PayPal

PayPal is one of the most accessible and user-friendly payment methods for freelancers on Freelancer.com. Due to its global reach and simplicity, it is often the preferred option for new users on the app.

Pros:

- It is widely used and supported globally.

- It has a fast payment processing time (1 or 2 business days).

Cons:

- They apply currency conversion fees with each transaction.

- Limited or restricted access in certain countries, such as Afghanistan, Bangladesh, Cameroon, etc.

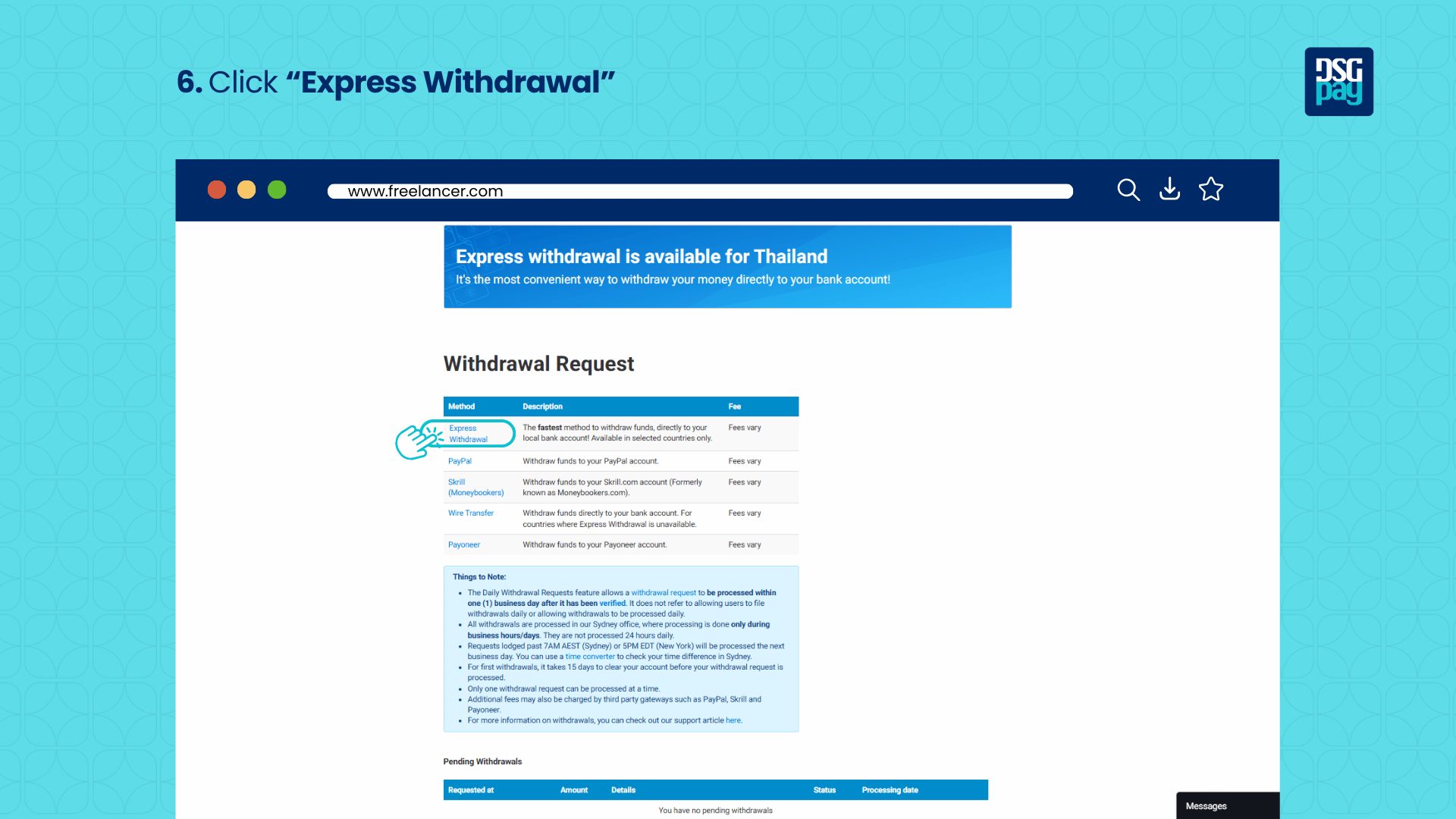

2. Express Withdrawal (Bank Transfer)

The Express Withdrawal option allows funds to be transferred directly to a freelancer’s bank account. It’s particularly useful for users who prefer not to deal with third-party wallets and want immediate access to local currency. However, the exact processing time and fees can vary depending on the country and the bank’s policies.

Pros:

- Recommended for US-based freelancers.

- Fast to operate.

Cons:

- Transaction processing time may be up to 3-5 business days.

- You may have to pay intermediary bank fees.

3. Skrill

Skrill offers a digital wallet service that’s often favoured for its lower withdrawal fees and support for multiple currencies. Freelancer.com users can transfer funds to their skill wallet and then withdraw them to their bank account or spend directly using the Skrill card. It’s especially useful for freelancers in Europe, the Middle East, and parts of Asia.

Pros:

- Offers a low withdrawal fee.

- Support multiple currencies.

Cons:

- Not supported in several countries, such as American Samoa, Angola, Anguilla, and others.

- It may take up to 2–3 days to process.

4. Payoneer

Payoneer is a widely used cross-border payment platform that connects Freelancer.com users to local bank networks in over 150 countries. It allows users to receive payments in USD, EUR, GBP, and more, and withdraw funds in local currency. Payoneer accounts can also be used as business accounts, which makes them ideal for professional freelancers and agencies.

Pros:

- Seamless integration with local bank account.

- Accepted globally.

Cons:

- Payoneer may charge an annual card maintenance fee.

- Exchange rates can be lower than their market value

5. Wire Transfer

Wire transfers are best suited for freelancers or businesses making high-volume withdrawals. Freelancer.com supports wire transfers to international bank accounts, which is ideal when other options are not available. Though it has a higher minimum limit and fee, it’s a secure method for transferring large amounts in a single transaction.

Pros:

- It is a reliable option for high-value transfers.

- Commonly used among agencies or highly valued freelancers with a large income.

Cons:

- There is a higher minimum withdrawal amount of $500+

- They also charge high flat fees of up to $30 or more.

Freelancer.com Payment Methods Compared

To better determine which payment method is best for you, let’s go over their processing times, transaction fees, and minimum withdrawal amounts.

| Payment Method | Processing Time | Withdrawal Fees from Freelancer.com | Minimum Withdrawal |

| PayPal | 1-2 business days | $1 + Currency conversion fees (total fee may vary by country) | $50 |

| Bank Transfer | 3-5 business days | $1 + Currency conversion charges | $50 |

| Skrill | 1-2 business days | $1 + Currency conversion charges | 50 EUR/GBP |

| Payoneer | 1-2 business days | $1 + Currency conversion fee | $50 |

| Wire Transfer | 5-7 business days | Up to $25+ and/or additional fees by intermediary banks | $500 |

Note: Among Freelancer.com payment methods, there’s an alternative payment provider that allows you to obtain your pay from Freelancer.com and convert it to a different currency with little charge.

You can also choose to send it to your local bank account or otherwise manage it as you like.

We’ll divulge this secret in the next few sections.

How to File a Withdrawal Request on Freelancer.com

Is it payday today? Here’s a quick step-by-step instruction on how to submit a withdrawal request on Freelancer.com. It’s quick and easy to do.

Here’s how:

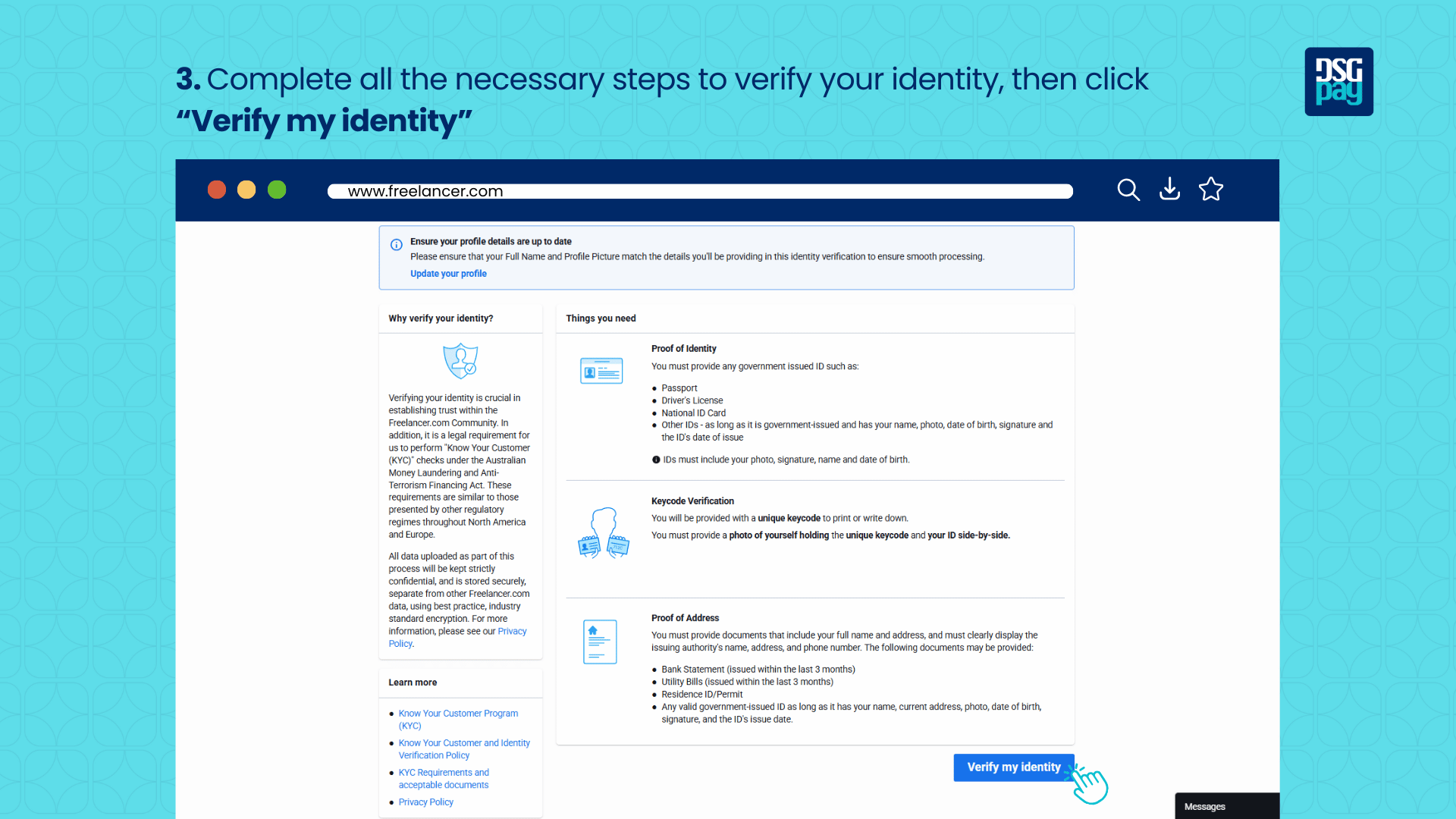

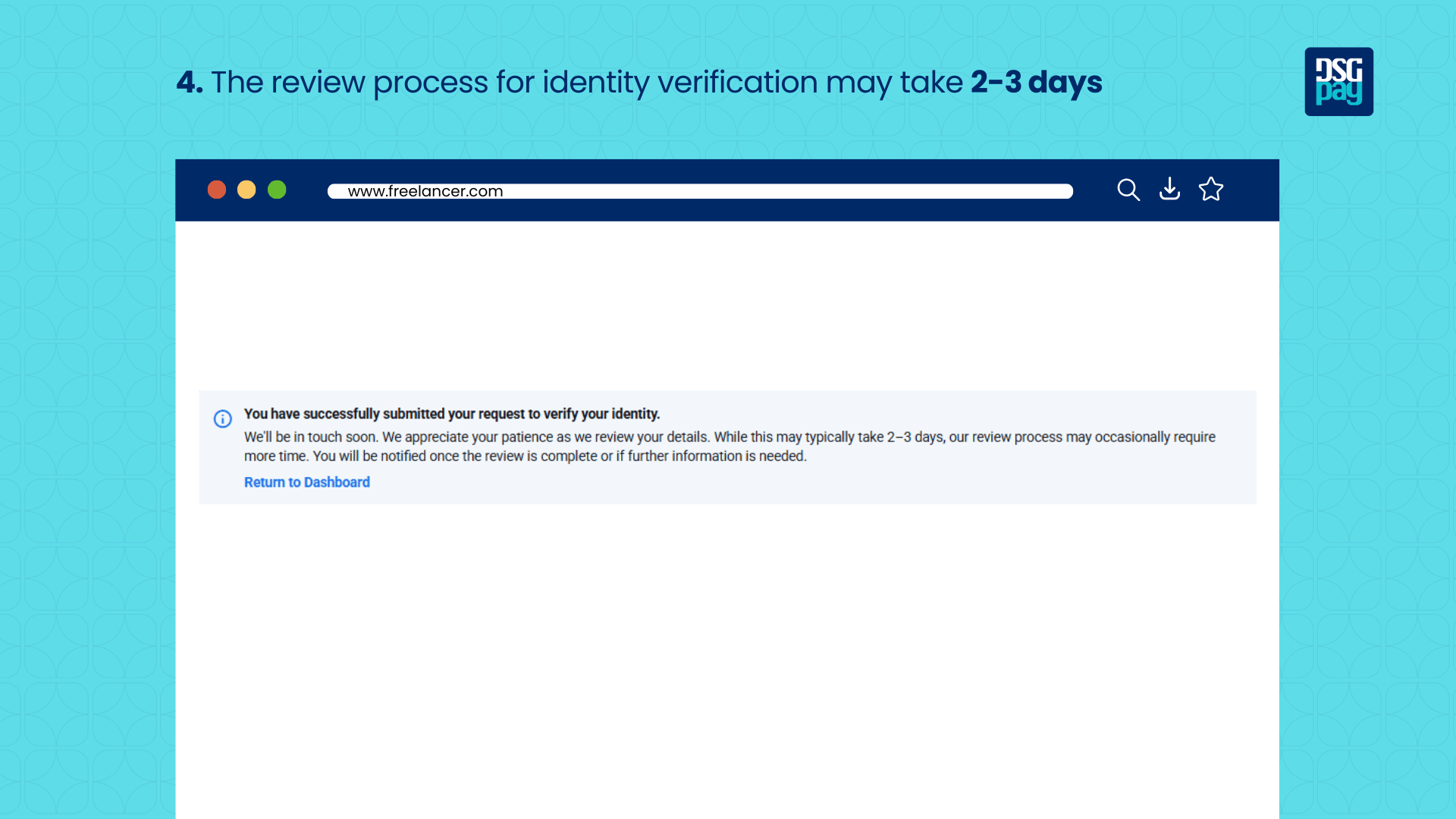

- Step 1: Log in to Freelancer.com. Ensure you’ve completed all forms of your account verification, i.e., your email, phone number, and KYC.

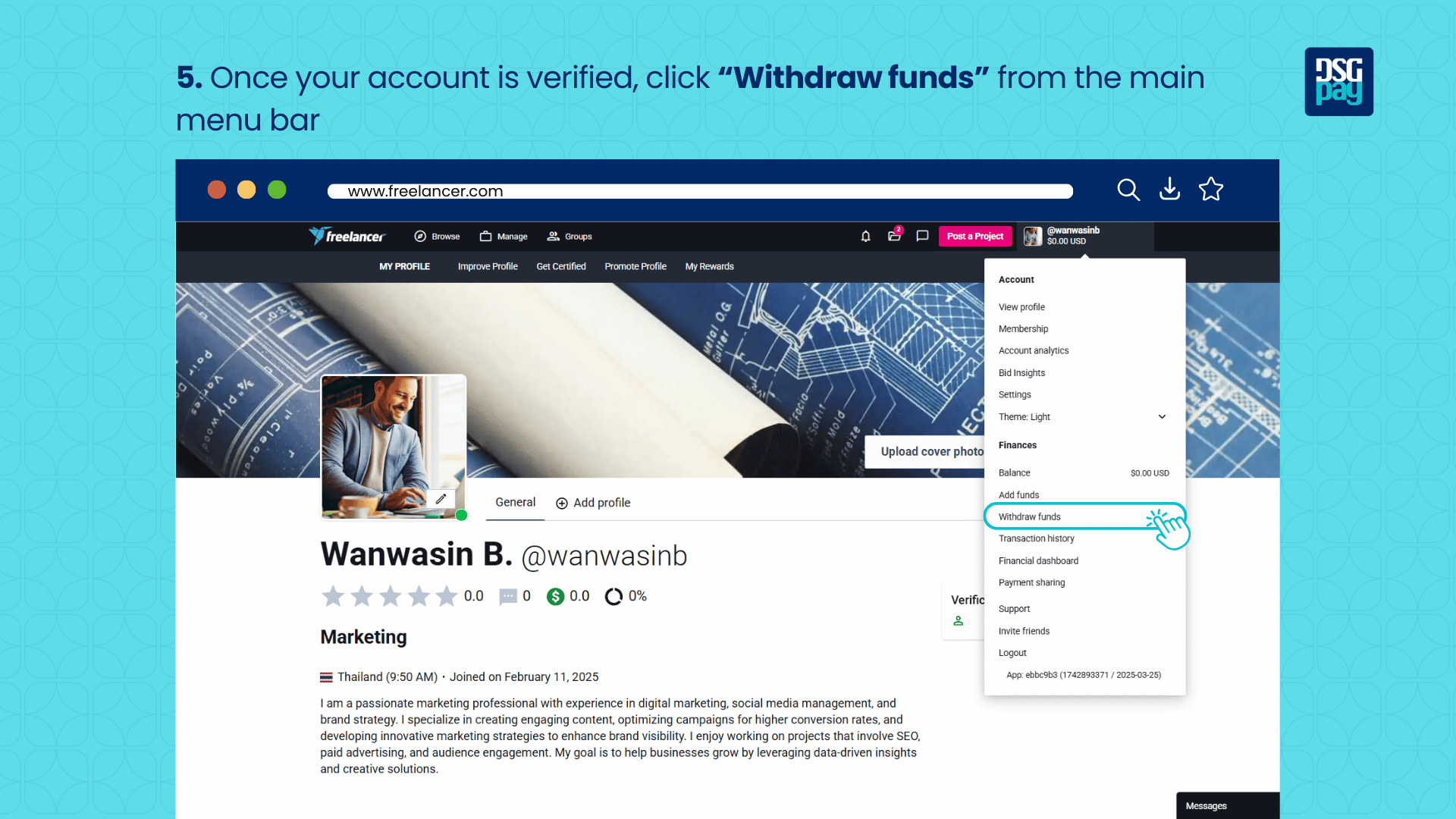

- Step 2: Then, click on your profile picture thumbnail from the main menu bar and click “Withdraw funds.”

- Step 3: Select your preferred withdrawal method to receive your earnings.

- Step 4: Enter the amount and currency you want to withdraw, as well as the details of your bank account if necessary.

- Step 5: Review the withdrawal details and click the “Withdraw Funds” button.

With these steps, your funds should be withdrawn within a few days to hours, depending on the selected payment method. However, take note that:

- The transaction fee for each withdrawal is not removed from your account, but from the withdrawn amount. Hence, be strategic when making such withdrawals.

- If you’re withdrawing for the first time on Freelancer.com, you’ll need to wait for the 15-day delay due to the security regulations. However, after the first time, any subsequent withdrawal request will be processed according to the normal processing times.

- Only one withdrawal request can be processed at a time. You must wait for the first request to be processed or cancel it before submitting a new one.

DSGPay: Freelancer.com Payment Method for Global Freelancers

Looking for a faster, more affordable way to withdraw your earnings from Freelancer.com?

DSGPay offers an easy-to-use alternative for freelancers who want to get paid in multiple currencies without the high fees and slow processing times that come with traditional methods.

With a DSGPay virtual account on our mobile app, you can receive payments in USD, EUR, GBP, and over 30 currencies and then choose when and how to withdraw. Whether you’re freelancing from Asia, Europe, or anywhere in between, DSGPay helps you take control of your income.

Why Choose DSGPay as Your Freelancer.com Payment Method:

- No Local Bank Account Needed: Ideal for freelancers working from regions with limited banking access.

- Lower Fees, Better FX Rates: Avoid unnecessary currency conversion and intermediary bank charges.

- Multi-Currency Flexibility: Receive, hold, and send payments in 30+ global currencies. You can convert them back to your local bank account or hometown currency whenever you need.

- Fast Processing Times: Get your earnings faster, often within the same day.

- Licensed and Reliable: Operates under a Money Service Operator license to ensure your funds are secure.

Whether you’re just starting your freelance career or managing multiple projects, DSGPay helps you withdraw your Freelancer.com earnings with less hassle and more flexibility.

Try it out now!

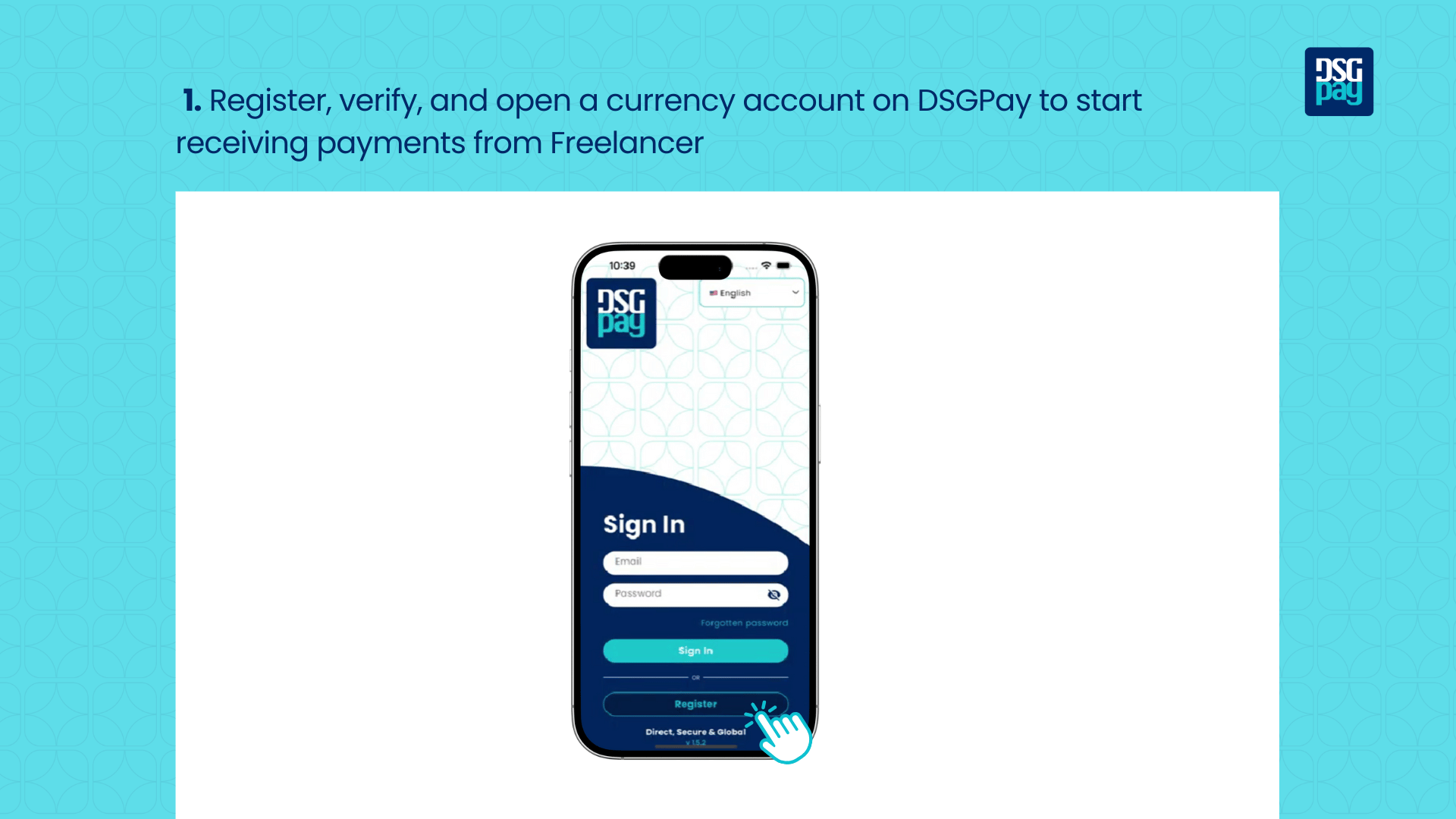

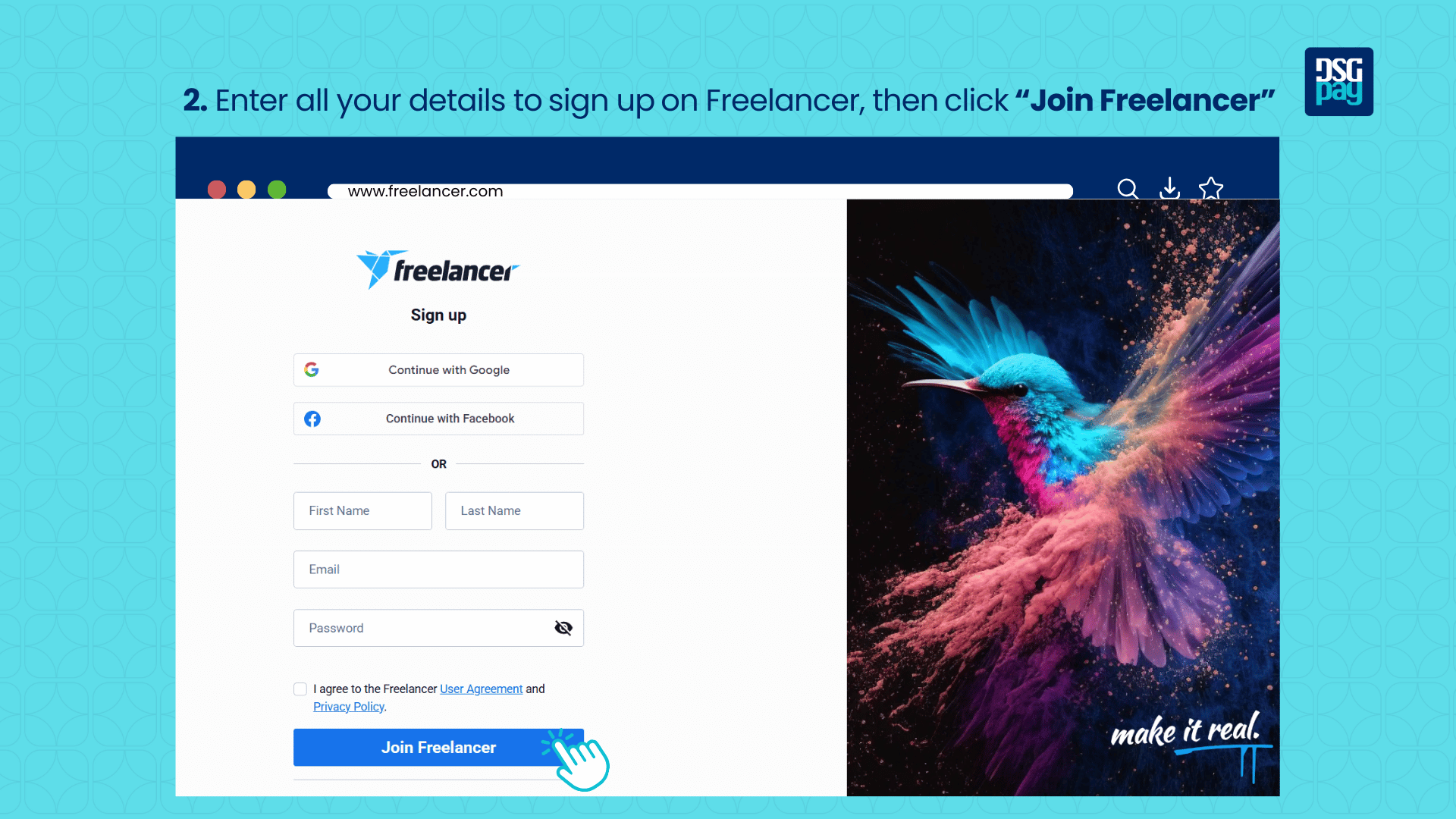

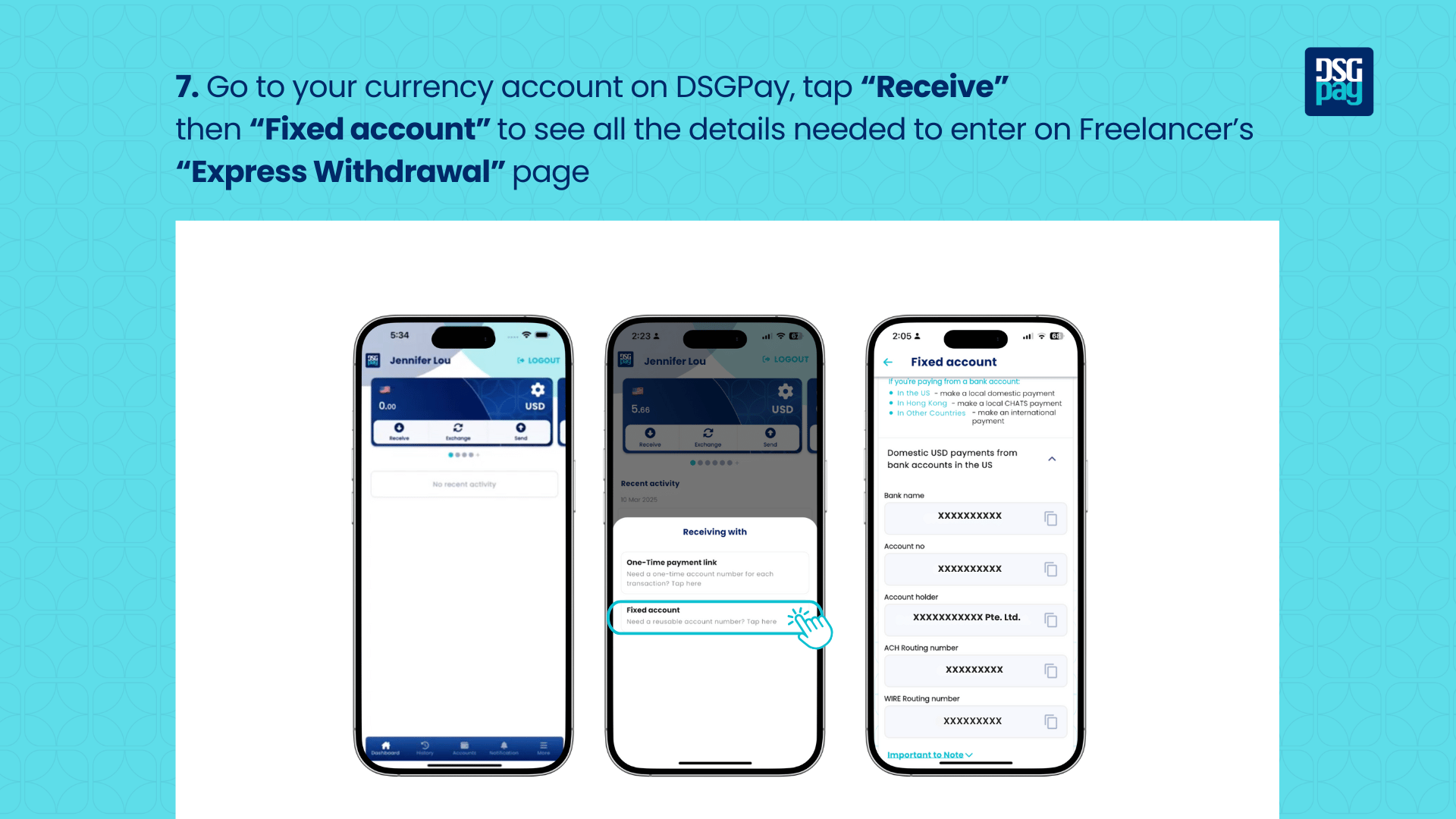

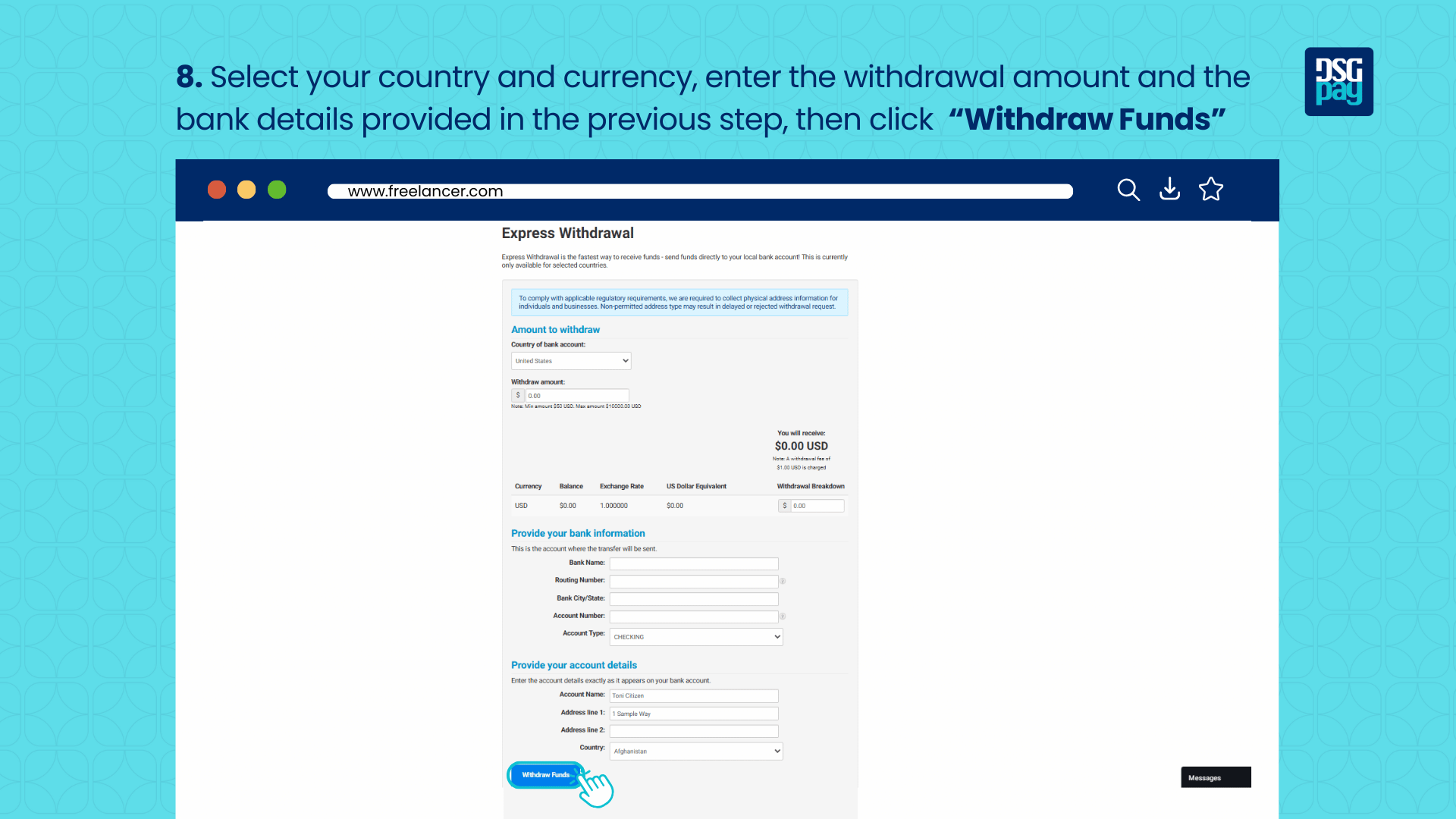

How to Receive Money From Freelancer.com Using DSGPay

To start receiving money on DSGPay, you need to download DSGPay mobile app and create a virtual account on DSGPay. Then, link it to your freelancer account on Freelancer.com.

Here’s how to do it:

FAQS About Using DSGPay as a Freelancer.com Payment Method

1. How long do Freelancer.com withdrawals take?

Payment processing times on Freelancer.com can take from 24 hours to 3 business days, depending on the method chosen and the account status. On DSGPay, it takes about 24 hours for a withdrawal to be completed.

2. Can I use DSGPay directly with Freelancer.com?

Yes, you can. By linking DSGPay through the Express withdrawal method, you can receive funds directly into your virtual business account. More details in the preceding section.

3. What is the minimum amount I can withdraw from Freelancer.com?

This depends on the selected payment methods. For DSGPay, you can withdraw as little as $5. Whereas, PayPal has a $50 minimum transfer limit, while wire transfers start at $500.

4. Is it safe to withdraw to DSGPay?

Yes. DSGPay is a secure, licensed payment platform that uses advanced encryption and complies with international regulatory standards to ensure safe global transactions.

Final Thoughts on ‘Freelancer.com Payment Methods’

Getting paid as a freelancer should be simple, fast, and cost-effective, and with the right payment method, it can be.

Now that you know the options available on Freelancer.com, plus a smarter alternative with DSGPay, you’re better equipped to keep more of what you earn and avoid unnecessary delays.

Take control of your payments, choose the method that works best for your goals, and focus on what really matters: growing your freelance success.