Integrated with over 2000 marketplaces, networks, and platforms, Payoneer is a payment service that caters to the needs of over 5 million customers worldwide. However, there are several alternatives to Payoneer.

If you’re exploring other ways to send and receive payments globally, this blog highlights the best alternatives to Payoneer. We’ll also disclose some tips to help you get the best advantage and make a smoother payment process.

Table of Contents

Key Takeaways

- While Payoneer is widely used, there are other flexible and cost-effective alternatives that provide seamless money transfers and business payments to users across the globe.

- Choosing the right platform depends on your goals; freelancers need affordability and platform support, while e-commerce sellers and startups may prioritise currency flexibility and team features.

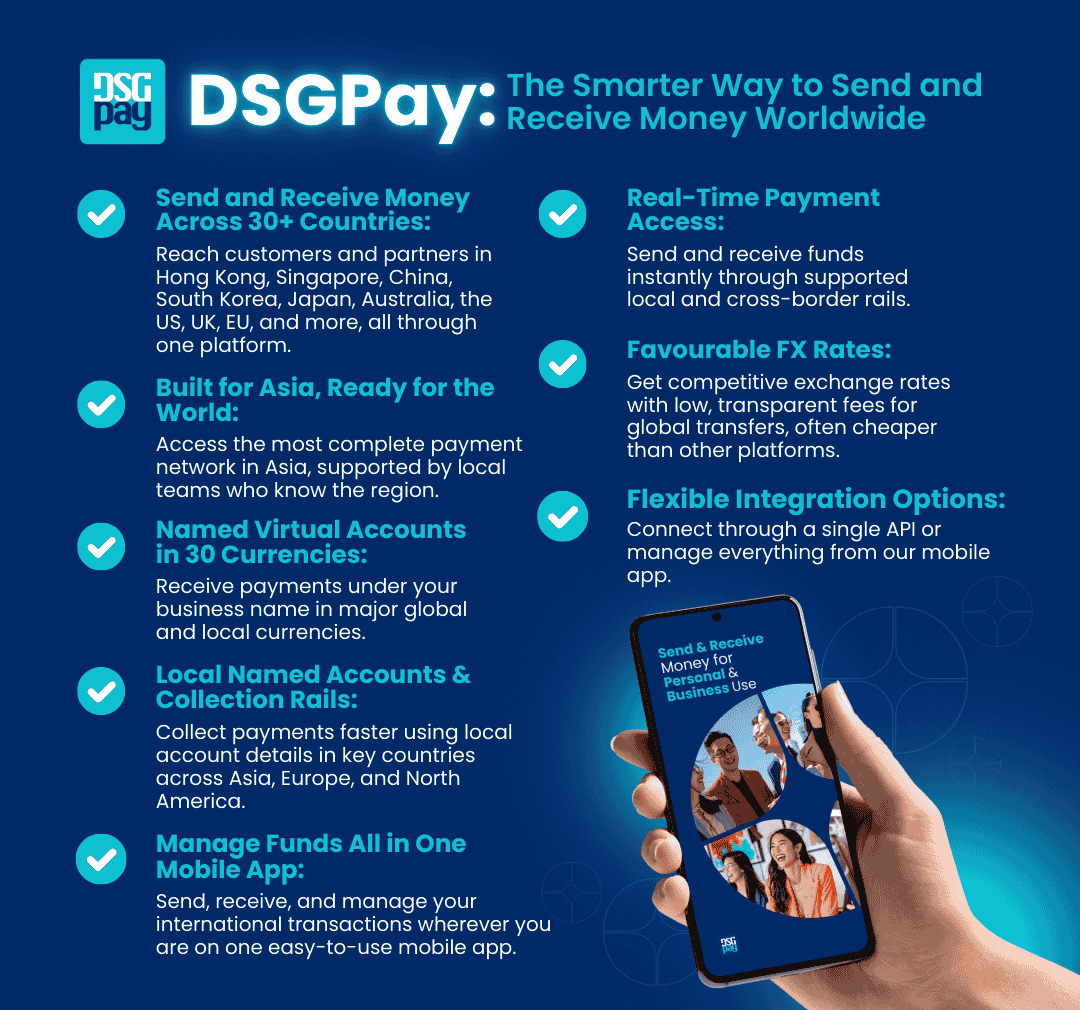

- DSGPay stands out as an alternative to Payoneer in 2025, offering named virtual accounts, fast settlements, low transparent fees, and broad platform integration.

Best Alternatives to Payoneer in 2025

1. Wise

Pros:

- Uses mid-market exchange rates with no markup

- Transparent, upfront fee structure

- Fast transfers to bank accounts in many countries

- Easy-to-use mobile app and dashboard

- Supports multi-currency balances and debit cards

Cons:

- No cash pickup or deposit options

- Transfers only to bank accounts (no e-wallet or cash-out support)

- Not ideal for very large transfers due to tiered fees

Fees:

- Transfer fees vary by currency and destination (usually low)

- Example: Sending USD to EUR may cost ~0.5% of the amount

- No hidden FX spread, you see the real rate upfront

Why It Could Be an Alternative to Payoneer:

- Wise offers lower and more transparent fees, especially for currency conversion.

- It’s ideal if you mainly receive and hold payments in multiple currencies, then withdraw to your local bank.

- You get a multi-currency account with local bank details (like EUR, GBP, USD), similar to Payoneer’s Global Payment Service.

- Unlike Payoneer, Wise lets you time your FX conversions or hold balances in various currencies without mandatory conversion.

2. PayPal

Why It Could Be an Alternative to Payoneer:

- Strong global infrastructure for freelancers and e-commerce sellers

- Seamless integration with marketplaces like eBay, Etsy, and Shopify

- Offers similar client invoicing and payment receiving features

- More widely accepted by individual customers for personal payments

Pros:

- Global brand recognition and user trust

- Instant transfers between PayPal accounts

- Built-in tools for invoicing, subscriptions, and buyer protection

- Easy website integration for businesses

Cons:

- High currency conversion fees and transaction fees

- Limited multi-currency account management

- Local bank withdrawals can take several days in some countries

Fees:

- Cross-border transaction fees: 4.4% + fixed fee

- Currency conversion fee: 3%–4% above market rate

- Receiving fees vary by country and payment type

3. Revolut

Why It Could Be an Alternative to Payoneer:

- Ideal for EU/UK freelancers and startups needing local EUR/GBP accounts

- Better control over FX and budget tracking

- Lower FX fees than Payoneer for intra-European transfers

- Mobile-first experience for managing business finances on the go

Pros:

- Competitive FX rates with no markup within the free allowance

- Multi-currency business accounts and cards

- Budgeting, expense management, and analytics tools

- Supports local bank details in various regions

Cons:

- Business features are mainly available in Europe and the UK

- Limited international payment acceptance compared to Payoneer

- Some features are behind paid business plans

Fees:

- Free plan available with limited transfers

- Paid plans start from €7/month for freelancers

- Currency conversion beyond allowance incurs a 0.4%–1% fee

4. Airwallex

Why It Could Be an Alternative to Payoneer:

- Better suited for SMEs needing local collection in multiple currencies

- Offers lower FX margins and more automation via API

- Supports named virtual accounts for improved client trust

- More transparent cost structure for recurring global operations

Pros:

- Local collection accounts in USD, EUR, GBP, AUD, and more

- FX conversion as low as 0.3% above interbank

- API integration for automated payments and reconciliation

- Virtual cards and team expense management

Cons:

- Not available to individuals; only for registered businesses

- Setup and onboarding may take longer than Payoneer

- Limited customer support in some regions

Fees:

- No monthly account fee

- FX margin: ~0.3%–0.6%

- Domestic transfers are often free; international transfers are low-cost

5. Neteller

Why It Could Be an Alternative to Payoneer:

- Preferred by users in industries where Payoneer is restricted (e.g., gaming, betting, trading)

- Offers a quick way to send/receive money globally without a bank

- Can act as a backup digital wallet for high-risk merchants or affiliates

Pros:

- Fast transfers between Neteller accounts

- Supports multiple currencies and prepaid Mastercards

- Available in 200+ countries

- High acceptance among high-risk industries

Cons:

- High FX conversion fees

- Limited usability for business invoicing or collections

- Account limitations in some regions

Fees:

- Transfer to another Neteller user: 1.45%

- Currency conversion fee: ~3.99%

- Withdrawal to bank: varies by region and method

6. Stripe

Why It Could Be an Alternative to Payoneer:

- Ideal for startups and SaaS businesses that need full control over payment flows

- Offers local payout support in more countries than Payoneer

- Better suited for scaling e-commerce or subscription platforms

- Provides better automation and developer support for custom payment systems

Pros:

- Powerful API for full payment customisation

- Accepts card payments in 135+ currencies

- Supports invoicing, recurring billing, and marketplaces

- Strong global compliance and reporting tools

Cons:

- Requires technical setup for full functionality

- Payouts may be delayed in some countries

- Limited support for individuals or freelancers in some regions

Fees:

- 2.9% + $0.30 per transaction (standard rate for cards)

- Cross-border and FX fees: ~1% extra

- No monthly fee for basic account

7. Skrill

Why It Could Be an Alternative to Payoneer:

- Useful for freelancers or affiliates in industries that Payoneer doesn’t support

- Can serve as a backup or secondary wallet for fast global transfers

- Offers similar prepaid card and digital wallet functionality

Pros:

- Available in 100+ countries

- Quick account setup and transfers

- Prepaid card available for global use

- High acceptance in high-risk industries

Cons:

- High FX and withdrawal fees

- Limited business features compared to Payoneer

- Customer support can be slow

Fees:

- Currency conversion: ~3.99%

- Withdrawal fee: varies (e.g., $5.50 for bank withdrawal)

- Sending to another Skrill user: 2.99%

8. Trolley

Why It Could Be an Alternative to Payoneer:

- Ideal for platforms or companies managing payouts to large global teams

- Offers automated tax and compliance workflows, which Payoneer lacks

- More scalable and customizable for tech businesses and marketplaces

- Gives better visibility and control over payout processes

Pros:

- Automates compliance (tax forms, KYC)

- Supports mass payouts in multiple currencies

- API-first platform for tech integration

- Works with PayPal, bank transfers, and more

Cons:

- Not available to individuals

- Requires setup and integration time

- Pricing is custom, depending on volume

Fees:

- Custom pricing based on payout method, country, and volume

- May include FX markup, platform fees, and payment processing costs

Comparing the Best Alternatives to Payoneer in 2025

Each of the alternatives to Payoneer has its strengths, which they all play to. Putting them together, let’s compare and see how each platform holds up against the others.

| Platform | Best For | Key Pros | Key Cons | FX Fees | Account Type | Why It’s an Alternative to Payoneer |

|---|---|---|---|---|---|---|

| Wise | Freelancers & small businesses needing transparent FX | Mid-market FX, low fees, easy to use | No cash pickup, not for large transfers | ≈ 0.5% | Individual/Business | Lower fees, multi-currency account, no forced FX |

| PayPal | Freelancers & ecommerce sellers needing global reach | Trusted brand, good for ecommerce, buyer protection | High fees, poor FX rates | ≈ 3–4% | Individual/Business | Marketplace integration, buyer tools |

| Revolut | EU/UK freelancers, startups managing FX & budget | Multi-currency cards, analytics, mobile-first | EU/UK focus, limited global reach | 0.4%–1% (after free limit) | Business/Freelancer | Local accounts, better FX control |

| Airwallex | SMEs needing scalable global collection & payout | API automation, low FX, virtual accounts | Business-only, onboarding takes time | 0.3%–0.6% | Business only | Local collection, API features, lower cost |

| Neteller | Users in gaming, forex, and high-risk industries | Fast transfers, prepaid cards, high acceptance | High FX, limited invoicing | ≈ 3.99% | Individual | Supports high-risk industries |

| Stripe | Tech businesses needing full control over payment flows | Customisable, developer-friendly, global coverage | Requires tech setup, payout delays | ≈ 1% on top | Business | Scalable for SaaS & e-commerce platforms |

| Skrill | Affiliates & users in restricted industries | Fast setup, prepaid cards, available globally | High fees, weak business tools | ≈ 3.99% | Individual | Backup wallet for restricted users |

| Trolley | Marketplaces & platforms managing mass global payouts | Automates compliance, scalable, API-first | Not for individuals, setup complexity | Custom, may include markup | Business only | Mass payouts, tax automation, custom API |

Why Do You Need Alternatives to Payoneer?

While Payoneer has millions of customers across continents, you can explore other alternatives that might better suit your specific payment needs.

Here are a few reasons to consider an alternative:

- To find a platform that aligns more closely with your budget, payment volume, or preferred currencies.

- To access additional payout or collection options in specific regions or countries.

It’s about enhancing flexibility. Comparing platforms helps you discover what aligns best with your specific use case.

Payoneer: Pros VS Cons

| Pros | Cons |

| Widely accepted globally | High withdrawal fees |

| Easy integration with sites | High conversion fees |

| Multi-currency accounts | Limited crypto or FX options |

Choosing the Right Alternative Based on Your Needs

For each user, choosing the right alternative to Payoneer depends on their specific needs.

1. For Freelancers and Remote Workers

If you’re looking to receive payment from your freelance app or even payment from international clients, you can utilise the following payment options.

- PayPal is a great alternative to Payoneer. It allows direct transfers to various account types and is most suitable for API integration on various freelancer apps such as Freelancer.com, Upwork, Etsy, etc.

- DSGPay is another great alternative due to its low, transparent fees, user-friendliness, and access to global markets.

2. For E-Commerce Merchants

If you need to connect with Amazon, Shopify, or Etsy payment processing portals:

- Airwallex is also a great option for e-commerce sellers, as it supports over 160 local payment methods across 130+ currencies. They also integrate seamlessly with major e‑commerce platforms.

- DSGPay provides virtual accounts and multi-currency wallet services, making it easy to send and receive funds globally, without any restrictions. They also handle settlements and API integration options for several e-commerce platforms.

3. For Startups & SaaS Businesses

If you need expense management, team payouts, or international payroll:

- Revolut offers solid fintech tools that support payroll payouts.

- Airwallex is great for automating global payments.

- DSGPay offers named virtual accounts, multi-currency collections and payouts, and API integration services.

Why DSGPay is a Great Alternative to Payoneer

Besides their basic capabilities of holding multiple currencies, DSGPay also offers:

- Virtual Accounts: DSGPay offers named, static, and dynamic virtual accounts. These types of virtual accounts are useful depending on the reason(s) why the users need them. Check out our blog for more information on how a virtual account can be a game-changer in your business – What is a Virtual Account: Unlocking Its Benefits and Key Features for Businesses in 2025.

- Low & Transparent Fees: DSGPay allows its clients to save more by offering low transaction fees with each transfer. They also offer competitive FX rates with zero hidden charges.

- Platform Compatibility: DSGPay provides seamless integration with all forms of payment portals. In other words, you can easily integrate DSGPay’s payment dashboard with several e-commerce apps or freelance platforms such as Amazon, Etsy, Upwork, etc.

- Multi-currency Support: DSGPay offers multi-currency support in over 30 countries, including Australia, the United States, the United Kingdom, New Zealand, and more.

- Fast Processing and Instant Settlements: DSGPay processes transactions quickly, completing each one within minutes to hours of its creation. This ensures their systems don’t have a backlog of unprocessed transactions and that each client receives their funds quickly.

- Simple Onboarding: Opening an account on DSGPay is simple, easy, and efficient. With the right data, you can start sending and receiving money across borders today.

If you’re an individual, student, freelancer, or business owner looking for a suitable alternative to Payoneer, DSGPay offers everything you need to transact globally without the hassle.

Final Thoughts: Alternatives to Payoneer

While there are several alternatives to Payoneer, DSGPay offers a seamless and faster payment process to individuals and business owners in and across countries.

If you’re seeking a quick and easy alternative that works for your freelance or e-commerce goals, try out DSGPay’s Virtual Accounts today.