Payment in Hong Kong is undergoing a noticeable shift in 2025 as the city sees a stronger uptake of digital, contactless, and QR-based methods.

While cash is still in circulation, mobile wallets, instant transfers, and tap to pay are now part of everyday spending across retail, transport, and online shopping. Adoption has accelerated this year as more merchants support digital payments and consumers show stronger trust in using them.

This article explains the major payment trends shaping Hong Kong in 2025, so businesses can plan their entry with clarity and confidence.

Table of Contents

Key Takeaways

- Contactless, QR, and mobile wallets are now the leading ways people make payments in Hong Kong.

- FPS has become a core part of daily transactions, supporting instant and low-cost transfers.

- Cash use continues to fall as more merchants accept digital options across the city.

- Cross-border wallet compatibility is improving, making spending easier for visitors and travellers.

- Stronger security measures and clear regulations are helping build trust in Hong Kong’s digital payment ecosystem.

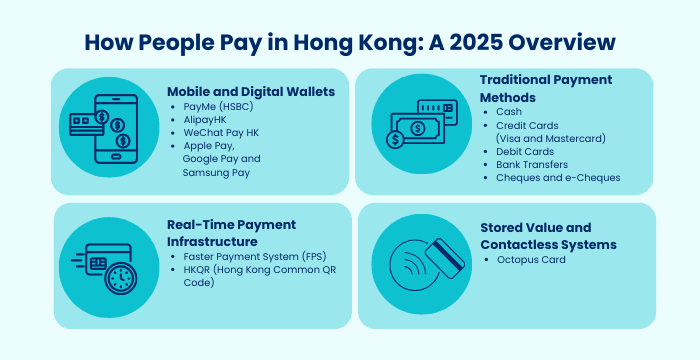

What Are the Key Payment Methods in Hong Kong

Hong Kong’s payment system blends long-standing habits with some of the most modern tools in Asia. From the city’s famous Octopus card to instant transfers through FPS, residents and visitors enjoy a wide range of ways to pay.

Below is a clear, simple overview of the main payment methods used across Hong Kong in 2025 and where each one fits in daily life.

1. Mobile and Digital Wallets

- PayMe (HSBC): A social payment wallet used for quick, cash-free transfers, bill splitting, and paying small cafés and shops.

- AlipayHK: AlipayHK grew from the wider Alipay ecosystem and has become a major wallet for QR-based spending across Hong Kong. It appeals to shoppers who enjoy promotions, as well as frequent travellers to Mainland China who benefit from automatic currency conversion. Many retailers and transport services support it due to its strong user base.

- WeChat Pay HK: WeChat Pay HK sits inside the WeChat app, making payments feel like part of a conversation. It is commonly used for small daily purchases in Hong Kong and works seamlessly in Mainland China and selected overseas markets.

- Apple Pay, Google Pay and Samsung Pay: These device-based wallets let users tap to pay with phones or wearables. Apple Pay offers strong hardware security, Google Pay works across most Android devices, and Samsung Pay supports older terminals.

2. Stored Value and Contactless Systems

- Octopus Card (Physical and Digital): Hong Kong’s universal contactless card for transport, convenience stores, groceries, vending machines, and quick-service retail. Today, both physical cards and mobile versions are used by students, office workers and families who want fast, reliable payments across the city.

3. Real-Time Payment Infrastructure

- Faster Payment System (FPS): An instant payment network connecting all major banks and digital wallets. It started as a way to simplify transfers by using phone numbers and email addresses, and it quickly gained traction as residents saw how reliably it moved money at any hour.

- HKQR (Hong Kong Common QR Code): A unified QR standard that lets merchants show one code while customers pay with any supported wallet they prefer. Popular among small shops, taxis, and market stalls.

4. Traditional Payment Methods

- Cash: Cash remains useful in street markets, small eateries and taxis for low-value purchases and places that operate traditionally.

- Credit Cards: Credit cards are widely used for retail, travel and online shopping. Visa and Mastercard dominate, while UnionPay and American Express are accepted in specific segments.

- Debit Cards: Debit cards draw directly from bank accounts and are commonly used for daily purchases and ATM withdrawals.

- Bank Transfers: Traditional bank transfers handle formal or business-related payments such as rent, payroll, and invoices.

- Cheques and e-Cheques: Cheques are declining, but are still used for corporate and legal payments. E-Cheques offer a digital alternative that is faster, more secure and easier to process, and they are gradually replacing paper versions.

Quick Summary of Payment Methods in Hong Kong (2025)

| Payment Method | Main Providers | Common Use Cases |

|---|---|---|

| Cash | Authorised note-issuing banks (HSBC, Standard Chartered, BOCHK) under HKMA oversight | Markets, local eateries, taxis, and gifting |

| Octopus Card (Physical & Digital) | Octopus Holdings | MTR, buses, supermarkets, convenience stores |

| Credit Cards | HSBC, Citi, SCB, Hang Seng, BOCHK, DBS, Amex | Retail, dining, travel, e-commerce |

| Debit Cards | All major HK banks | Daily spending, ATM withdrawals |

| Mobile Wallets | AlipayHK, WeChat Pay HK, PayMe, Tap & Go, Octopus App | Retail, dining, delivery, online shopping |

| Apple Pay / Google Pay / Samsung Pay | Supported by most banks | Fast checkout, cafés, transport, supermarkets |

| FPS (Faster Payment System) | All banks + SVFs connected to FPS | P2P transfers, bill payments, QR checkout, wallet top-ups |

| HKQR (Unified QR Standard) | HKMA | Taxis, small shops, markets, services |

| Bank Transfers | All Hong Kong banks | Invoices, rent, business payments |

| Cheques / e-Cheques | Major banks | Corporate, legal, property-related transactions |

How Payment in Hong Kong is Evolving in 2025

Hong Kong’s payment ecosystem is now driven by convenience, speed, and interoperability. These shifts are shaping the key trends that define how people pay in 2025.

1. FPS Strengthens the Shift Toward Real-Time Payments

A big part of Hong Kong’s payment shift comes down to one thing: people expect money to move instantly. The Faster Payment System (FPS) delivers exactly that. What began as a quick way to send small transfers has become the main network connecting banks, e-wallets, government services and merchants.

People now use the Faster Payment System to handle everyday tasks like paying bills, topping up wallets and making QR code purchases.

By early 2025, registrations had already passed 17 million, showing how deeply the system is built into daily life.

The daily transfer limits under the Faster Payment System differ depending on the bank or wallet a user is registered with.

Common FPS limits in 2025 include:

- Small-value transfers are often capped at around HKD 10,000.

- Registered payees receive much higher limits, often HKD 1,000,000 to HKD 1,500,000, depending on the bank.

- Wallets such as AlipayHK and Octopus set their own limits based on verification level, usually ranging from HKD 3,000 to HKD 20,000 per day.

- Larger transfers usually require two-factor authentication or biometric approval.

Together, these limit structures give users flexibility while ensuring that security remains strong across Hong Kong’s real-time payment network.

2. Contactless Payments Become the Everyday Standard in Hong Kong

Contactless spending has become part of Hong Kong’s daily rhythm. Tap-to-pay is now widely accepted across MTR gates, buses, ferries, trams, taxis, supermarkets, cafés, and major retail chains. The expansion of contactless entry across the transport network has anchored card-based payments as one of the most stable methods in the city.

Consumers continue to prefer the speed of tap-and-go, and tourists value the ability to use their home cards without additional registration. For merchants, the predictable settlement cycle and smooth checkout experience make contactless a reliable pillar in their payment mix.

3. QR Code Payments Surge Through FPS and HKQR

QR code payments are gaining momentum at a rapid pace. FPS and HKQR (Hong Kong’s unified QR code standard) have created a unified digital environment where merchants can accept multiple wallets using a single QR display. This interoperability has removed hardware barriers and encouraged adoption across small shops, market stalls, and service providers.

For merchants, FPS-enabled QR payments settle instantly, reducing waiting time and improving cash flow. For consumers, QR offers flexible wallet switching and familiar interfaces that make checkout convenient.

QR is now one of Hong Kong’s fastest-growing payment channels, especially among younger users and tourists who prefer mobile-first spending.

4. E-Wallets and Cross-Border Payments Grow Together in 2025

Hong Kong’s digital payments boom is being driven by two forces that now work hand in hand: the rise of mobile wallets and the rapid expansion of cross-border payment connectivity. Instead of functioning as separate trends, they are increasingly shaping each other.

Mobile wallets like Octopus, AlipayHK, WeChat Pay HK, Tap & Go, and PayMe have become everyday tools for transport, retail, food delivery, and online shopping. At the same time, these wallets are gaining new relevance through regional payment links that make travel and cross-border commerce easier.

For visitors, the ability to pay in Hong Kong using the same wallet they use at home removes friction at checkout. For Hong Kong residents, cross-border QR acceptance and clearer FX conversions make overseas spending smoother.

This two-way flow is helping wallets become more than local convenience tools; they are now part of the infrastructure that supports tourism, e-commerce, and multi-market trade.

5. Cash Use Declines as Digital Habits Strengthen

Cash still plays a role in traditional markets and among older demographics, but its influence is fading. More stalls now display unified QR codes, and younger consumers rarely carry cash for small purchases. Public transport’s shift towards contactless cards and mobile wallets has also reduced reliance on physical banknotes.

Banks and regulators are promoting digital literacy and fraud awareness, giving residents more confidence to adopt secure digital tools.

Hong Kong is steadily becoming a cash-lite environment where digital channels take the lead.

6. Credit Cards Hold Their Ground in Hong Kong’s Digital Shift

While mobile wallets, QR payments, and instant transfers are shaping the future of payment in Hong Kong, credit cards continue to play a major role in how residents spend in 2025.

Instead of being replaced, they now operate alongside newer digital options, especially for higher-value and online purchases.

Card usage in Hong Kong remains strong in 2025. By Q2, there were 22.8 million credit cards in circulation, up both quarter on quarter and year on year. Transaction activity also continued to grow, with 360.1 million transactions completed in Q2, an increase from both the previous quarter and the same period last year.

These transactions were worth HKD 268.4 billion. Most of this came from retail spending in Hong Kong, followed by overseas spending, with a small share from cash advances.

7. Regulation and Security Upgrades Support Digital Adoption

As digital usage expands, regulators are prioritising consumer protection and system stability. Wallet providers and FPS operators now follow stricter verification processes, clearer disclosures, and enhanced fraud-monitoring standards. These changes build trust and ensure payments remain safe as adoption grows.

How Businesses Can Accept Payments in Hong Kong

Let’s take a look at the core steps businesses should follow when setting up payment acceptance in Hong Kong.

- Offer the Payment Methods Customers Expect:

- Hong Kong shoppers are used to fast, digital options, so even a basic setup should include Octopus, FPS, contactless cards and a couple of major QR wallets to ensure smooth checkout for both locals and visitors.

- Choose the Right Setup:

- Larger retailers typically rely on full POS terminals that handle tap payments, cards and QR scanning.

- Smaller shops, market stalls and service providers often prefer QR-based acceptance because it is affordable, portable and easy to deploy.

- FPS remains popular among small merchants for its instant settlement.

- Understand Settlement Timelines:

- Different methods clear funds on different schedules:

- FPS: instant

- Cards and mobile wallets: usually the next business day

- Octopus: typically next business day

- Different methods clear funds on different schedules:

- Keep the Checkout Experience Clear and Simple:

- Visible payment signs, easy-to-scan QR codes and familiar tap prompts help customers move through the line quickly. A clean, predictable payment process strengthens trust and keeps transactions flowing smoothly.

Critical Factors to Consider When Enabling Payments in Hong Kong

Here are the main things businesses should be prepared for when setting up payments in Hong Kong.

- Slow Bank Account Setup:

- To connect with FPS or enable merchant settlement, companies need a Hong Kong corporate account. Banks carry out strict onboarding checks and request extensive documentation, which can slow down your ability to begin taking payments.

- Compliance and Security Requirements:

- Every business accepting payments must meet the Hong Kong Monetary Authority’s expectations for KYC and AML.

- Payment providers also require ongoing verification, record keeping and fraud monitoring. Strong data protection measures are essential, as consumer trust depends heavily on how securely their information is handled.

- Businesses must also be prepared to manage chargebacks, which require proper documentation and timely responses.

- Operating Costs:

- Cross-border activity is common in Hong Kong, so companies need to understand how currency conversion, international fees and settlement partners affect margins.

- Hong Kong’s high labour and rental costs mean payment fees and settlement delays can directly impact profitability, especially for cafés, retailers and service-based businesses.

- The city’s simple tax structure reduces paperwork, though some models may require additional licences for remittance or financial services.

- Focusing on cost efficiency and settlement speed helps businesses maintain healthy cash flow.

- Tourism Influence:

- A large share of spending comes from Mainland China visitors. To capture this volume, businesses must accept cross-border QR wallets and HKD-based digital payments that tourists already use.

Future Outlook: What to Expect in Hong Kong’s Payment Space (2026–2030)

Hong Kong’s payment landscape is set to enter a far more advanced stage between 2026 and 2030, as the city upgrades its core infrastructure and deepens cross-border connectivity.

Here are the key trends shaping the city’s payment future:

- More automation: Payments will become faster and more seamless, with many processes running quietly in the background.

- AI-powered security: Real-time fraud detection will strengthen trust and reduce risks.

- Advanced technology: Blockchain, 5G and smart devices will support faster and more transparent payments.

- Stronger cross-border links: Hong Kong payments will become even more integrated and convenient.

- Higher security investment: Banks, fintechs and the Hong Kong government will continue boosting cybersecurity and resilience.

As these technologies mature, they are expected to strengthen user confidence, boost engagement and support a more resilient, future-ready payment environment across the city.

Conclusion: Hong Kong Moves Closer to a Fully Digital Future

If there is one clear takeaway from Hong Kong’s 2025 payment shift, it is this: the market rewards businesses that remove friction. Consumers are making decisions based on speed and convenience, not on how many payment signs a shop hangs near the counter. That means any company entering Hong Kong must treat payment acceptance as a strategic advantage, not an afterthought.

The businesses that win in this environment are the ones that adapt quickly. They support the tools people already use, keep settlement fast and predictable, and choose payment partners that simplify onboarding instead of slowing it down.

Hong Kong’s infrastructure is only getting stronger from here, and the next wave of innovation will make payments even more embedded in daily life. For merchants, this creates a simple reality: match the pace of the market, and the market will reward you.

How DSGPay Supports Fast, Flexible Payments in Hong Kong’s Digital Market

DSGPay helps businesses operate smoothly in Hong Kong by providing named virtual accounts, fast settlement capabilities, multi-currency support, and seamless local and international transfers.

Why Choose DSGPay:

- HKD Named Virtual Accounts: Collect payments locally with your business name shown to customers and partners.

- Multi-Currency Support (30+ currencies): Hold, send, and receive funds globally with competitive FX.

- Fast Local Settlements: Benefit from real-time or same-day settlement across supported payment rails such as FPS, CHATS, and SWIFT.

- Global Payouts: Send funds to suppliers, staff, or platforms through SWIFT or local payout routes.

- Transparent Fees: Predictable pricing with no hidden charges.

- Secure & Compliant: Strong KYC, AML, and transaction monitoring aligned with Hong Kong regulatory standards.

- Built for SMEs & Corporates: Scalable infrastructure for businesses operating across Asia and internationally.