Virtual Account vs Physical Account: What’s Actually Right for Your Business?

It’s a decision a lot of business owners are facing right now. As the world leans into digital-first operations, choosing between a virtual or physical account isn’t just a minor detail. It affects how quickly you can move money, expand into new markets, and stay focused on growth.

But here’s the problem: too many businesses get stuck weighing up the pros and cons, instead of looking at what will actually support their operations long term.

Rather than providing a basic comparison, we will examine which option is most suitable for different types of businesses and why many are transitioning to virtual solutions.

Let’s dive in.

Table of Contents

Key Takeaways:

- Virtual accounts are built for speed, automation, and global reach, making them a smart choice for digital-first businesses, remote teams, and online sellers.

- Physical accounts still play a role where in-person banking, cash handling, or regulatory compliance is required.

- Cost efficiency gives virtual accounts an edge. Lower fees, faster setup, and multi-currency support reduce overheads and simplify international operations.

- Hybrid setups are becoming the norm, with businesses using virtual accounts for scale and reach, and physical ones for local operations.

- Around 71% of U.S. employers are using a hybrid work model, making digital-first finance tools, such as virtual accounts, more essential.

- Security is strong on both sides, but it depends on the provider. Choose virtual accounts that are licensed or backed by regulated institutions.

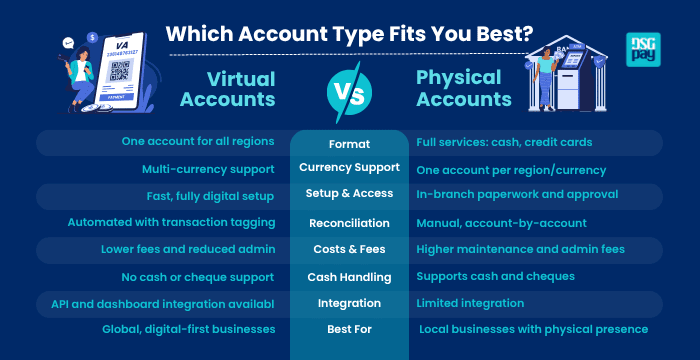

Virtual Account vs Physical Account: A Quick Look at the Differences

To help you decide faster, here’s a clear breakdown of how these two compare:

Understanding the Basics

Let’s take a look at what physical and virtual accounts actually are, how they work, and when each one is the better fit.

What is a Physical Account?

A physical account is a traditional account opened at a bank branch. It is specific to a country and currency, and managed either in person or through online banking. You can use it for deposits, withdrawals, cheque payments, or sending and receiving funds.

Key features:

- Supports cash handling.

- Comes with debit cards, cheque books, and banking staff support.

- May offer credit, overdrafts, and loans.

- Operates within the rules and time zones of its country.

What is a Virtual Account?

A virtual account is a digital sub-account linked to a main account. It lets you assign a unique account number or reference for each client, currency, or transaction stream, without needing separate accounts for each.

Key features:

- Fully digital, no paperwork or branch visits.

- One master account handles everything.

- Payments can be grouped and tagged for easy reconciliation.

- Supports multiple currencies and has a faster setup.

Comparing Virtual Accounts and Physical Accounts

Let’s see how these account types compare in terms of transactions, security, fees, and real-world business use cases.

How Transactions Work Differently

With a physical account setup, you need a separate account for each currency or region. Each one has its own login, local rules, and reconciliation steps.

For example, if you get £1,000 from a UK client, €1,000 from a German customer, and $1,000 from a US client, the money goes into three different accounts. You’ll have to log into each one, convert currencies manually, and match payments one by one.

With a virtual account setup, you give each client or region a unique virtual account number, but all payments go into one main account.

Each transaction is tagged with the virtual account it came from, so you can easily track who paid what. There’s no need to manage multiple logins or bank accounts.

Key Features Compared

Here’s how virtual and physical accounts compare across key features, so you can quickly see which fits your business needs:

Account Security

Security isn’t just about where the money sits. It’s about how well it’s protected and how quickly you can act if something goes wrong.

Physical accounts are insured and closely regulated. Virtual accounts can be just as secure, especially if backed by licensed banks or major fintech companies. They often use encryption, two-factor authentication, and fraud monitoring tools.

That said, always check if your provider is licensed or works with a licensed partner. Not all offer the same level of protection.

Costs and Fees

Understanding the true cost of managing your money is key when choosing between a virtual and a physical account. Here’s how the two options stack up:

Quick Use Case Guide

Here’s a simple breakdown of how businesses use each type of account for different situations, based on their needs, goals, and scale.

When to Use a Virtual Account

- Best for launching an online store with fast setup and global payments

- Ideal for remote team payroll and multi-currency transfers

- Suits freelancers on platforms like Upwork or Fiverr

- Useful for expanding into new countries without a physical branch

- Great for digital agencies handling global clients

When to Use a Physical Account

- Needed for paying local suppliers in cash

- Required for government tenders needing a local bank presence

- Useful for businesses with in-store cash and point-of-sale needs

- Preferred for audits and financial compliance

Financial Trends to Watch in 2025 and Beyond

Let’s take a look at how hybrid banking and virtual accounts are changing the way modern businesses manage their money.

The Rise of Hybrid Banking in 2025

So, what actually works for businesses today?

Businesses today aren’t picking between virtual and physical accounts. Most use both to streamline operations and expand globally.

A hybrid setup lets them:

- Collect payments from global clients through virtual accounts

- For example, a digital agency bills in GBP, USD, and JPY.

- Cover local expenses and cash deposits through a physical account

- For example, a shop handling in-person sales.

- Bill global and local clients with ease

- For example, a B2B SaaS platform serving the UK and Europe.

- Support online and retail operations

- For example, a fashion brand with both a Shopify store and a high street location.

- Manage payouts in multiple currencies

- For example, a marketplace pays out to vendors across regions.

Making the Right Choice for Your Business

If you’re still wondering which one is best, ask yourself these questions:

- Do you need to deposit or withdraw physical cash?

- Are your customers or clients global?

- Do you value speed and online control?

- Are there regulatory issues that affect your choices?

- Do you need to hold multiple currencies?

- Is managing multiple logins and accounts slowing down your operations?

- Do you frequently pay local vendors or employees in different countries?

- Are reconciliation and transaction tracking becoming a time drain?

- Do you want to reduce banking fees and admin overhead?

- Are you planning to scale globally without setting up offices abroad?

There’s no one-size-fits-all answer. But the good news is you don’t have to pick just one. Many successful entrepreneurs and modern businesses use both, switching between them as needs evolve.

Why More Businesses Are Moving Towards Virtual Accounts in 2025

Traditional banks weren’t built for the way modern businesses operate. Between the clunky paperwork, delayed international payments, and limited access outside office hours, they’ve become a bottleneck instead of a support system.

Virtual accounts offer faster setup, real-time visibility, and global reach without the hassle of opening local branches. Businesses can receive, hold, and convert multiple currencies from one dashboard, and automate flows through APIs that actually integrate with their systems.

The result? More flexibility, lower costs, and the ability to scale without friction.

DSGPay: Virtual Accounts That Actually Scale With You

If you are expanding into new markets, handling international payments, or working with multiple currencies, DSGPay offers flexible virtual account types that support smoother money management and better visibility across your finances.

Virtual Accounts That Match How You Work

DSGPay offers three types of virtual accounts. Each one is suited to different payment needs and business setups. Let’s take a closer look at how each account works:

- Named Virtual Account

- This is a virtual account that appears under your or your company’s name. It helps build client trust, supports multiple currencies, and is ideal for collecting payments.

- Example: A marketing agency uses named virtual accounts to receive payments from international clients under its own business name.

- Dynamic Virtual Account

- This type generates a new virtual account for each transaction or customer. It’s great for tracking incoming payments automatically, managing high-volume or changing flows, and simplifying reconciliation.

- Example: A logistics firm assigns a unique account number for each shipment to easily match payments to orders.

- Static Virtual Account

- A fixed virtual account number that stays the same for every payment. It’s perfect for repeat clients, simplifying recurring billing and reducing friction.

- Example: A corporate training company uses static virtual accounts to collect monthly fees from regular clients.

These options let you choose an account structure that fits how you actually work. You can separate customer payments, manage different projects, or keep subscriptions organised in one place.

Why Businesses Choose DSGPay?

- Named Virtual Accounts in Your Business Name: Instantly send and receive payments under your own brand across key markets like the U.S., Europe, Australia, Korea, UAE, Hong Kong, and more.

- Supports for 30+ Currencies: Hold, send, and receive payments in major currencies including USD, EUR, GBP, AUD, KRW, AED, HKD, SGD, and more.

- Seamless Global Transfers Without Local Bank Accounts: Access local rails and virtual IBANs to move funds across borders faster, without needing to open multiple physical bank accounts.

- Flexible Account Types That Fit Your Workflow: Choose from named, dynamic, or static virtual accounts to match how you invoice clients, track transactions, or manage multiple revenue streams.

- Competitive FX Rates & Lower Fees: Convert currencies instantly with transparent rates and avoid inflated markups.

- API & Dashboard Integration: Automate your financial operations and get full visibility with real-time tracking and intuitive reporting tools

- Licensed and Secure Infrastructure: Operates under a Hong Kong license and works with trusted financial institutions to ensure compliance, security, and peace of mind.

What Our Users Are Saying:

“We used to lose nearly 10 hours every week just sorting through payments from clients in the US, UK and Malaysia. Some came late. Others were missing references. It was a nightmare trying to match who paid what. After switching to DSGPay, each client now has their own virtual account. No more mix-ups. We’ve cut admin time by 80% and started getting paid three days faster on average.”

Adeel H.

SaaS Founder, Singapore

“DSGPay’s virtual accounts helped us scale quickly into new markets without needing a physical bank account in every country.”

Karla P.

E-commerce Business Owner, Philippines

“What I like most is how simple it is to set up. Within a few days, we had accounts ready to go and started collecting payments from clients in the UK and Australia.”

Jason L.

Freelance Consultant, Hong Kong

Want to hear more from real users? Explore more stories from businesses using DSGPay to simplify cross-border payments, save time, and grow globally. Read more reviews.

Conclusion

Scaling a business today means juggling currencies, platforms and markets. So this is not exactly a virtual account vs physical account debate. It is about picking what powers your growth without slowing you down.

DSGPay makes that easier, offering flexible virtual accounts that support your operations wherever and however you work.

Start simplifying your payments with DSGPay today.