Choosing how to receive money from abroad to the UK isn’t always simple. With so many services offering different fees, speeds, and features, it can be hard to know which one suits you best.

Whether you’re a business collecting payments from international partners, a freelancer working with overseas clients, or getting support from family, you’ll want a method that’s secure, fast, and affordable.

In this guide, we’ll explore the most reliable and cost-effective ways to receive international payments in the UK, so you can feel confident every step of the way.

Table of Contents

Key Takeaways

- Digital options are growing fast, and the UK’s digital remittance market is expected to reach US$6.04 billion in 2025, reflecting the shift away from slow, costly transfers.

- Receiving money from abroad to the UK is fast and affordable with services like Wise, Revolut, and DSGPay.

- Digital platforms often have better rates and lower fees than traditional banks.

- To receive international payments, you’ll need correct details like your IBAN, SWIFT/BIC, and full name.

- There’s no legal limit on how much you can receive, but large transfers may need to be flagged with your bank.

- Gifts from abroad aren’t usually taxed, but income earned from them in the UK might be.

5 Best Ways for Receiving Money from Abroad to the UK

Below is a quick comparison of the most commonly used services to help you identify the best way to receive money from abroad into a UK account.

1. Wise

Wise offers a modern solution for anyone looking for the best way to receive money from abroad to the UK. With local account details in multiple currencies, it allows individuals and businesses to get paid from overseas without high fees or long delays.

Pros:

- Clear, low fees with full transparency.

- Uses the mid-market exchange rate with no hidden markups.

- Fast transfers are often completed within seconds.

- Hold and convert between 40+ currencies in one account.

- Includes a Wise card for low-cost spending in multiple currencies.

Cons:

- Customer service can be slow or unresponsive for some users.

- Certain payment methods may result in slower transfers.

- No physical branches for in-person support.

- No loans or credit options like traditional banks.

2. Western Union

Western Union is one of the most well-known names in international money transfers. With a presence in over 200 countries and a large network of agent locations, it gives people in the UK flexible ways to receive money from abroad.

Whether the sender uses cash, card or bank transfer, the money can be received in person, through the app or straight into a bank account. It’s a familiar choice for many, especially when speed and worldwide access matter most.

Pros:

- Transfers can arrive within minutes when funded by cash.

- Extensive agent network across the UK for easy cash pick-up.

- Multiple ways to send and receive money, including in-person and online.

- Cash transfers are available for those without a bank account.

Cons:

- Higher fees and markups compared to providers like Wise.

- Less competitive exchange rates may reduce the received amount.

- Costs can vary based on the transfer method, making it hard to compare.

- The risk of scams exists despite built-in security measures.

3. Revolut

Revolut is trusted by over 55 million people around the world. It’s a simple way to receive money from abroad to the UK. Whether you’re paying for university, looking after a property, or getting help from family, Revolut gives you flexible options.

You can receive money through bank transfers, card payments, or instant transfers between Revolut accounts. You can use it in over 30 currencies, and built-in security helps keep your money safe.

Pros:

- Offers exchange rates close to the interbank rate on weekdays.

- Supports holding and exchanging multiple currencies in-app.

- Sends instant transaction notifications for better tracking.

- Transfers in Euros within SEPA can arrive almost instantly.

- Weekday transfers within limits are usually fee-free.

- Built-in budgeting tools help manage your spending.

Cons:

- A 1% currency conversion fee applies on weekends.

- Fee-free withdrawals and exchanges have monthly limits.

- Some users experience account freezes due to fraud checks.

- Not always reliable in refunding push payment fraud victims.

- Customer support may be limited for complex issues.

4. Bank Transfers (Barclays, HSBC, Lloyds, NatWest)

When sending money from abroad to the UK, bank transfers through well-known institutions like Barclays, HSBC, Lloyds, or NatWest are often seen as a secure and dependable option. These traditional banks have established global networks and offer the reassurance of regulated, traceable transactions.

However, while they provide peace of mind and familiarity, users should also be aware of factors like higher fees, slower transfer times, and less competitive exchange rates compared to newer digital money transfer services.

UK Bank Transfer Fee Comparison (2025)

Pros:

- Bank transfers are secure due to strict regulations and fraud protection.

- Established global networks like SWIFT ensure reliable transfers.

- Transfers are convenient if you have accounts in both countries.

- They offer a reliable method with a clear transaction history.

Cons:

- Bank transfers often come with higher fees than money transfer services.

- International transfers can take several business days to complete.

- Exchange rates offered by banks are usually less competitive.

- Hidden fees or exchange markups may apply without clear disclosure.

- The recipient’s bank may charge an incoming wire transfer fee.

5. WorldRemit

WorldRemit offers a simple and secure way to send money to the UK from abroad. The platform supports multiple transfer methods like bank deposits, mobile money, and cash pickup.

It provides real-time tracking, upfront pricing, and 24/7 customer support. With an easy signup process and quick delivery times, WorldRemit aims to make international transfers smooth and reliable for everyday users.

Pros:

- Supports transfers to many countries and currencies.

- Offers multiple ways to receive money like bank deposit, cash pickup, and mobile wallets.

- Transfers are often fast, especially with mobile money and cash pickup.

- 24/7 customer support is available for help anytime.

- Websites and mobile apps are easy to use.

- No minimum transfer amount is required.

Cons:

- Adds a markup to exchange rates, which can increase costs.

- Transfer fees change based on destination and payout method.

- Not all payout options are available in every country.

- Customer support can be slower during busy hours.

- Sending limits may restrict large transfers.

- No dedicated manager for high-value transfers.

Step-by-Step Process for Receiving Money from Abroad to the UK

Follow these steps to receive money from abroad to the UK smoothly and securely.

- Choose your preferred method: Decide between money transfer services (like Wise, Revolut, WorldRemit) or a traditional bank wire, based on fees, speed, and convenience.

- Provide the sender with your details: Share your IBAN, SWIFT/BIC code, full name (as on the account), and bank name. If using a service like Wise, include your local GBP account number and sort code.

- Confirm exchange rates and fees: Double-check the total cost and expected GBP amount with the sender before they initiate the transfer.

- Wait for funds to arrive: Transfers can take anywhere from seconds to a few business days, depending on the method used and any security checks.

- Double-check with your bank if large amounts are expected: Notifying your bank in advance helps prevent delays or temporary holds on incoming international payments.

Details Needed for International Payments to the UK

Make sure you have the correct account and bank details ready before the sender initiates the transfer.

- Your full name (as on the account): Ensure it matches the exact name registered with your bank.

- Bank account number or IBAN: Use your standard UK account number or the IBAN for international transfers.

- SWIFT/BIC code: This identifies your bank internationally (e.g., BARCGB22 for Barclays).

- Bank name and address: Include your bank’s official name and branch address if required.

- Reason for transfer (sometimes requested): Some providers ask for a brief explanation (e.g., “family support” or “freelance payment”) for compliance purposes.

How Much Money Can You Receive in the UK?

In the UK, there are no legal limits on how much money you can receive from abroad into your bank account.

However, banks and money transfer services might have their own limits, so it’s best to check with them if you’re expecting a large amount. If you bring £10,000 or more in cash into the UK, you must declare it at the border.

Gifts and inheritances from overseas are not taxed directly, but any income they earn in the UK, like bank interest, may be taxed. For wedding gifts, parents can give up to £5,000 tax-free and grandparents up to £2,500.

If someone gives you a large gift and passes away within seven years, it might be counted for inheritance tax. In short, you can receive large amounts from abroad, but you should always be aware of your bank’s rules and any tax requirements.

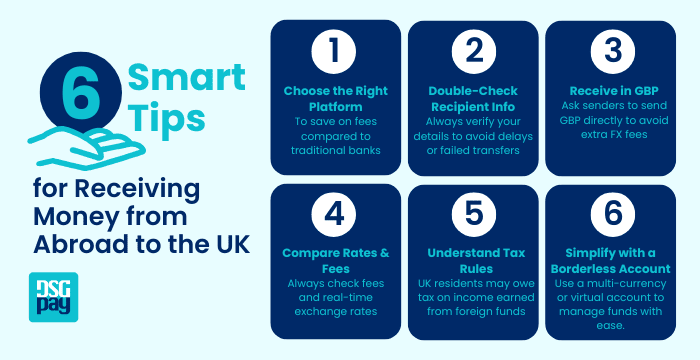

Tips for Receiving Money from Abroad to the UK

- Use a reliable money transfer service instead of traditional banks to save on fees.

- Always double-check your bank details to avoid delays or failed transfers.

- Receive funds in GBP when possible to reduce conversion losses.

- Watch out for hidden fees and compare exchange rates before choosing a service.

- Know the tax implications of receiving foreign income if you’re a UK resident.

- Consider a borderless account for easy multi-currency management.

FAQs for Receiving Money from Abroad to the UK

Do I have to pay tax when receiving money from abroad in the UK?

It depends on your residency status.

- If you’re a non-resident, UK tax usually does not apply.

- If you’re a UK resident, foreign income is typically taxable unless you’re eligible for Foreign Income & Gains relief.

How can I receive money from abroad in the UK?

A secure and common method is an international bank transfer. While traditional banks can be costly and slow, using a reliable global payment platform like DSGPay helps make the process faster, more affordable and easier to manage, ensuring the money reaches your UK account safely.

Can I transfer money from a US bank to a UK bank?

Yes, absolutely. USD to GBP transfers are possible and often complete within the same business day, depending on the transfer method and exchange rate processing times.

Is it legal to receive money from abroad in the UK?

Yes, it’s completely legal. While there are no legal limits, your bank or money transfer service might have internal limits for security and fraud prevention. It’s best to confirm with your provider.

DSGPay: Receive International Payments into the UK with Confidence

Chasing delayed transfers, losing money to poor exchange rates, and dealing with high fees should not be part of your workflow. DSGPay is built for those who need fast, reliable and cost-effective ways to receive money from abroad to the UK.

Whether you’re running a remote team, managing cross-border subscriptions or scaling an online business, DSGPay helps you get paid without the usual friction.

Benefits of Receiving Money from Abroad to the UK with DSGPay

- Flexible Virtual Account Options: Access both local and global virtual accounts to receive funds into the UK, making it easier for international customers or partners to pay you in their preferred way.

- Named Virtual Accounts in 30 Currencies: Receive payments under your business name in major global and local currencies without delays or forced conversions.

- Competitive Rates and Transparent Pricing: Benefit from competitive rates and low fees. All costs are shown upfront before the transfer begins, giving you better value compared to many traditional platforms.

- Fast transfers: Payments arrive quickly through DSGPay’s global network and local payment rails.

- Seamless API Integration: Integrate DSGPay directly into your internal systems or platforms. Automate your collections, streamline reconciliation, and scale efficiently.

- Real-Time Tracking and Notifications: Get full visibility on every transaction with live status updates and instant notifications via the DSGPay app and dashboard.

- Scalable for Growth: Suitable for both one-off payments and high volumes, making it ideal for growing businesses and cross-border sellers.

Concluding Thoughts on Receiving Money from Abroad to the UK

Receiving money from abroad to the UK is easy when you use the right service. Digital platforms are often faster and cheaper than banks, offering better exchange rates and fewer delays. Always check the fees, use correct account details, and try to receive payments in GBP to avoid extra costs.

If you want a simple way to manage international payments without delays or high fees, DSGPay gives you the control, speed and savings you need through one easy-to-use platform.