Whether you’re buying a home abroad, investing in a new business, or just moving money between your own accounts, transferring large sums of money between bank accounts comes with a few extra steps. From fees and limits to security and legal checks, there’s quite a bit to keep in mind.

In this guide, we’ll discuss the most common ways to transfer large amounts, cover the key legal points, and show you how to do it safely. We’ll also introduce a smarter way to handle international transfers.

So, let’s get started.

Table of Contents

Key Takeaways:

- Wire transfers and ACH are popular methods of transferring large sums of money between bank accounts. Each has different speeds and fees.

- Cheques and branch visits are still used, but may be slower and less secure.

- Always check for transfer limits, hidden fees, and security measures before sending.

- Online banking offers convenience but requires extra care to avoid errors.

- Virtual accounts are a modern alternative that can simplify large money transfers.

Is It Legal to Transfer Large Sums Between Bank Accounts?

Yes, it’s perfectly legal to transfer large sums between bank accounts, as long as the money comes from a legitimate source and isn’t tied to illegal activity.

While there’s no law capping how much you can move, banks are required to report transfers over $10,000 to the IRS under the Bank Secrecy Act to help flag potential financial crimes.

This doesn’t mean the transfer is illegal; it’s just a compliance measure. That said, large transfers might trigger tax implications if they relate to business income or investments.

Also, banks often impose their own limits on daily or monthly transfers for fraud prevention, so it’s worth checking with yours before initiating a big move.

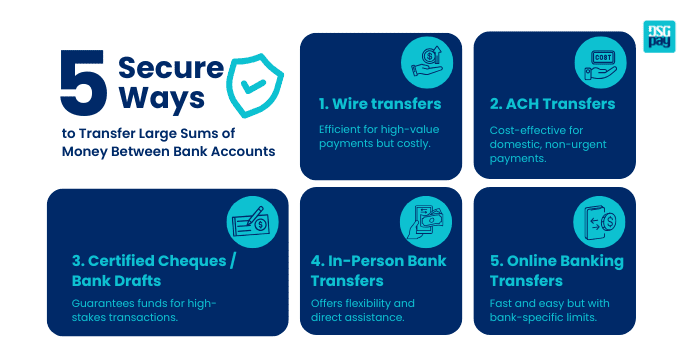

Common Ways to Transfer Large Sums of Money Between Bank Accounts

Here are some of the most popular methods for moving large amounts, including their pros, cons, and typical limits.

1. Wire transfers

Wire transfers are one of the most efficient and direct ways to transfer large sums between bank accounts, both domestically and internationally.

They’re commonly used for high-value payments like buying property, settling large invoices, or moving funds between business accounts.

The money goes straight from one bank to another, usually on the same day for domestic transfers, or within a couple of business days if it’s international.

They’re not cheap, and they’re not forgiving. One wrong digit can cause delays or worse. So if you’re sending a large amount, double-check the details and know what the fees look like before you send.

Typical Sending Limit:

Note: Limits and fees are subject to change over time. Always confirm with your bank for the latest information.

Pros:

- Fast processing times.

- Secure and direct between banks.

- Widely accepted across borders.

Cons:

- Transfer fees typically range from $25 to $50.

- Irreversible once processed.

- Requires accurate recipient banking information.

2. ACH Transfers (Automated Clearing House)

ACH transfers are the backbone of everyday payments in the US.

They’re used for things like payroll, bills, and moving money between accounts. Unlike wire transfers, they don’t move money instantly. They’re processed in batches, which keeps costs low but makes them slower.

For domestic, non-urgent payments, they work well and are cost-effective.

Typical Sending Limit:

Note: Limits and fees are subject to change over time. Always confirm with your bank for the latest information.

Pros:

- Low-cost or completely free.

- Ideal for domestic payments.

- Excellent for scheduled or recurring transfers (like salaries or rent).

Cons:

- Slower processing times (typically 1 to 3 business days).

- Not supported for international transfers.

- May be subject to delays due to bank holidays or processing cut-off times.

3. Certified Cheques / Bank Drafts

For high-stakes payments, certified cheques and bank drafts still matter.

Whether you’re buying property or closing a business deal, both offer one key thing: guaranteed funds. That’s why they’re trusted for large transactions where assurance and reliability are non-negotiable.

They may be old-school, but when certainty matters, they work.

Typical Sending Limit:

- No fixed limit.

- Transfers over $50,000 may prompt internal bank checks or additional verification.

Pros:

- Funds are guaranteed by the issuing bank, giving peace of mind to the recipient.

- Commonly used in real estate and legal transactions.

- It can be tracked in case of disputes or delays.

Cons:

- Must be physically delivered, which adds time and potential inconvenience.

- Slower to clear compared to electronic transfers.

- At risk of being lost, damaged, or stolen.

4. In-Person Bank Transfers

Sometimes, going into a bank branch is still the better option.

If you’re moving a large amount of money and want to avoid digital limits or get help from someone directly, speaking to staff in person can make the process smoother. It also lowers the chances of mistakes or fraud.

Banks tend to be more flexible with transfer limits when you’re dealing with them face to face. So if speed, security, or peace of mind matters, walking in might be worth it.

Typical Sending Limit:

- Varies by bank and account type

- Six-figure transfers can usually be approved with managerial oversight

Pros:

- Allows for higher transfer limits than online banking.

- In-person identity verification adds a layer of security.

- Staff can guide you through the process and address any issues on the spot.

Cons:

- Requires you to visit a physical branch, which may not be convenient.

- It may involve wait times, paperwork, or booking an appointment.

- Some banks charge fees for manual processing or high-value transfers.

5. Online Banking Transfers

Most people use online banking to check balances or pay bills. But it’s also a simple way to move large sums of money between accounts without visiting a branch.

Banks now let you transfer high-value amounts through their apps or websites. It’s fast, easy, and doesn’t require paperwork.

That said, each bank has its own limits. If you move large amounts often, it’s worth knowing what your bank actually allows.

Typical Sending Limit:

Depending on the bank and account type, limits can range from $1,000 to $250,000, with higher limits typically available for business accounts.

Pros:

- Accessible 24/7 from anywhere with an internet connection.

- Instant transfers between accounts at the same bank.

- Easy to schedule recurring payments or future-dated transfers.

Cons:

- Lower daily limits than in-person or wire transfers.

- High-value transfers may trigger verification holds or manual reviews.

- Not always suitable for international or time-sensitive transactions.

How to Transfer Large Sums Between Bank Accounts

Transferring large sums of money between bank accounts requires careful planning to ensure security, compliance with regulations, and minimal delays.

Here are the steps to follow:

- Check transfer limits with both banks.

- Choose the best method: Wire transfer for speed, ACH for low cost, or bank draft for security.

- Gather recipient details: Account number, routing number, and SWIFT or IBAN for international transfers.

- Initiate the transfer: Online for convenience, in person for large sums, or via phone banking.

- Verify all details: Confirm the recipient’s name, account number, and amount before sending.

- Monitor the transaction: Track progress through online banking or customer support.

- Prioritise security: Use trusted channels and avoid sharing sensitive details over unsecured platforms.

Things to Consider Before Transferring Large Sums of Money Between Bank Accounts

Let’s take a look at what things to look for when you’re sending large sums.

- Transfer method: Choose the option that suits your needs for speed, cost, and convenience.

- Security: Ensure the transfer method is secure and verify all recipient details.

- Transfer limits: Check your bank’s daily and per-transaction limits for large transfers.

- Fees and charges: Compare fees from both the sending and receiving banks.

- Processing time: Understand how long the transfer will take to reach the recipient.

- Required documentation: Be ready to provide ID or paperwork for high-value transfers.

- Exchange rates: Review conversion rates and additional fees for international transfers.

- Bank policies: Know your bank’s rules around large sums and possible hold periods.

- Proof of transfer: Choose a method that gives a receipt or confirmation for tracking.

- Legal and compliance checks: Large transfers may trigger regulatory review or reporting.

Tips for Transferring Large Sums of Money Between Bank Accounts

Here are some essential tips for businesses transferring large sums of money between bank accounts:

- Use business accounts with higher limits to handle large transactions more efficiently.

- Ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Keep detailed records of all transfers for accounting and tax purposes.

- Consider splitting large payments into smaller ones to stay within daily transfer caps, if appropriate.

- Avoid public Wi-Fi when initiating transfers.

- Use official bank apps or websites.

- Be cautious of phishing emails or scam calls posing as banks.

FAQs on Transferring Large Sums of Money Between Bank Accounts

Can I transfer $100,000 in one go?

Yes, though your bank may require you to do it in person or split it across several days.

Do banks report large transfers?

Yes. Transactions over $10,000 are often flagged for regulatory compliance.

What’s the safest method?

Wire transfers, certified cheques, or in-person bank transfers are generally the most secure.

Is there a maximum amount I can send?

Yes. It depends on your bank, the method, and whether it’s a domestic or international transfer.

Is It Safe to Transfer Large Sums Between Bank Accounts Online?

Transferring large sums online is generally safe when using secure methods, but requires careful precautions. Always choose trusted platforms like banks or regulated money transfer services with robust security measures.

Verify all recipient details thoroughly before sending funds, and remain cautious of suspicious requests or pressure to act quickly. For optimal security, enable additional protections like two-factor authentication and monitor transactions closely. When in doubt, consult your bank directly for high-value transfers.

Simplify Your Large Transfers With DSGPay

While bank-to-bank transfers are secure, another option is using a virtual account service. These accounts let you manage multiple currencies easily from home. Most providers also offer fast, same-day transfers with low fees.

Whether it’s local or international, DSGPay gives you a smarter, safer way to move your money without hassle. You get fast transfers, competitive exchange rates, and real support. Perfect for individuals and high-volume businesses alike.

Why Use DSGPay for Large International Transfers?

- Send and receive money across 30+ countries: Move large sums with ease to and from Hong Kong, Singapore, China, South Korea, Japan, Australia, the US, UK, EU and more, all in one secure platform.

- Favourable FX rates on high-value transfers: Save more when sending or receiving large amounts with competitive exchange rates and low, transparent fees that often outperform traditional banks and platforms.

- Named virtual accounts in 30 currencies: Receive large payments under your business name in major currencies, helping you maintain trust, compliance and credibility with high-value clients and partners.

- Built for Asia, ready for the world: Optimised for high-volume businesses operating in Asia with global ambitions, with infrastructure that supports complex multi-region transactions.

- Flexible integration options: Automate large, recurring transfers via a single API or manage manual payouts securely using our web and mobile platforms.

- Manage large transfers in one app: Gain full control over every stage of your high-value transaction, from funding and conversion to disbursement, through our centralised mobile app or online dashboard.

How Much You Save on Transferring Large Sums of Money with DSGPay

Whether you’re buying property overseas, paying global suppliers, or moving funds between your own accounts in different countries, DSGPay gives you control, speed, and lower fees, all in one platform.