Dubai is one of the world’s most connected financial hubs. Whether you’re paying suppliers, collecting from clients, or supporting your family, understanding how to send money to Dubai securely and affordably is essential.

In 2025, there are more ways than ever to transfer funds to Dubai, but the best method depends on your goals.

This guide breaks down everything you need to know, so you can compare options and choose the right solution with confidence.

Table of Contents

What Currency is Used in Dubai?

Dubai uses the United Arab Emirates Dirham (AED) as its official currency. When sending money from abroad to Dubai, the transfer can be:

- Send AED directly (preferred for speed and lower FX costs)

- Convert your home currency into AED before delivery (common, but may incur conversion fees)

Tip: Choosing a provider that supports direct AED transfers can save you money and reduce settlement delays.

What is an IBAN?

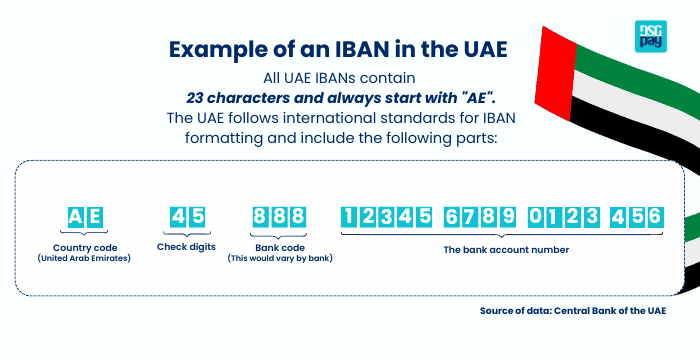

An IBAN (International Bank Account Number) is a globally standardised bank account number format used to identify individual bank accounts and route payments accurately.

Since 2011, the UAE Central Bank has required that all incoming and domestic transfers use an IBAN. Transfers without an IBAN may be rejected or delayed.

All UAE bank accounts are issued with a unique IBAN that begins with “AE” and contains 23 characters.

Why IBAN Is Essential for Sending Money to Dubai

- Required for all domestic and international payments into UAE accounts.

- Reduces errors and ensures your funds arrive at the correct destination.

- Missing or incorrect IBANs may cause failed transactions and extra fees.

4 Methods to Send Money to Dubai in 2025

When sending money to Dubai, whether for personal or business purposes, it’s important to choose a method that fits your needs.

1. Bank Transfers (via SWIFT and IBAN)

How it works: Funds are transferred through the SWIFT network between banks. You must provide both the recipient’s IBAN (to identify the account) and the bank’s SWIFT/BIC code (to identify the institution).

Examples: HSBC, Standard Chartered, Citibank, OFX

Pros:

- Globally supported.

- Secure for high-value transfers.

Cons:

- Multiple fees: sender, intermediary, and receiving bank.

- Poor FX transparency.

2. Online Payment Platforms

This method includes both online money transfer services for personal use and payment service providers (PSPs) built for business transactions.

How it works:

- Personal transfers: The sender uses a mobile app or website to initiate a transfer.

- Business payments: Businesses open a digital account to send, receive and manage their funds across different currencies.

Examples: Wise, Revolut, Xoom, Remitly, Airwallex, Statrys

Pros:

- Fast delivery and real-time tracking.

- Transparent FX rates and low fees.

- Scales for both individual and business needs.

Cons:

- Limited to supported currencies and jurisdictions.

- Some platforms may charge subscription or inactivity fees.

3. Cash Pickup

How it works: The Sender pays online or at a local agent. The recipient collects AED cash at a pickup point in Dubai.

Examples: Western Union, MoneyGram, Ria, GCC Exchange

Pros:

- Fast, often minutes.

- No bank account needed.

Cons:

- Higher fees and FX markups.

- Not ideal for business use.

4. Virtual Accounts

How it works: A virtual account is a digital account issued under your business name that functions like a local bank account. You can use it to receive, hold, and manage funds without needing a physical presence in that country.

Example: DSGPay

Pros:

- Receive AED locally without a UAE bank account.

- Hold, send, and receive money in many currencies.

- Faster and cheaper than SWIFT transfers.

- Competitive FX rates.

Cons:

- FX rates and fees vary by provider.

Compare Your 4 Options: Sending Money to Dubai

| Method | Provider | Speed | Fees | Best For |

| Bank Transfers (SWIFT & IBAN) | HSBC, Standard Chartered, Citibank, OFX | 2–5 business days | Medium–High | Large transfers, formal payments |

| Online Payment Platforms | Wise, Revolut, Xoom, Remitly, Airwallex, Statrys | Minutes – 1 day | Low–Medium | Individuals, SMEs, and Business |

| Cash Pickup | Western Union, MoneyGram, Ria, GCC Exchange | Minutes – few hours | High | Unbanked recipients, urgent cash needs |

| Virtual Accounts | DSGPay | Same day – 1 day | Low | Individuals, SMEs/Business payments, overseas companies |

Step-by-Step: How to Send Money to Dubai

Sending Money to Dubai? Here’s How Your Recipient Can Receive AED Seamlessly:

- Step 1: Choose the Right Transfer Method

- Select a method that fits your needs (bank transfer, online platform, cash pickup, or virtual account). Consider speed, fees, and whether the recipient has a UAE bank account.

- Step 2: Register Your Transfer Platform

- To begin, you’ll need to create an account or log in with a licensed provider.

- Step 3: Collect the Recipient’s Details

- Bank Transfer: Recipient name, UAE IBAN, bank SWIFT code

- Online Transfer: Name, bank name, account number or IBAN

- Virtual Account: Business name (pre-linked to account/IBAN)

- Cash Pickup: Full name (matching ID), phone number (optional)

- Step 4: Fund the Transfer

- Decide whether to send AED directly or let the provider convert your home currency. Before confirming, carefully check the transfer fee, FX Rates, and estimated delivery time.

- Step 5: Track and Confirm

- Monitor the transfer status through your provider’s dashboard, app, or email/SMS updates.

Factors to Consider Before Sending Money to Dubai

Whether you’re sending a personal remittance or a business payment, consider the following:

- Transfer fees: Different providers charge varying fees, such as flat fees, percentage-based fees, and intermediary bank fees

- Exchange rates: Some providers offer real-time and mid-market rates, while others include hidden markups.

- Transfer limits: Limits vary by provider and user type. Higher limits may require verification or business onboarding.

- Settlement speed: Transfers can be completed in minutes to several days. Choose based on your urgency.

- Compliance requirements: You may need to provide ID, declare the payment purpose, or submit documents, especially for large amounts.

FAQs on Sending Money to Dubai

Q: How long does it take to send money to Dubai?

Transfer speed depends on the method you choose. For urgent transfers, opt for digital services that support same-day AED payout.

Q: Can I send money to someone without a bank account in Dubai?

Yes, you can. If the recipient doesn’t have a local bank account, consider using a virtual account that doesn’t require traditional banking access.

Q: What is the cheapest way to send money to Dubai from abroad?

The cheapest method depends on the amount and currency you’re sending. Always compare the total cost, including fees and FX margin, before choosing a provider.

Q: Is it legal to send large amounts to Dubai?

Yes, it is, but transfers over certain thresholds may trigger compliance checks. You may need to provide documents such as invoices, contracts, or proof of funds. Always use licensed providers that follow anti-money laundering (AML) regulations.

Final Thoughts

Whether you’re sending business payments or personal transfers, navigating the best way to send money to Dubai comes down to speed, cost, and reliability.

With more transfer options available than ever, including reliable bank wires, digital platforms, and virtual accounts, the right method depends on your specific needs.

Simplify Your AED Transfers with DSGPay

Whether you’re a business expanding into the UAE or an individual managing international payments, DSGPay provides a seamless way to move AED.

Here’s how DSGPay helps you streamline your AED transactions:

- Collect AED Like a Local: Accept payments from UAE clients through local rails for faster settlement, reduce friction, and a better customer experience.

- Send AED via Domestic Rails: Transfer AED directly to UAE bank accounts using local payment rails, faster, cheaper, and more reliably than traditional SWIFT transfers.

- Get a Named Virtual AED Account with UAE IBAN: Each virtual account is issued under your business name with a UAE IBAN, allowing partners and clients to send payments under your brand, improving trust and reconciliation.

- Support for B2C, B2B, and C2B Use Cases: Whether you’re receiving customer payments, paying suppliers, or managing collections, DSGPay handles all common AED flows in one platform.

- No UAE Bank Account Needed: Access local AED payment capabilities without opening a UAE bank account.

- 30+ Currency Support for Global Business: Easily fund your AED transfers or convert collections into major global currencies, all managed from a single, unified platform.

- End-to-End API and Dashboard Integration: Use the API to automate your flows or manage everything from your DSGPay dashboard with full tracking and control.

- Mobile App Access: Monitor balances, initiate AED payments, and manage activity on the go with the DSGPay mobile app built for speed and flexibility.