Thinking of cost-effective ways to make payments to suppliers? Well, this is not as simple as it may sound. Large stacks of invoices, delayed transactions, and high fees incurred during the process can make the situation much more difficult.

With costs rising and market uncertainty making cash flow tighter, many businesses are struggling to keep up. A study by Sapio Research found that 52% of businesses delayed supplier payments by an average of 22 days over the past year. The result? Frustrated suppliers, potential supply chain disruptions, and even lost business opportunities.

So how can you make sure everything runs perfectly?

It’s simple, you choose a payment solution that is budget-friendly, secure, fast and has a good reputation in the market.

In this article, we’ll break down the supplier payment process, explore different methods, and show you how to make payments to suppliers effectively and affordably without the usual stress.

Table of Contents

Key Takeaways:

- Choosing a cost-effective payment method for suppliers is crucial to avoiding delays and high fees.

- Late payments can harm supplier relationships, disrupt the supply chain, and lead to lost business opportunities.

- Timely payments improve trust, ensure smooth operations, and provide better negotiation power with suppliers.

- Common payment methods include bank transfers, credit cards, checks, online platforms, and cash, each with pros and cons.

- The supplier payment process involves receiving and verifying invoices, selecting a payment method, initiating the transaction, and confirming payment.

- Consider payment terms, due dates, fees, and supplier preferences before making payments.

- Using a secure, fast, and reliable payment system helps maintain strong supplier relationships and business credibility.

What is a Supplier Payment

Supplier payment, also known as vendor payment, is the process of transferring funds to a business in exchange for goods or services necessary for operating your business. For example, a person starting an e-commerce store may source cheap products from China and pay suppliers for inventory, packaging and shipping fees.

These payments typically follow agreed terms, like paying within 30 days, though some businesses settle invoices faster or extend terms depending on cash flow and industry practices.

Important Note: Late payments can hurt your business’s reputation. To avoid conflicts with suppliers, identify and fix any issues that could cause delays.

Main Drivers of Late and Long Payment Terms

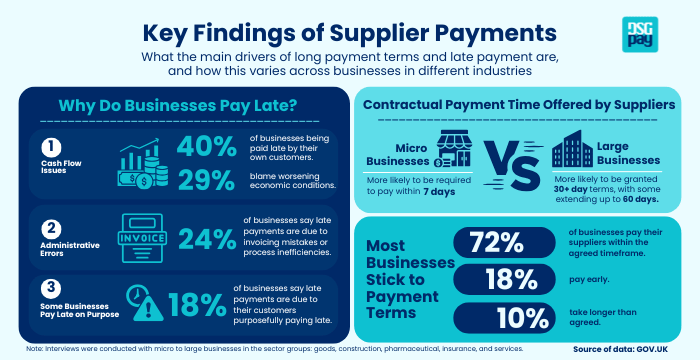

Some of the main drivers of delayed payments include cash flow issues, administrative inefficiencies, and intentional delays.

While micro businesses struggle more with cash flow, large businesses are more likely to enforce payment policies. The goods sector sees the longest payment terms, while services and micro businesses often settle invoices faster. The infographic can give you a clearer picture of what’s really happening in the market and why suppliers think twice before closing a deal with a business.

Importance of Fast and Reliable Payments to Suppliers

Businesses that want to grow in the long run must adhere to making timely payments to suppliers. This can benefit your business in multiple ways.

- Maintaining Supplier Relationship: If you’re paying your suppliers on the set schedule, they will trust you more and will look forward to working with you in future as well. In contrast, late payment can hurt a business’s creditworthiness and reputation in the market.

- Uninterrupted Supply Chain: When you make payments to suppliers on time, they won’t hesitate to deliver goods or services on time. As a result, you don’t have to worry about stock shortages or production delays.

- Better Negotiation Power: Your strong payment history reflects a lot about your business and puts you in a better position to negotiate your terms. It allows you to enjoy benefits like discounts or extended credit lines from suppliers.

- Avoiding Penalties and Extra Costs: Many suppliers impose late fees for overdue payments. Consistently paying on time prevents unnecessary costs and keeps your credit rating intact.

- Enhanced Business Reputation: A reputation for reliability attracts high-quality suppliers, strengthens industry credibility, and can even improve relationships with lenders and investors.

What Are the Payment Methods for Suppliers

Choosing the right payment method depends on factors like transaction size, processing speed, security requirements, and regional availability. Some offer lower fees for high-volume transactions, while others prioritize faster payouts or better fraud protection. It’s essential to weigh these factors against your business needs before choosing a platform.

There are various ways to make payments to suppliers, each with its advantages and drawbacks. Here are some of the most common options:

1. Bank Transfers

When thinking of sending payments to suppliers, the first solution that would come to your mind is bank transfers. They are considered reliable and secure means of transferring funds from one account to another. You can either conduct transactions on a domestic level or opt for SWIFT or Wire transfer for international transactions.

While bank transfers ensure a high level of security, they might turn out to be a less preferred option due to high fees and slow speed. Bank transfers can take 3-5 business days to reach the recipient. And if your supplier is not a patient one, they may get irritated and prioritise customers that pay faster.

If your supplier values quick payments, they may prefer alternative methods like digital wallets or instant payment platforms that offer faster transactions with lower fees.

Pros:

- Secure and widely accepted.

- Good for large payments.

- Provides clear records for accounting.

Cons:

- Can take several days to process.

- Fees can be high, especially for international transfers.

- Some banks require extra verification, causing delays.

2. Credit Cards

If you need to make payments to suppliers, credit cards offer a convenient and fast option. While they are quicker than bank transfers, the high interest rates can be a drawback, especially if you’re unable to repay the balance on time. Also, some suppliers might charge extra fees for credit card payments, which can add to the cost.

Pros:

- Fast and convenient.

- Helps manage cash flow with credit availability.

- Fraud protection and chargeback options.

Cons:

- High interest if not paid on time.

- Some suppliers charge extra fees for card payments.

- Credit limits may not cover large payments.

3. Checks

Checks are another means of making payments to suppliers. Though in this digital age, it might be an outdated method, still some follow this religiously. Post-dated checks let businesses delay payment until a future date when funds are available, while bearer checks can be cashed by anyone, making them less secure.

Although checks are becoming less common globally, they are still widely used in certain regions like the UAE due to local business customs.

Pros:

- Can delay payments with post-dated checks.

- Provides a written record of transactions.

- Still used in some regions and industries.

Cons:

- Slow processing time.

- Can be lost, stolen, or bounced.

- Becoming less common with digital payments.

4. Online Payment Platforms

A quick way to make payments to suppliers is through online payment platforms like Paypal, Stripe and Square. They offer convenience, support multiple currencies, and accept various payment methods.

However, they typically charge a percentage-based fee or a fixed transaction fee, which varies by platform and transaction type. Be sure to compare rates and terms to find the most cost-effective option for your business.

Pros:

- Fast and easy to use.

- Supports multiple currencies and payment options.

- Works 24/7 without banking delays.

Cons:

- Charges transaction fees.

- Some platforms hold funds temporarily.

- Not all suppliers accept online payments.

5. Cash

Paying suppliers in cash is straightforward and avoids transaction fees or delays. However, it comes with risks like theft, loss, and a lack of proper records, which can make tracking expenses and handling taxes more difficult.

Pros:

- No transaction fees.

- Instant payment with no delays.

- Simple and does not require a bank account.

Cons:

- High risk of theft or loss.

- Hard to track accounting and taxes.

- Not practical for large payments or remote transactions.

What is the Process of Supplier Payments

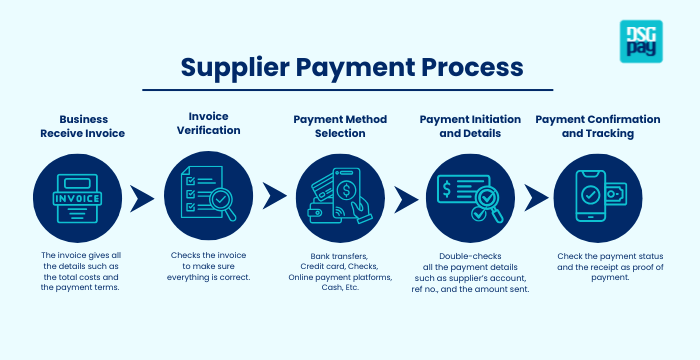

To make payments to suppliers, follow these steps.

1. Receive Invoice

The payment process begins when the supplier sends a bill (invoice) to the buyer. This bill lists what was provided, how much it cost, and when the payment is due. It’s basically a request for payment and gives all the details needed to move forward.

For example, if you order 200 custom stickers, the supplier might send an invoice saying you owe $300, payable within 30 days.

2. Invoice Verification

Before making a payment, the buyer carefully checks the invoice to make sure everything is correct. This means looking at the date, the amount due, the payment terms, and any taxes or discounts applied. Double-checking helps catch mistakes early, preventing overpayments or delays.

For example, if an invoice says $550 instead of the agreed $500, the buyer can contact the supplier to fix the error before sending the payment.

3. Payment Method Selection

The buyer selects a payment method based on what the supplier accepts, the payment terms, and any extra fees involved. Options include bank transfers, credit cards, checks, or online payment platforms like PayPal. Picking the right method ensures the payment goes through smoothly and securely.

For example, if a supplier prefers PayPal and offers a discount for using it, the buyer might choose that option to save money and speed up the process.

4. Payment Initiation

After choosing how to pay, the buyer moves forward by entering the supplier’s payment details and the amount to be sent. This could be through a bank, credit card, or an online payment platform. This step is important because it officially sends the money to the supplier.

For example, if paying by bank transfer, the buyer logs into their online banking, types in the supplier’s details, and clicks “send” to complete the payment.

5. Payment Details

Before finalizing the payment, the buyer double-checks all the details to make sure everything is correct. This includes the supplier’s account information, the amount being sent, and any reference numbers needed for tracking. Getting these details right is important to avoid delays or mistakes.

For example, if a single digit in the account number is wrong, the payment could go to the wrong person or get stuck in processing, causing unnecessary delays.

6. Payment Confirmation and Tracking

After sending the payment, the buyer usually gets a message or email from the bank or payment service confirming it’s been processed. To be sure everything goes smoothly, the buyer can check the payment status to see if it has gone through.

Once the supplier receives the money, they send a receipt as proof of payment. This is important in case there’s a mix-up or delay.

For example, if the supplier says they haven’t received the money, the buyer can use the confirmation details to sort out the issue.

Things to Consider Before You Make Payments to Suppliers

Before you make payments to suppliers, keep the following important factors in mind to ensure a smooth and strong relationship with your supplier.

1. Payment Terms

For starters, make sure you know the terms agreed upon with your suppliers.

- Due Dates: Pay on time to avoid late fees and keep a good relationship with your supplier.

- Early Payment Discounts: Some suppliers offer discounts if you pay early; this can help save money and improve cash flow.

- Why It Matters: Sticking to payment terms can strengthen supplier relationships, possibly leading to better deals or services.

2. Currency and Exchange Rates

If you’re paying suppliers in another country, keep these things in mind:

- Currency Conversion: Payments might need to be converted into another currency, so check the exchange rate before paying.

- Exchange Rate Fluctuations: Rates go up and down, which can make payments cheaper or more expensive.

- Transaction Fees: Banks and payment platforms often charge extra for currency conversion. Factor this into your costs.

- Why It Matters: Keeping an eye on exchange rates and fees helps you budget better and avoid surprises.

3. Security

Always use safe payment methods to protect your business from fraud.

- Secure Platforms: Use trusted and encrypted payment systems to keep your money and data safe.

- Why It Matters: Secure payments prevent financial losses and protect your reputation.

4. Cash Flow Management

Managing your money wisely is key to keeping your business running smoothly.

- Plan Payments: Make sure you have enough cash to cover supplier payments without putting a strain on your business.

- Avoid Cash Shortages: Paying too fast can leave you short on funds; delaying too much can upset suppliers. Find the right balance.

- Why It Matters: Smart cash flow management keeps your business stable and stress-free.

Other Things to Consider

- Supplier Relationships: A good relationship with suppliers can lead to better deals, discounts, or priority service.

- Rules & Regulations: Make sure your payments follow local and international laws, like anti-money laundering rules.

- Keep Records: Track all payments for accounting, audits, and future reference.

Tips for Building Strong Relationships With Suppliers

Building strong relationships with suppliers makes business smoother and more successful. Here are some simple ways to do it:

- Keep suppliers in the loop about your needs and any changes, and listen to their feedback.

- Pay on time, be clear about agreements and treat them fairly to build trust.

- Share useful market info and work towards common goals so everyone benefits.

- Be flexible and open to solving problems together when issues pop up.

- Take time to understand how their business works. It helps create better deals and stronger partnerships.

- Long-term contracts can mean better prices and more reliable service.

- Be honest and upfront. Don’t make promises you can’t keep.

- Use technology to make communication and payments easier.

- Make sure both you and your suppliers are working towards keeping customers happy.

Conclusion

Now you know how supplier payments work and the different ways to pay them. Late payments can mess up supply chains and strain relationships. To keep things smooth, businesses should choose the best payment method and supplier policies that fit their needs. Whether it’s bank transfers, credit cards, online platforms, or even old-school checks, the key is paying on time. A happy supplier means a happy business!

FAQS

Q: What is the supplier payment process?

The supplier payment process involves verifying invoices, getting approvals, and making payments using methods like bank transfers, credit cards, or online platforms.

Q: What are the best payment methods for suppliers?

Common methods include bank transfers, credit cards, online platforms, and digital wallets, depending on speed, cost, and convenience.

Q: Can I pay suppliers with a credit card?

Yes, many suppliers accept credit cards, but there may be transaction fees.

Q: What is the cheapest way to pay suppliers internationally?

Wise and Payoneer offer lower fees than traditional bank wire transfers for cross-border payments, but if you’re looking for the ultimate all-in-one solution with the lowest rates, fastest transactions, and top-tier security, DSGPay is the smarter choice.

DSGPay: The Ultimate Solution for Global Payments

In a fast-moving global market, you need a powerful, secure, and seamless payment solution to keep your supplier transactions swift, cost-effective, and hassle-free—no delays, no hidden fees, just total control over your payments.

With DSGPay, you get more than just transactions; you get efficiency. By leveraging virtual accounts, DSGPay simplifies cross-border payments, streamlines collections, and enhances financial management. Multi-currency support, automated tracking, and real-time notifications ensure that your supplier payments are smooth, cost-effective, and free from unnecessary complexities.

How to Make Payments to Suppliers With DSGPay

DSGPay makes it easy to pay suppliers all around the world. Here’s how you can do it:

- Get Set Up: Create a DSGPay account via DSGPay mobile app, verify your business details, and connect it to your payment system.

- Add Your Supplier: Collect their payment details and add them to the beneficiary details so they can receive payments.

- Use a Virtual Account: DSGPay provides virtual accounts, allowing you to hold 30+ currencies and simplify international transactions.

- Top Up Your Account: Top up your DSGPay account with the desired amount.

- Make a Payment: Enter the amount, choose the currency, and pick the best payment method.

- Check Notification: Check the transaction notification on DSGPay and let your supplier know once it’s done.

Why Choose DSGPay?

- Multi-Currency Support: DSGPay Virtual Accounts can hold, send, and receive funds in 30+ currencies.

- Named Account: Open an account in your business name.

- Fast & Easy: Real-time payments with minimal delays.

- Secure: Protects your transactions from fraud.

- Flexible: Hold and manage funds in different currencies

- Cost-Effective: Lower fees and better exchange rates.

- Mobile Apps: DSGPay’s mobile app allows you to send money in real time while on the go.

Using DSGPay’s virtual accounts and payment features, businesses can simplify supplier payments, reduce costs, and improve efficiency.