Cross-border payments are expected to reach $290 trillion by 2030. Through multi-currency accounts, businesses can store, manage, and transact in different currencies from a single account.

However, not every business understands the unique value of a multi-currency account, or what they stand to gain using it.

In this article, we’ll be exploring the reasons why your business needs a multi-currency account and how you can leverage that advantage.

Table of Contents

What is a Multi-Currency Account?

An account capable of receiving, sending, and holding multiple currencies from the same dashboard is referred to as a multi-currency account.

Unlike a traditional bank account that supports one currency (e.g., USD or HKD), a multi-currency account allows people to transact in multiple currencies without having to open separate accounts in each country.

For example, you can receive payments in USD, pay suppliers in EUR, and hold balances in GBP, all in one place. This flexibility makes it a powerful tool for remote workers and businesses trading across borders.

4 Top Businesses That Need a Multi-Currency Account System

Here are some primary business sectors that should apply these accounts to their payment infrastructures.

- For E-commerce Businesses: E-commerce companies can easily receive payments from global marketplaces like Amazon or Shopify, or pay other local suppliers with ease.

- For Freelance & Agency Businesses: These freelancers or remote workers can invoice and get paid by international clients without high conversion costs.

- For Import/Export Businesses: Business owners can pay overseas suppliers directly in their local currency, avoiding poor exchange rates.

- International Service Providers: Service providers with international clients gain streamlined billings and collections. This helps them tap into new markets and better serve more global clients.

Benefits of a Multi-Currency Account for Businesses

On a general level, these accounts can help you to:

1. Save on Currency Conversion Costs

Traditional banks often add high margins to their exchange rates, meaning you lose money every time you convert. With a multicurrency account, you can hold funds in foreign currencies until rates are favourable. This will help you save significantly on currency conversion fees.

For example, a US business that receives EUR payments can hold the funds in EUR and convert them to another currency only when necessary. This helps avoid multiple unnecessary exchanges.

2. Increase the Speed of Completing International Payments

Global trade thrives on speed. Waiting days for international bank wires can delay operations. Meanwhile, these accounts often allow local currency transfers, meaning faster delivery times and happier clients or suppliers.

3. Be Flexible in Managing Global Revenue

With the ability to hold multiple currencies, businesses can better manage global income. Instead of instantly converting all incoming funds, you choose when and how to exchange them, giving you more financial control.

4. Grow and Maintain Professional Image and Client Trust

Imagine a client finding out they can pay for international services using their local currency. Not only will this make payment convenient for them, but it will make your business look professional and internationally ready.

Key Features to Look for in a Multi-Currency Account

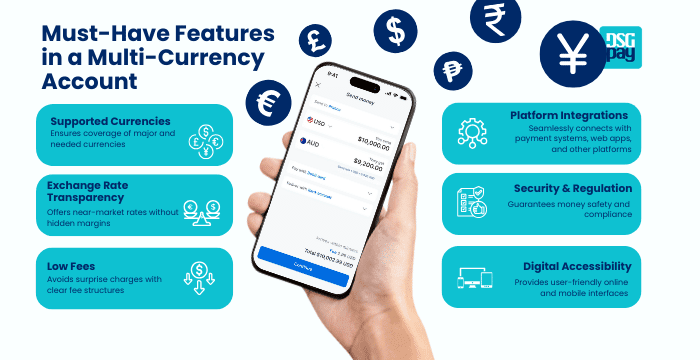

Here are some features to prioritise when you’re looking to open a multi-currency account:

- Supported Currencies: Ensure the account covers all the major currencies alongside the currencies you need most.

- Exchange Rate Transparency: Look for platforms that offer near-market rates without hidden margins.

- Low or No Hidden Fees: Choose a platform that states clearly what the fee you’re paying for is about so you can avoid surprise charges when sending, receiving, or holding funds.

- Platform Integrations: The account should be able to seamlessly connect with accounting and payment systems, web apps, and platforms like Amazon, Shopify, Upwork, or other platforms you use.

- Security & Regulation: A regulated provider ensures your money is safe and compliant.

- Digital Accessibility: User-friendly online and mobile interfaces for real-time access and transaction management are a must.

Finding the Right Multi-Currency Account Provider in 2025

Here are a few key things to note when picking your account provider.

- Evaluate your business size.

- Calculate the average transaction volume and global footprint of your business.

- Compare providers by focusing on the fees, currency ranges, transfer speeds, and platform usability.

- Factor in scalability to support future growth.

A provider that can easily meet all the above needs is suitable for your business.

DSGPay: The Smart Multi-Currency Account Solution For Businesses

While many providers offer multi-currency accounts, DSGPay was designed with utmost precision to cater to every business’s needs.

It goes beyond making simple international money transfers and strives to streamline all types of cross-border transactions. They allow users to hold multiple currencies while still offering other tools that match business usage to make it a complete international payment solution.

Why DSGPay Stands Out:

- Supports Multiple Global Currencies: DSGPay is capable of holding as many as 33 global currencies in one account. They include major currencies such as USD, GBP, EUR, AUD, etc.

- Named Virtual Accounts: DSGPay offers virtual accounts with global capabilities that match the name of your business. This makes for easy identification and fosters trust from foreign clients.

- Competitive Exchange and FX Rates: DSGPay uses competitive exchange rates to ensure transparency and a low-cost option for each currency conversion and cross-border transaction.

- Rapid Settlements: With DSGPay, you can take advantage of local rails to complete your international transactions within minutes. This ensures a recipient isn’t spending hours or days waiting for a payment.

- Multi-use Platform: Through DSGPay’s API system, the platform can connect to payment portals of various kinds.

- Fully Licensed and Secured: It utilises the latest security measures and holds a full license from Hong Kong and Australian authorities to ensure compliance with financial laws.

With DSGPay, you don’t just open a multi-currency account; you unlock a global payment gateway built to simplify your financial operations in 2025.

FAQs About Multi-Currency Accounts

1. Can individuals open a multi-currency account, or is it just for businesses?

Both individuals and businesses can open a multi-currency account. But the benefits are especially valuable for businesses handling international clients or suppliers.

2. What currencies can I hold in a multi-currency account?

The number of currencies depends on the provider. DSGPay, for example, supports major currencies like USD, EUR, GBP, AUD, and over 30 other currencies.

3. Is a multi-currency account better than using a traditional bank?

It depends on your business goals. Multi-currency accounts often provide lower fees and faster payments compared to traditional banks. However, some businesses may prefer banks for their in-person support of existing financial relationships.

4. Do I need multiple accounts for each currency?

No, a multi-currency account allows you to manage all currencies within a single account.

5. How do I get started with a multi-currency account?

Choose a trusted provider, sign up, complete the verification steps, and you’ll be able to start managing multiple currencies in one place.

Final Thoughts

A multi-currency account is no longer optional in 2025. It’s essential for businesses that want to thrive in the global economy by saving on fees and giving themselves a professional edge.

So, if you’re looking for the right provider, go over all the key features and choose a recommended platform like DSGPay that offers flexibility, speed, and transparency for businesses of all sizes. Now, future-proof your finances by opening a multi-currency account with DSGPay.