In today’s global economy, businesses often need to handle large amount money transfers efficiently. These transfers may be to suppliers, employees, or other partners across the world. With various payment methods available, choosing the right type of transfer can be overwhelming.

In this blog post, we will explore the most common types of large amount money transfers and provide recommendations on which might be best suited for your business needs.

What are Large Amount Money Transfers?

Large amount money transfers refer to the movement of high-value funds, typically USD 10,000 or more, either as a single transaction or across multiple recipients.

Also known as bulk payments or batch payments, large amount money transfers enable businesses to move significant sums efficiently using different payment rails, depending on their operational and geographic needs.

Understanding the options available and how they work can help you streamline your payment processes.

Explore the 7 Types of Large Amount Money Transfers

Handling large transfers can be a complex task, especially with the numerous options available. Below, we break down seven commonly used transfer methods to help you understand how they work and which one may best suit your business needs.

1. ACH (Automated Clearing House) Payments

ACH payments are U.S.-based electronic transactions processed in USD through the ACH network. They are commonly used for large amount money transfers, especially when businesses need to send high-value or bulk payments within the United States.

ACH payments are secure, reliable, and cost-effective, making them a popular choice for businesses of all sizes.

Compared to wire transfers and other methods, ACH payments offer a more economical way to handle large amount money transfers when speed is not the top priority.

🎯 Best for: Businesses making recurring payments or bulk transactions in USD within the U.S. at a lower cost.

Popular Providers for ACH Payment

- Chase Bank: One of the largest U.S. banks, widely used by businesses for ACH payroll, bill pay and recurring domestic transfers.

- Bank of America: Offers robust ACH solutions for small and large businesses, with batch payment support.

- Payoneer: Offers mass USD payouts via ACH, especially for freelancers, marketplaces, and global platforms.

- Wise: Wise uses the ACH network for low-cost USD transfers within the U.S. and to fund global payments.

2. Wire Transfers

Wire transfers are electronic payments sent directly from one bank to another. These payments typically go through the SWIFT network, which connects financial institutions around the world.

They are a trusted option for one-time, high-value transactions, such as paying international vendors, settling large invoices, or making large purchases.

🎯 Best for: Large, one-time payments that require speed, security, and international reach.

Popular Providers for Wire Transfers

- J.P. Morgan: Offers robust wire services with advanced fraud protection and tracking. Ideal for large corporates.

- HSBC: Offers extensive global transfer capabilities with strong SWIFT infrastructure.

- Citibank: Trusted for business wire transfers in over 100 markets.

- Standard Chartered: Strong presence in Asia, Africa, and the Middle East. Offers cross-border and domestic wires for businesses.

- Wells Fargo: Popular in the U.S. for domestic and international wire transfers, with tailored services for commercial clients.

- Deutsche Bank: Trusted in Europe and globally for corporate wire payments and treasury solutions.

- DBS Bank: Leading bank in Asia offering wire transfers with real-time tracking and digital tools for business payment management.

3. Cheques

Cheques are a traditional payment method that can be used for large amount money transfers, although many businesses are moving away from paper cheques and towards electronic payments. Cheques are easy to use, but slower and less secure than other mass payment options.

🎯 Best for: Businesses that prioritise ease of use and do not require immediate transaction completion.

4. Digital Wallet Payments

Digital wallet payments offer businesses an easy way to send large amounts of money to individuals or groups using a digital wallet platform. While traditionally used for smaller transfers, many digital wallets now support larger business transactions, especially for paying freelancers, remote teams, or digital vendors.

They offer fast, convenient, and often low-cost transfers, though limits, fees, and supported currencies can vary by platform.

🎯 Best for: Businesses that need a fast and convenient way to send large sums of money to individuals or groups.

Popular Digital Wallet Payment Providers

- PayPal Business: Widely accepted with options for mass payouts and invoice payments.

- Alipay (Global version): Used for large-scale cross-border e-commerce payments, especially in China. Supports enterprise accounts with higher transaction capabilities.

- WeChat Pay (via enterprise account): Accepts high-volume payments in CNY and is widely used in China for merchant and business payments.

5. Cryptocurrency Payments

Cryptocurrency payments, such as Bitcoin, Ethereum, or other digital assets, are a newer type of large amount money transfers that are growing in popularity.

Cryptocurrency payments can offer faster settlement for international transactions and improved accessibility when paying recipients in regions with limited banking services.

🎯 Best for: Businesses making cross-border large sum payments or paying individuals in countries with unstable currencies or limited access to traditional banking systems.

6. Escrow Services

For businesses dealing with high-value transactions, escrow services provide an added layer of security. An escrow provider holds the funds until both parties fulfil their agreed-upon conditions. This is particularly useful in industries like real estate, mergers and acquisitions, and high-value B2B contracts.

🎯 Best for: Businesses conducting high-value transactions that require third-party security, such as real estate deals or major B2B agreements.

7. P2P (Peer-to-Peer) Payments

P2P (Peer-to-Peer) payments are transactions where money is transferred directly between individuals or businesses without intermediaries like banks. These payments are typically facilitated through digital platforms or apps.

While traditionally used for personal payments, some businesses leverage P2P platforms for large amount money transfers. These methods are convenient for sending payments quickly, but they may have transaction limits and security risks compared to bank-based options.

🎯 Best for: Small businesses and freelancers who need a fast, low-cost transfer method for direct payments.

Popular P2P Payment Platforms

- Venmo: Widely used in the U.S. for personal and micro-business payments.

- Cash App: Supports direct peer-to-peer payments and banking features for U.S.-based freelancers and small businesses.

- Zelle: Linked to major U.S. banks and offers near-instant transfers for domestic use.

How to Choose the Right Large Amount Money Transfer Method?

When deciding which large amount money transfer method is best for your business, it’s important to consider the following factors:

- Payment Frequency: Are you making one-time transfers or recurring payments?

- Cost: Check the transaction fees, exchange rates, and hidden charges associated with each method.

- Security: Make sure the method is secure and follows financial rules.

- Speed: How quickly do you need the funds to reach the recipient? Some methods are instant, while others take days.

- Transfer Limits: Some methods impose caps on the amount you can transfer at once or within a given period.

- Ease of Use: Look for a transfer method that integrates seamlessly with your business operations and accounting systems.

- Global Reach: If you’re making international transfers, check whether the method supports the recipient’s country and currency.

- Reporting: Choose a method that offers detailed transaction tracking, statements, and automated reconciliation to simplify financial management.

If you’re unsure which type of large amount money transfer is right for your business, consult with a financial advisor or payment processor. They can help you understand the different options available and which is the best fit for your needs.

In conclusion, large amount money transfers are a convenient and efficient way for businesses to pay multiple parties simultaneously. Understanding the different types of large amount transfers can help you select the most suitable option for your business needs.

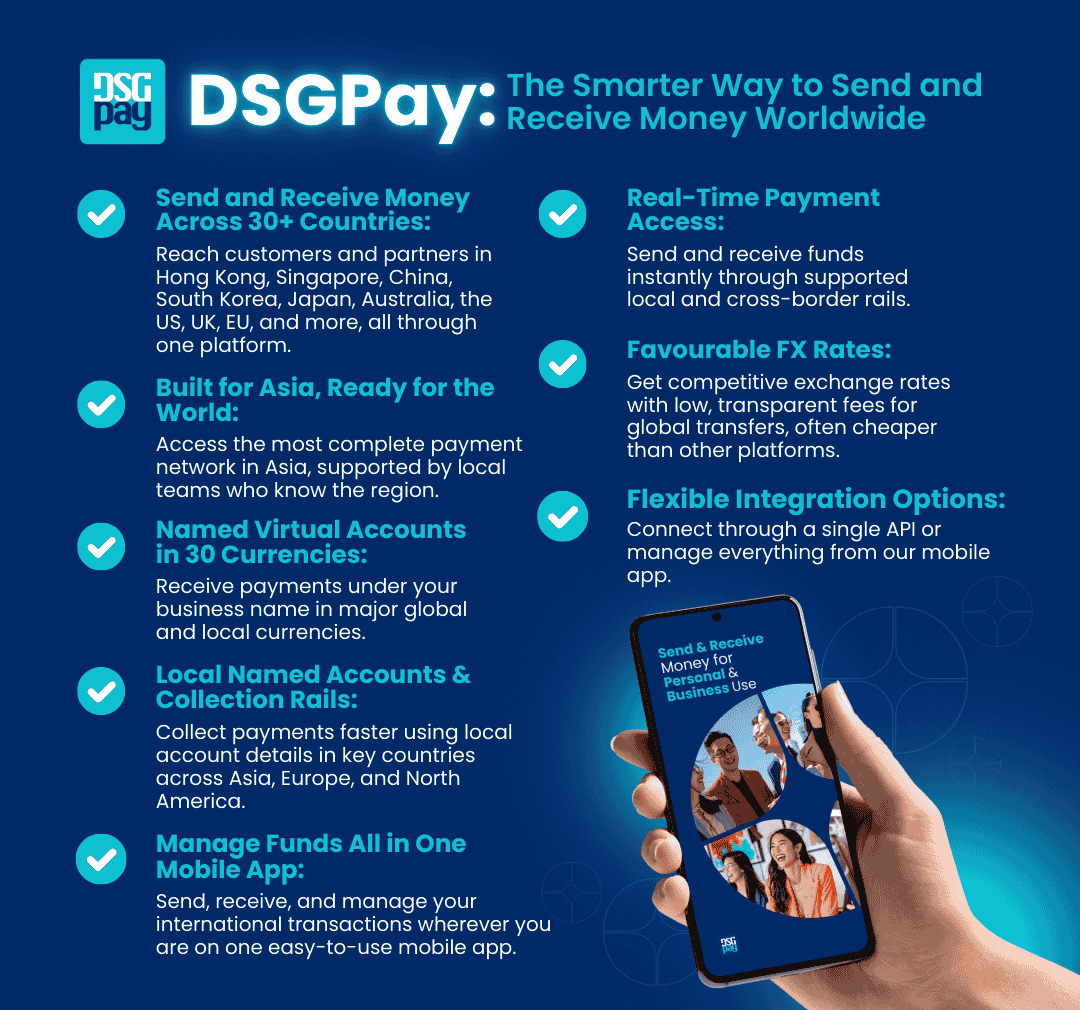

DSGPay: A Reliable Solution for Large Amount Money Transfers

Looking for a flexible, secure, and cost-effective way to move large sums of money across borders or between business accounts?

DSGPay offers a virtual account, an all-in-one solution built for individuals, SMEs, and corporations handling high-value transactions.

Why Choose DSGPay for Large Transfers?

- Named Virtual Accounts: Receive and send payments under your business name in major currencies like USD, EUR, HKD, and more.

- 30+ Currencies Supported: Hold, send, and convert funds globally with competitive and transparent exchange rates.

- Local & SWIFT Transfers: Access fast and reliable transfers through local banking rails and the SWIFT network, with full tracking.

- Lower Fees, Faster Processing: More cost-effective and efficient than traditional wire transfers.

- Secure Transaction: Compliance with global financial security standards.

- Mobile App Access: Manage your transfers anytime with a streamlined dashboard and easy-to-use mobile app.

Whether you’re paying suppliers, managing payroll, or handling cross-border business transactions, DSGPay ensures smooth and hassle-free large amount money transfers.