Waiting days for payments to arrive isn’t just frustrating, it slows your business down. It locks up cash you could be using, delays payouts, and makes planning harder than it should be. And in a world where customers expect everything instantly, outdated payment systems are starting to feel like a real obstacle.

Real-time payments change that. They move money in seconds, with instant confirmation and full visibility. Whether it’s paying suppliers, running payroll, or settling invoices, RTP keeps cash flowing, operations smooth, and customers satisfied.

In this article, we’ll break down how real-time payments work, why they matter, and the top providers leading the shift in 2025.

Table of Contents

Key Takeaways

- Real-Time Payments (RTP) move money between bank accounts in seconds, offering instant settlement, clear visibility, and 24/7 availability.

- Global RTP networks like FedNow in the US, UPI in India, Pix in Brazil, and PayNow in Singapore are changing how money moves across borders.

- RTP is driving new use cases across B2B, B2C, P2P, government, and cross-border payments, improving cash flow and customer experience.

- The RTP market is expected to grow from $24.91 billion in 2024 to over $284 billion by 2032, driven by mobile finance, AI security, and CBDC innovation.

- Top providers such as Visa Direct, Mastercard Send, PayPal, Alipay, and Ripple are building the infrastructure for faster, smarter, and more scalable global payments.

What Are Real-Time Payments (RTP)

Real-time payments (RTP) are instant digital transfers that send money directly between bank accounts in just a few seconds, working around the clock without the usual delays.

Unlike traditional payment methods:

- ACH transfers process transactions in batches and can take several days.

- Card payments pass through multiple intermediaries before reaching the recipient.

- RTP clears and settles funds immediately, with instant confirmation and full visibility.

The idea isn’t new. Japan introduced the first real-time payment system in the 1970s, and what began as a local innovation has now become a global standard. Today, major networks such as FedNow in the United States, UPI in India, and PIX in Brazil are reshaping the way money moves around the world.

In a financial landscape where speed and certainty are crucial, RTP is no longer a futuristic concept. It is rapidly becoming the default method for moving money across businesses, borders, and industries.

How Real-Time Payments Work: Step-by-Step

Real-Time Payments (RTP) are not instantaneous by chance; they follow a defined process that ensures security, speed, and accuracy. Every step in the flow plays a specific role, from capturing payment details to delivering funds in seconds. Here’s how it all works:

Step 1: Initiation

The first stage of a real-time payment is the initiation of the transaction. At this point, the sender provides the necessary details so the system can process the transfer securely.

- The sender initiates payment through a banking app, online portal, API, or even a QR code.

- Key details like account number, amount, and reference info are entered and formatted for real-time processing.

- In some cases, the recipient can even trigger the transaction with a “request-to-pay,” prompting the sender to approve and release funds.

Step 2: Authentication

Once a payment is initiated, the system must verify that the transaction is valid and authorised. This stage helps prevent fraud and ensures the sender has sufficient funds.

- The sender’s bank verifies identity through passwords, biometrics, OTPs, or device authentication.

- It confirms that funds are available before the payment is approved.

- Advanced tools, from real-time fraud detection to encryption and tokenisation, shield sensitive data before it leaves the bank.

Step 3: Network Processing

Once authenticated, the transaction enters the RTP network for rapid validation.

- The payment is sent into the national or regional RTP system (e.g., FedNow, RTP, UPI, Pix, or Faster Payments).

- The network validates the message format, ensures both the sender’s and recipient’s banks are connected, and checks compliance requirements.

- The recipient’s bank is notified to verify account details and signal readiness to receive funds.

Step 4: Clearing and Settlement

Transactions are processed individually and settled in real time.

- Both banks update their records immediately, reflecting the payment.

- The settlement authority debits the sender’s account and credits the recipient’s account within seconds.

- Funds move as soon as approval is complete, without batch delays.

Step 5: Confirmation and Finality

The process concludes with instant confirmation and guaranteed settlement.

- Both sender and recipient get instant notifications confirming the payment.

- Transaction details like invoice numbers or references are included to make reconciliation seamless.

- Once funds are settled, the transaction is final, no chargebacks, no uncertainty, just full control and immediate availability.

Market Outlook & Key Trends Shaping RTP in 2025

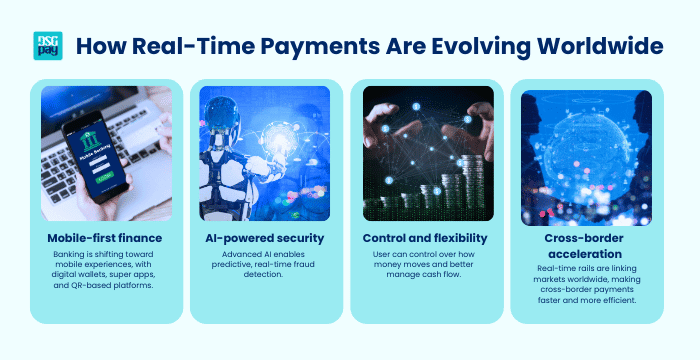

Real-time payments are becoming a central part of the financial backbone in a digital-first economy. The RTP market, valued at $24.91 billion in 2024, is projected to surge past $284 billion by 2032, showing that instant payments are steadily becoming the norm.

Here are the key forces shaping the RTP landscape:

- Mobile-first finance: Banking is moving to the palm of your hand. Digital wallets, super apps, and QR-based platforms are rapidly replacing traditional card payments, particularly across Asia, where mobile-first ecosystems are setting the pace.

- AI-powered security: As transaction volumes grow, so does the focus on security. Advanced AI is making fraud detection more predictive and adaptive, ensuring RTP remains both fast and safe.

- Control and flexibility: Tools like Pay-by-Bank and Request-to-Pay are giving users more visibility and control over how money moves, while helping businesses better manage cash flow.

- Cross-border acceleration: Real-time rails are now expanding beyond domestic markets. From near-instant global settlement to early Central Bank Digital Currency (CBDC) pilots, the push toward a fully connected payment ecosystem is gaining momentum.

Real-time payments are evolving from a payment option into the infrastructure that underpins global finance, enabling faster, smarter, and more seamless money movement for businesses, governments, and individuals alike.

6 Key Global Real-Time Payment Networks

Real-time payments are only as strong as the rails that power them. These networks are the invisible engines behind every instant transfer, linking banks, businesses, and consumers around the world in seconds.

Here are some of the major real-time payment (RTP) networks around the world:

1. United States: RTP and FedNow

In the US, two key players are transforming how money moves: RTP® from The Clearing House (launched in 2017) and the FedNow® Service from the Federal Reserve (2023). RTP is built for high-volume business payments, like payroll, supplier invoices, and merchant settlements, while FedNow is expanding access to real-time rails for smaller banks and fintechs.

Together, they’re steadily pushing the US closer to a fully instant, round-the-clock payments ecosystem.

2. United Kingdom: Faster Payments System (FPS)

The UK’s Faster Payments System (FPS) has been proving the power of real-time rails since 2008. It was one of the first networks to achieve mass adoption, and today it clears millions of transactions every day, from bill payments and online purchases to business transfers, with most completing in under a minute.

3. India: IMPS and UPI

India is one of the world’s leaders in real-time payments. IMPS (Immediate Payment Service) enables 24/7 interbank transfers, while UPI has become the backbone of the country’s digital economy, handling over 100 billion transactions in 2024 alone.

Its versatility is unmatched: from QR code payments at street stalls to request-to-pay for businesses, UPI is now the model many nations are trying to replicate.

4. Singapore: PayNow

In Singapore, PayNow has redefined convenience. Users can send money instantly with just a mobile number, NRIC, or corporate ID, no account details needed. It’s now a core part of Singapore’s cashless ecosystem, powering salary disbursements, e-commerce payments, and peer-to-peer transfers with equal ease.

5. Brazil: Pix

Launched by Brazil’s central bank in 2020, Pix is one of the fastest-growing real-time networks in the world. It processes billions of payments each year, from peer-to-peer transfers and online purchases to tax payments and utility bills. Its rapid adoption shows how government-led infrastructure can drive financial inclusion and transform everyday payments.

6. Indonesia: BI-FAST

Indonesia’s BI-FAST is built to support the country’s rapidly expanding digital economy. It delivers instant fund transfers, proxy payments, and large-scale corporate disbursements, all designed to speed up domestic transactions and connect millions of consumers and businesses to real-time financial services.

From New York to New Delhi, São Paulo to Singapore, real-time payment networks are rewriting the rules of money movement. And as they continue to expand in reach and capability, instant transactions are shifting from a competitive advantage to an industry standard.

Top 5 Real-Time Payment Providers Leading the Industry

Here are five leading providers shaping the real-time payments industry

| Company | Headquarters | Key Capability |

| Visa Direct | USA | Global coverage in 195+ countries with instant payouts to bank accounts, cards, and wallets |

| Mastercard Send | USA | Cross-border real-time payments in minutes, ideal for B2B, marketplaces, and gig payouts |

| PayPal | USA | End-to-end real-time payment ecosystem for consumers, merchants, and marketplaces |

| Alipay | China | Massive scale with 25B+ RTP transactions and deep integration into super-app services |

| Ripple | USA/Singapore | Blockchain-based real-time settlement, cutting cross-border costs and delays |

1. Visa Direct

Visa Direct isn’t just another payment rail; it’s how global businesses turn payouts into a growth lever. Instead of battling slow settlement cycles or clunky legacy systems, companies can offer seamless, instant payment experiences that customers now expect.

- Marketplaces can pay sellers the moment a sale closes.

- Gig platforms can boost loyalty with same-day earnings.

- Enterprises can improve cash flow visibility and operational agility overnight.

It’s the kind of infrastructure that makes payments disappear quietly into the background, and that’s exactly how users like it.

2. Mastercard Send

Mastercard Send is Mastercard’s real-time payment network that enables businesses to move money quickly to bank accounts, cards, and digital wallets. It integrates with existing banking and fintech infrastructure, allowing companies to offer real-time payouts with a broad reach.

- Insurers can settle claims in minutes instead of days.

- Platforms can clear merchant balances instantly.

- Businesses can compress entire payment cycles from days to hours.

It’s not just faster money movement; it’s a way to unlock new revenue streams and scale faster.

3. PayPal

PayPal has made real-time payments second nature. For consumers, money appears within seconds after a sale. For freelancers and small businesses, it means the ability to reinvest earnings on the same day.

And for brands, PayPal removes the friction that slows conversions, turning a payment tool into a revenue engine. With its ecosystem spanning wallets, marketplaces, and merchant services, PayPal helps businesses do more than just process payments; it helps them deepen customer relationships and capture more value with every transaction.

4. Alipay

Alipay is the heartbeat of a financial lifestyle. Real-time payments power a super-app where users can shop, borrow, invest, and insure, all in one place. This all-in-one approach makes transactions stickier and engagement stronger.

- Consumers in China use Alipay for everyday transactions, both online and offline.

- Merchants benefit from its integration into e-commerce platforms and retail environments.

- Global brands expanding into China and parts of Southeast Asia often adopt Alipay to reach local consumers who prefer mobile-first payments.

For global brands expanding into China or Southeast Asia, Alipay is more than a checkout option; it’s the bridge to customer trust, loyalty, and long-term growth in some of the world’s fastest-growing markets.

5. Ripple

Ripple is redefining how cross-border payments work. By stripping away layers of intermediaries, it eliminates the delays, costs, and friction that have slowed international transfers for decades.

The result: faster market entry, stronger margins, and happier customers, especially in regions where traditional rails can’t keep up. For banks, fintechs, and financial institutions, Ripple isn’t just a technology upgrade; it’s a strategic shortcut to global reach and real-time scale.

Real-Time Payments: Top Use Cases Across Industries

Here are some of the most common real-time payment use cases driving adoption across different industries.

B2B: Smoother Operations, Stronger Cash Flow

For businesses, liquidity is the lifeblood of growth, and RTP keeps it flowing without friction.

- Supplier payments: Pay invoices the moment they’re approved to strengthen relationships and avoid costly late fees.

- Intercompany transfers: Move funds between subsidiaries or accounts in seconds, improving agility and balance sheet control.

Treasury management: Gain real-time visibility into cash positions to improve forecasting and make faster financial decisions.

B2C: Meeting Rising Customer Expectations

Fast, predictable payments aren’t a nice-to-have anymore; they’re the baseline customers expect.

- Payroll: Push out salaries, bonuses, or adjustments instantly, even for last-minute changes.

- Refunds: Deliver refunds in real time to boost trust and reduce support costs.

- Gig payouts: Pay freelancers or gig workers the moment a task is complete, driving loyalty and platform stickiness.

P2P: Everyday Transfers, Simplified

For individuals, RTP removes the friction from personal payments, turning once-awkward money moments into seamless, instant transactions.

- Everyday transfers: Send money to friends or family in seconds, no waiting, no excuses.

- Remittances: Get funds across borders quickly and affordably, without the usual delays or high fees.

G2C: Improving Public Services and Support

Governments are using real-time rails to deliver public funds with greater speed, transparency, and impact.

- Tax refunds: Push refunds as soon as returns are processed, improving citizen experience.

- Social benefits: Ensure welfare payments arrive on time, every time.

- Disaster relief: Deliver emergency funds instantly when people need them most.

Cross-border: Removing Friction From Global Trade

Real-time infrastructure is now breaking through national borders, making international payments faster and more efficient.

- Remittances: Enable near-instant cross-border transfers with more competitive exchange rates.

- Multi-currency settlements: Pay global suppliers in real time to keep supply chains moving without disruption.

Cross-border real-time payments are doing more than speeding up transactions; they’re redefining how money powers the modern world.

Challenges and Risks to Consider

Real-time payments deliver speed and control, but they also come with new challenges. Knowing these risks upfront helps you build a smarter, safer payment strategy.

- Security risks: Payments happen in seconds, so fraud detection and real-time monitoring are essential.

- Irrevocability: Once sent, payments can’t be reversed, making refunds and dispute handling more complex.

- Interoperability: Many RTP systems don’t connect easily across borders due to different standards and networks.

- Regulation: Meeting AML, KYC, and privacy rules is harder, especially for cross-border transactions.

- High costs: Upgrading systems or building RTP capabilities can be expensive for smaller banks and fintechs.

Conclusion: RTP Is Becoming the New Financial Infrastructure

Real-time payments have moved far beyond being a shiny add-on; they’re fast becoming the financial backbone that everything else runs on. What started as a quicker way to send money is now transforming how businesses run their operations, how consumers expect to pay, and how governments deliver critical services.

The companies that embrace RTP now won’t just keep up, they’ll pull ahead. They’ll run faster, build deeper customer trust, and stay agile in a world where waiting for payments simply isn’t an option. The future of money isn’t coming, it’s already here, and it’s happening in real time.

DSGPay: Powering the Future of Cross-Border Real-Time Payments

Real-time payments are no longer limited to domestic networks like FedNow, UPI, or PIX. Businesses increasingly need solutions that combine instant settlement, multi-currency support, and cross-border capability. That’s where DSGPay helps bridge the gap.

With DSGPay, you can:

- Collect payments instantly through local named accounts, giving suppliers and customers the confidence of real-time settlement.

- Send payouts in seconds to bank accounts, e-wallets, or via local rails across key markets in Asia, the U.S., and Europe.

- Manage over 30+ currencies in one platform, with competitive FX and transparent fees.

- Integrate easily through a single API for collections and payouts.

- Operate securely under licensed, compliant infrastructure with strong AML standards.

- Scale flexibly with solutions designed for SMEs, corporates, and global enterprises.

By combining the speed of real-time payments with cross-border and multi-currency flexibility, DSGPay offers businesses a practical way to keep cash flowing, reduce delays, and meet customer expectations in a digital-first economy.