Getting paid should be simple. For many Australian businesses, it isn’t. Transfers take too long, card fees quietly cut into margins, and customers wrestle with account details that slow everything down. What should be straightforward often turns into uncertainty, and that uncertainty costs time, money, and momentum.

PayID was designed to change that. It replaces delays with speed, friction with clarity, and uncertainty with control.

Learning how to get PayID is not just about adopting a new payment method. It is about building a faster, more stable foundation for how your business gets paid.

Table of Contents

Key Takeaways

- 63% of Australian SMBs spend time chasing late payments, losing an average of AUD 1,328 each month. PayID helps reduce these delays by speeding up settlement times.

- PayID makes it faster and easier for businesses to receive payments.

- It works 24/7, so funds can arrive at any time, including weekends and public holidays.

- Businesses can set up multiple PayIDs to stay organised and flexible.

- Customers see your business name before paying, which builds trust.

- Keeping your PayID details updated ensures smooth and secure transactions.

What PayID is and Why It Matters

A PayID is a simple and secure way to receive payments without relying on traditional bank details. It is a unique identifier, such as your business mobile number, email address, or ABN, that connects directly to your business bank account.

When customers pay you, they only need to enter your PayID, confirm your business name, and send the funds. Payments are processed through New Payments Platform Australia Ltd (NPP) and usually arrive within seconds, at any time of the day or night.

Most major banks support PayID, including Commonwealth Bank of Australia, Westpac Banking Corporation, National Australia Bank and Australia and New Zealand Banking Group.

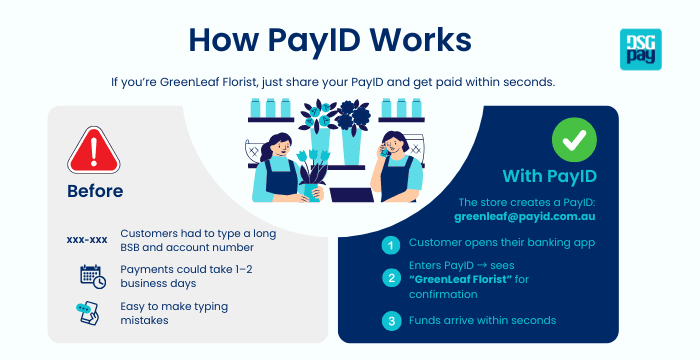

For example, imagine a small business called GreenLeaf Florist. Instead of asking customers to type in a long BSB (Bank State Branch) and account number, the owner sets up greenleaf@payid.com.au as their PayID.

A customer opens their banking app, enters PayID, sees “GreenLeaf Florist” displayed for confirmation, and sends the payment. Within seconds, the money appears in the business’s account, ready to be used or reconciled.

This simple step removes the friction from payments and gives both the business and the customer a faster and more reliable experience.

What You Need Before Registering PayID

Before learning how to get PayID for your business, make sure the essentials are in place. These are the foundations that make the setup process fast and smooth.

- An eligible business bank account with a participating financial institution.

- Authority to operate that account.

- A valid identifier such as a mobile number, email address, or ABN/ACN.

- Access to online or mobile banking.

- A bank that supports PayID and NPP payments.

How to Get PayID for Your Business

The steps to register for PayID are straightforward. While the exact process may vary slightly between banks, it follows the same clear path from start to finish.

- Log in to your business online banking: Access your account through your bank’s website or mobile app.

- Go to the PayID section: Look for a menu option labelled “PayID” or “Manage PayID”.

- Create a new PayID: Choose the business account you want to link.

- Select your identifier: Pick your business mobile number, email address or ABN/ACN.

- Link the PayID to your account: Connect it to the bank account where you want to receive payments.

- Set your PayID name: This is what customers will see when they make a payment. Make sure it reflects your business accurately.

- Verify your details: If you are using an email address or mobile number, your bank may send a verification code.

- Start receiving payments: Once verified, your PayID is active. Customers can send funds to this identifier, and payments will arrive almost instantly.

Using PayID After Setup

Once you’ve learned how to get PayID and completed the registration, using it in daily business is simple. Instead of giving customers your BSB and account number, you can share your PayID.

When they enter it, your business name appears for confirmation, and payments usually arrive within seconds, even on weekends and public holidays.

To get the most out of PayID after setup:

- Add your PayID to invoices, quotes and your website.

- Let regular customers and suppliers know it’s available.

- Highlight that it allows fast and secure payments.

- Keep your existing bank details active if needed for flexibility.

How Many PayIDs Can You Have

Once you know how to get PayID for your business, the next step is understanding how flexible it can be. PayID gives businesses more control over how they manage incoming payments, making it easier to stay organised and efficient.

- Multiple PayIDs for one account: You can link more than one PayID to the same bank account. For example, a business might use its mobile number as one PayID and an email address as another, both pointing to the same account. This gives customers more than one simple way to pay.

- Multiple PayIDs for different accounts: Different PayIDs can be linked to different accounts. A personal mobile number could be tied to a personal account, while a business ABN could be linked to a business account. This separation keeps transactions clear and organised.

- One PayID per identifier: Each individual identifier can only be connected to one account at a time. If a mobile number is already registered, it must be removed before it can be linked elsewhere.

- Joint accounts: For joint accounts, each account holder can create their own PayID. This allows payments to flow directly to the same account through separate identifiers.

How Can PayID Help Your Business?

Let’s take a look at why PayID is gaining ground as a smarter, more reliable payment solution for Australian businesses.

- Faster payment settlement: PayID payments are processed almost instantly, which means funds land in your account within seconds. This creates more predictable cash flow and helps businesses stay on top of their operations.

- Easier reconciliation: Every transaction comes with a clear payment description. Matching payments to invoices becomes faster and cleaner, reducing manual work and keeping financial records organised.

- Always available: PayID works around the clock, not just during banking hours. Whether it is a weekday or a weekend, payments can arrive at any time, giving your business the flexibility to move faster.

- More trust at checkout: When customers pay, they see your registered business name before confirming the transaction. This transparency builds confidence and strengthens the relationship between you and your customers.

- Fewer payment errors: Long account numbers are easy to mistype. PayID removes that risk by replacing them with a simple, memorable identifier. Fewer mistakes mean fewer delays and smoother transactions.

Key Things to Remember

When you understand how to get PayID and set it up correctly from the start, you avoid problems later on. A few simple rules help keep your payments secure, accurate and easy to manage.

- You can only link one PayID to one bank account at a time.

- If your contact details change, you will need to update or re-register your PayID.

- Customers should always verify your business name before confirming a payment.

- Banks may have specific eligibility rules for linking business accounts.

Conclusion

Knowing how to get PayID is a smart move for any business that wants to speed up payments and create a smoother experience for customers. It’s easy to set up, secure, and supported by major Australian banks. By offering PayID, you make it simpler for customers to pay you, while strengthening your cash flow and reducing delays.

Send and Receive AUD Payments Effortlessly with DSGPay

If your business works with Australian clients or partners, DSGPay makes PayID payments faster, smarter, and more global.

You can take advantage of a complete platform that helps you collect, hold, and send AUD, all in one place.

Why choose DSGPay?

- Named Virtual Accounts for AUD: Gain access to named virtual accounts that support AUD collections and payouts under your business name.

- Instant AUD Transfers via PayID: DSGPay fully supports PayID, Australia’s most trusted real-time payment network. You can send instant local payouts directly to your recipient’s Australian bank account through PayID within seconds.

- Support for 30+ Currencies: Hold, convert, and transfer funds in over 30 global currencies, including AUD, USD, GBP, EUR, HKD, and more.

- Transparent FX and Low Fees: Every transfer comes with clear, upfront rates.

- Regulated and Secure: DSGPay operates under strict regulatory standards across multiple regions, ensuring that every transaction is compliant, traceable, and protected from start to finish.

PayID simplifies your domestic collections, and DSGPay powers the global movement of funds, creating a fast, cost-efficient, and seamless payment flow for modern businesses.