Paying your team is more than just sending money. With 36% of HR executives at large U.S. companies open to hiring fully remote workers worldwide, payroll has become a central part of how businesses run.

The salary payment method you choose can shape everything from cost control and legal compliance to employee satisfaction and retention.

This guide examines the top salary payment methods for 2025, enabling you to select an approach that aligns with your team and goals.

Table of Contents

Key Takeaways:

- Salary payment method impacts cost, compliance and employee trust.

- Instant payments, digital wallets and global platforms are gaining ground.

- ACH and SEPA transfers remain reliable for local payroll.

- International money transfer platforms simplify cross-border payments.

- The best method fits your team size, location and future growth plans.

Global Trends & Shifts in Salary Payment Methods

Salary payments are moving away from slow, costly systems and shifting towards faster, more flexible solutions. New technology is changing how businesses pay their teams, especially across borders.

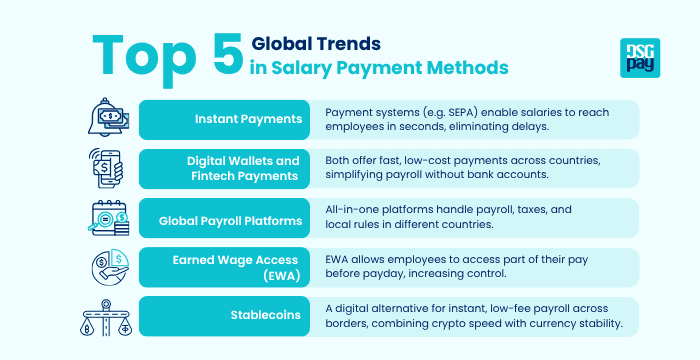

Here are the key trends leading the change:

- Instant Payments: Payment systems such as FedNow (U.S.), SEPA Instant (EU), and India’s Unified Payments Interface (UPI) let salaries reach employees in seconds rather than days. No more delays over weekends or holidays. Instant transfers are becoming a standard feature of modern payroll.

- Digital Wallets and Fintech Payments: Digital wallets offer fast, low-cost payments across countries and make it easier to pay workers without bank accounts. Fintech platforms are simplifying payroll and helping companies reduce payment costs.

- Global Payroll Platforms: All-in-one platforms handle payroll, taxes, and local rules in different countries. Businesses can pay international teams from a single system, cutting down errors, delays, and manual paperwork.

- Earned Wage Access (EWA): EWA allows employees to access part of their pay before payday. Combined with instant transfers, it gives staff more control over their income and helps employers offer more flexible benefits.

- Stablecoins: A digital alternative for instant, low-fee payroll across borders, combining crypto speed with currency stability.

5 Cost-Effective Salary Payment Methods for Businesses in 2025

1. Payroll Software with Automated Direct Deposit

Payroll software has become the core system of how small and mid-sized businesses handle salary payments. Instead of juggling spreadsheets, tax filings, and manual transfers, companies can automate the full process.

This improves accuracy, keeps them in line with changing labour laws, and frees up time for HR and finance teams. It gives businesses better control and visibility without adding to their administrative load.

Top Payroll Software Providers

| Provider | Best for | Key Features | Pricing |

| Gusto | SMBs and startups | Full-service payroll, benefits, tax filing | From $40/month + $6/employee |

| OnPay | Growing teams | Automated filings, easy onboarding | From $49/month + $6/employee |

| Patriot Payroll | Budget-conscious SMBs | Flat pricing, basic payroll | From $17/month + $4/employee |

| ADP | Larger businesses | Scalable solutions, strong compliance | Custom |

| Paychex | All sizes | Tax filing, reporting, integrations | $39 per month plus $5 per person |

Pros

- Saves time through automation and self-service features.

- Reduces errors and ensures compliance with tax and labour laws.

- Scales easily as teams grow.

Cons

- Monthly subscription costs can add up for very small businesses.

- Initial set-up may require time and onboarding.

- Some integrations may need customisation.

2. Direct Bank Transfers (ACH / SEPA / Local Rails)

Direct deposits are one of the most common payroll methods globally. Payments are sent directly into employees’ accounts through national or regional payment networks.

Comparison of Common Direct Transfer Methods

| Method | Cost | Speed | Compliance & Reporting | Global Reach | Best For |

| ACH | Very low | 1–3 business days | High, automated | Domestic only (U.S.) | SMBs |

| Local Rails | Low | Same day or 1 business day | High | Domestic only (varies by country) | SMEs in Asia-Pacific, AUS, etc. |

| SEPA Instant | Low to none | Seconds | High | Europe | EU businesses |

| Wire Transfer | High | 1–5 days | High | Global | Enterprises |

Pros

- Secure and widely accepted.

- Easy to automate and scale.

- Low domestic transaction costs.

Cons

- It can be slow for international transfers.

- Bank accounts are required for all employees.

- Wire transfers carry higher costs.

3. International Payment Platforms

For companies with remote or global teams, managing payroll across borders can be challenging. International payment platforms solve this by consolidating global payments, tax compliance, and currency conversions into one system.

It is ideal for scaling start-ups and businesses hiring globally.

Top International Payroll Providers

| Provider | Best for | Key Features | Pricing |

| Deel | Global teams | Payroll in 100+ countries | From $49/contractor |

| Remote | Distributed teams | EOR services, tax handling | From $29/contractor |

| Wise Business | SMBs | Low FX rates, multi-currency | Transaction-based |

| Papaya Global | Larger companies | Full global payroll | Custom |

Pros

- Handles cross-border payroll from one platform.

- Low FX rates compared with banks.

- Ensures compliance with local tax rules.

Cons

- More expensive than domestic payroll.

- Not necessary for local-only teams.

- Some platforms require minimum commitments.

4. Paper Cheques

Although considered outdated, some small businesses still rely on paper cheques for payroll. This method requires no software or special setup, making it straightforward for microbusinesses.

However, it is also the most time-consuming and error-prone option. For companies with more than a handful of employees, paper cheques quickly become inefficient and risky.

| Cost | Speed | Compliance & Reporting | Global Reach | Best For |

| Low | 2–7 days | Manual paperwork | Mostly domestic | Small traditional businesses |

Pros

- No transaction fees.

- Simple to issue.

- No technology set-up required.

Cons

- Time-consuming to manage.

- Prone to errors, loss, or theft.

- Lacks compliance and tracking features.

5. Crypto / Blockchain-Based Payments (Where Legal)

Crypto and stablecoins are an emerging option for businesses that want fast, borderless payments. Adoption is still limited but growing in tech-forward sectors.

| Method | Cost | Speed | Compliance & Reporting | Global Reach | Best For |

| Stablecoin Payouts (e.g. USDC, USDT) | Very low | Minutes | Low to medium | Global | Tech startups |

| Crypto Wallet Transfers | Low | Minutes | Low | Global | Freelancers |

Pros

- Very fast cross-border transactions.

- Low transfer costs.

- No need for bank accounts.

Cons

- Regulatory and tax hurdles.

- Volatility risks.

- Limited employee adoption.

How to Choose the Right Salary Payment Method

Each method comes with trade-offs in cost, timing, and control. The goal is to find one that fits your business today and still works as you grow. Here’s how to make that choice wisely.

1. Map Your Workforce

Start by identifying who you’re paying, where they’re based, and how they prefer to receive their salaries. A local team and a global workforce need very different solutions.

2. Weigh the Core Factors

- Cost: Look beyond upfront fees. Include FX mark-ups, transaction charges, and any intermediary costs.

- Compliance: Make sure the method supports local tax and labour requirements to avoid legal issues.

- Speed: Delays damage trust. Fast or real-time payments make payroll smoother for everyone.

- Global Reach: A single platform that handles multiple currencies is far easier than managing separate tools.

3. Define What Matters Most

Every business has different priorities. Some focus on cost, others on speed or compliance. Knowing your top priorities helps narrow down suitable options quickly.

4. Ensure Seamless Integration

A good salary payment method should plug into your existing systems with minimal friction. Automation reduces manual work and errors, especially as teams grow.

5. Plan for Future Growth

Pick a system that can handle more employees, more currencies, and more regions without a major overhaul later.

6. Assess on a Small Scale First

Test the system with a smaller group to spot issues early. Once the process is smooth, scale it company-wide with confidence.

Conclusion

Choosing the right salary payment method isn’t just admin; it’s a strategy. In 2025, businesses can choose from lean options like bank transfers to advanced digital payroll platforms.

Efficient payroll benefits everyone. Employees feel valued, and finance teams save time and avoid chaos. Whether you’re a startup or a large enterprise, the best method is the one that fits your goals.

Payroll isn’t a set-and-forget task. Review it often, stay open to new tech, and use tools that work for both your business and your people. When payroll runs smoothly, everything else does too.

DSGPay: Simplifying Salary Payment Methods Across Borders

DSGPay is redefining how businesses handle payroll by connecting them directly to fast, secure, and cost-efficient payment networks, all through one unified platform.

Whether you’re paying remote employees, overseas contractors, or local staff in different markets, DSGPay helps you move money confidently and transparently.

How DSGPay Transforms Your Payroll

- Global Named Accounts: Send salaries under your registered business name across supported countries.

- Multi-Currency Virtual Accounts: Hold, send, and receive payments in over 30 currencies without opening multiple bank accounts.

- Local and International Payouts: Pay salaries through local rails or SWIFT transfers, fast, traceable, and cost-efficient.

- Real-Time Notifications: Stay updated with instant alerts for every collection and payout to maintain full payroll visibility.

- Faster payouts: Deliver salaries in seconds across supported markets.

- Security and Compliance: Operates under strict AML and KYC standards, ensuring cross-border payroll meets regulatory requirements.

With DSGPay, you can focus on your people while we handle the salary payment method, ensuring every salary reaches your employees safely, on time, and in their local currency.