From the thriving local market to the fast-growing economy, you can start a business in the Philippines with the right mindset, knowledge, and skills.

This guide covers all the practical steps a foreigner needs to know to make their entrepreneurship dreams a reality.

Table of Contents

Key Takeaways

- To start a business in the Philippines, it’s important that you understand the laws and regulations guiding the establishment of new businesses by non-natives in the country.

- Choose a business structure and sector based on your goals, preferences, and state requirements. Bear in mind that your choice will have an effect on the overall business establishment in the long run.

- Long-term success requires paying taxes, following labour laws, and adapting to local culture.

Understanding the Legal Framework for Foreign Business Owners

Before getting ahead, it is crucial for prospecting foreign business owners to understand the legal landscape for foreign businesses in the Philippines. Some of the key laws that govern business ownership in the Philippines are:

- The Foreign Investment Act of 1991 (R.A. 7042) and its amendment (R.A. 8179): This law promotes foreign investments and sets the extent of a foreigner’s business ownership rights in the Philippines.

- The Philippine Foreign Investment Negative List (FINL) consists of two lists (List A and List B) that specify the sectors or industries where foreign investments are permitted, where they are partially allowed, and where they are not allowed entirely, due to constitutional reasons.

- The Philippine Constitution: In some sectors, such as education, land ownership, utilities, etc., the Constitution permits foreigners to hold up to 40% ownership rights in businesses. This way, foreign investors can be minority owners in businesses that allow multiple business executives.

The Philippines also has an Anti-Dummy law that ensures violators of the above laws are penalised accordingly.

How to Start a Business in the Philippines As a Foreigner

To start a business in the Philippines as a foreigner, there are a few key steps you need to follow.

Step 1: Knowing Business Ownership Rights

Anyone looking to start a business in the Philippines must first understand which industries or sectors are available to them.

Industries with 100% Ownership Rights

There are several industries in which a foreigner can start a business in the Philippines and still retain complete ownership rights.

These sectors include:

- Tourism and travel industry.

- IT and network carrier industry.

- Export industry.

- Wholesale trade businesses that meet the minimum capital requirements.

- Certain sectors like BPO and manufacturing.

Industries with Partial Ownership Rights

Most of these industries reduce ownership rights to various levels, contingent on the requirements. The primary purpose of this policy is to encourage foreign investments from a variety of sources. They include water and electricity distribution, real estate development, exploration of natural resources, and more.

Tip: If you register under the Philippine Economic Zone Authority (PEZA) or the Board of Investments (BOI), you may benefit from tax holidays, reduced tariffs, and relaxed business ownership laws.

Step 2: Choosing An Industry or Sector

Some of the high-profile sectors where you can start a business in the Philippines are:

- Education and training

- Healthcare services

- Finance and fintech

- Agriculture and agribusiness

- Renewable energy

- Tourism and hospitality

- Retail and e-commerce

- Manufacturing

- Real estate and construction

- IT and BPO services

Step 3: Choosing A Business Structure

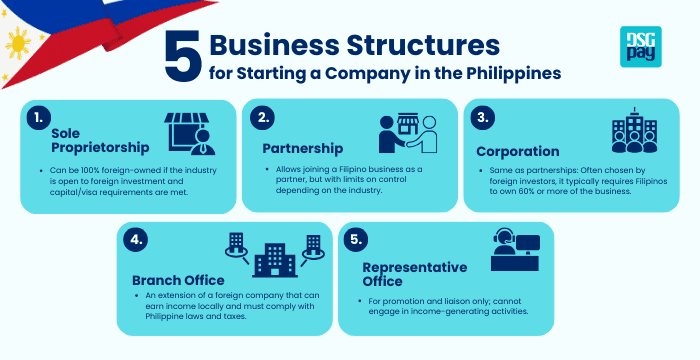

After choosing an industry, a foreigner who wants to start a business in the Philippines can choose to use any of the following business structures:

- Sole Proprietorship: For this business structure to be viable, you must meet certain age, visa, and other capital requirements.

- Partnership: You can also join a Filipino business as a partner in certain industries, but there are restrictions on how much control you can have over it.

- Corporation: The larger equity rights of the business belong to the Filipino side of the operation, up to 60% or more. This is the business structure mostly chosen by foreign investors.

- Branch Office: This structure is chosen when a foreign business expands its operations into the Philippines. The company can earn income locally and must comply with the Philippines’ local laws, taxing policies, and other corporate regulations.

- Representative Office: This structure accommodates foreign businesses that only promote their services but cannot engage in any profit-generating endeavours.

The selected business structure affects the rights of business ownership, capital requirements, taxation, and the permits required for the business.

Step 4: Comply With the Legal Requirements to Start a Business in the Philippines as a Foreigner

Here are all the legal requirements a foreigner must know to successfully start a business in the Philippines.

Visa and Residency Requirements

There are a few types of visas that can be of help to a foreigner looking to start a business in the Philippines. These visas often come with residency benefits and can allow the foreigner to stay in the Philippines for a while.

- 9(a) Visa: This visa is also known as a Temporary Visitor’s Visa. It allows for a short-term visit to the Philippines for business-related purposes. It gives a 30-day stay initially, which can then be extended by a maximum of 29 days to a total of 59 days. However, this visa does not support the establishment or long-term operation of a business. It is intended solely for business meetings and other short-term business purposes.

- Special Investor’s Resident Visa (SIRV): This visa offers a foreigner residency in the Philippines in exchange for certain investments into a business.

- Alien Employment Permit (AEP): This permit is issued by the Department of Labour and Employment (DOLE). It is required if a business is hiring foreign nationals to hold high-level positions in their business or company.

- 9(G) Work Visa: This type of visa is mandatory for businesses (local or foreign) looking to hire foreign nationals to hold any position in the business. The AEP is a requirement to apply for this visa.

Labor Requirements

Foreigners are required to hire Filipinos to hold positions in their companies or businesses to support local employment. They can, however, withhold specific managerial roles in the business by applying for an Alien Employment Permit (AEP) from the Department of Labour and Employment (DOLE).

Capital Requirements

For a domestic market business with foreign equity exceeding 40%, a minimum paid-up capital of $200,000 is generally required. This amount can be reduced to $100,000 if the business meets specific criteria, such as employing at least 50 Filipinos, utilising advanced technology, or being a registered start-up or startup enabler.

For export-only businesses, the paid-up capital requirement is as low as PHP 5,000, and the foreigner can have full ownership.

Documentary Requirements

To start a business in the Philippines, you must submit certain documents to the appropriate government bodies. The required documents include the business’s

- Articles of Incorporation

- Byelaws

- Purpose and Structure Details

- Share Distribution

- Proof of capital infusion

- Treasurer’s affidavit

- Proof of address

All of these documents are to be submitted to the Securities and Exchange Commission (SEC) or the Department of Trade and Industry (DTI).

Tip: Document submission may require the presence of a personal or authorised representative for the business.

Step 5: Register the Business

A foreign business owner must follow these steps to register their business in the Philippines:

- Reserve the Business Name: This is done by checking the SEC’s (for partnerships or corporations) or DTI’s (for sole proprietorships) online system to see if the business name they’ve decided on is available. If the name is available, they can then reserve it by completing the necessary steps.

- Submit the Necessary Documents: Prospecting business owners are required to submit all the above-stated documents to the SEC (for partnerships or corporations) or DTI (for sole proprietorships). Some of them may be required in hardcovers, which will require an in-person visit to the agency.

- Pay the SEC Registration Fees: Payment for the registration will be made on the SEC or DTI online platforms, following which a Certificate of Registration (CoR) will be given to you.

- Get the Business Permits: With the CoR, you can proceed to get the mandatory business permits, including the Mayor’s and Barangay’s business permits, from the local government units (LGUs).

- Register with the Bureau of Internal Revenue (BIR): Every business, regardless of structure type, is required to register with the BIR for tax purposes. Successful registration gives the business a Taxpayer Identification Number (TIN).

- Secondary Licences (If applicable): Business owners must obtain secondary licences from the appropriate government bodies if their foreign business operates in sectors like banking, insurance, medicine, and loans.

- Apply for Government Incentives: The Philippine government offers incentives and other special accreditations to businesses in various sectors, which foreign businesses can apply for. Some of the bodies that offer these incentives for businesses are PEZA, BOI, BOC, and PhilGEPS.

- Register with Social Security and Employee Benefit Agencies: Registering with the necessary agencies, such as the Social Security System (SSS), PhilHealth (PHIC), and Pag-IBIG Fund (HDMF), ensures your employees are eligible for their benefits. It also enables your business to further comply with pending labour laws in the country.

Tip: Business owners are expected to renew all their permits and licences as soon as they expire.

Step 6: Set Up The Payment Systems

Efficient payment processing is essential when you start a business in the Philippines as a foreigner. You’ll need a reliable way to manage both local and international payments.

Key points to consider when setting up your payment solutions:

- Banking Access: Foreigners can open business bank accounts in the Philippines, but requirements differ between banks.

- Multi-Currency Capability: If you work with overseas clients or suppliers, choose a provider that lets you hold, send, and convert multiple currencies.

- Online & Mobile Banking: Crucial for monitoring accounts and processing payments wherever you are.

- Minimum Deposit Requirements: Compare providers, as some require higher initial deposits than others.

- Virtual Accounts: These work like local bank accounts and allow you to receive payments in various currencies without maintaining multiple physical accounts.

Step 7: Understanding Tax Obligations

The Philippines uses a graduated tax rate for corporations and individuals.

The key taxes for foreign business owners are:

- Corporate Income Tax: Generally 25%

- VAT: Standard rate of 12%

- Withholding Taxes: Only applicable to certain payments

Tip: Hire a local accountant to avoid compliance issues.

Step 8: Hire Employees and Comply With Labour Laws

After setting up the location and hiring employees, a foreign business owner must comply with labour laws that protect employees.

These laws include:

- Equal Work Opportunities: The law mandates equal treatment of all workers regardless of sex, race, or creed.

- Security of Tenure: Employees have the right to job security, and termination must be for just cause and with due process.

- Weekly Rest Day: Employers must provide at least 24 consecutive hours of rest after every six consecutive workdays.

- Wages and Benefits: Employees are entitled to a fair wage, including overtime pay and other legally mandated benefits.

- Safe Working Conditions: Employers are responsible for providing a safe and healthy work environment.

- Right to Self-Organisation and Collective Bargaining: Workers have the right to form unions and bargain collectively.

- 13th-Month Pay: Employees are entitled to receive 13th-month pay, equivalent to one month’s salary, on or before December 24.

- Overtime Pay: Employees who work beyond eight hours a day are entitled to overtime pay, usually at a premium rate.

- Night Shift Differential: Employees who work the night shift are entitled to a night shift differential and additional payment for working at night.

Step 9: Adapt the Business to Local Culture

In order for a business to grow, building relationships is necessary. As a foreign business looking to make a stable foothold in a new market, it should:

- Respect the local customs.

- Use polite and professional language at all times.

- Attend networking events and make meaningful connections with locals as much as possible.

- Hire local legal advisers and partners for smoother navigation of cultural and regulatory nuances.

By following each of these steps, it should be easy for a foreign entrepreneur to start a business in the Philippines and manage it to successful heights.

How DSGPay Supports Foreign-Owned Businesses in the Philippines

One of the biggest challenges foreign entrepreneurs face when starting a business in the Philippines is managing both local and international payments without the delays and high costs of traditional banking.

DSGPay makes this easier with payment solutions designed for businesses operating in and beyond the Philippines:

- Named Virtual Accounts: Open a PHP virtual account in your business name to enhance trust and credibility with customers, suppliers, and partners.

- Local Collection in PHP: Accept payments from your customers and partners in Philippine pesos through local rails, with fast settlement times.

- Support 30+ Currencies: Hold, send, and receive payments in over 30 currencies, including PHP, USD, EUR, and more.

- Real-Time Tracking and Instant Alerts: Monitor every transaction step in the DSGPay app, from initiation to confirmation, with live status updates and automatic notifications.

- API Integration for Business Automation: Seamlessly connect DSGPay to your internal systems to streamline disbursements, recurring payments, and reconciliation workflows on a large scale.

Final Thoughts

Starting a business in the Philippines as a foreigner is quite feasible, despite the multiple steps involved. It requires the business owner to understand the legal frameworks, choose the right structure, register with the right government agencies, and manage finances effectively.

Equally important is adapting to the local culture and building strong relationships with partners, employees, and customers. Having efficient payment systems in place can also make it easier to manage transactions, handle multiple currencies, and grow your business both locally and internationally.

With the right preparation, trusted local advisers, and reliable financial tools, you can confidently enter the Philippine market and turn your business plans into a thriving reality.