You’re looking for a simple, reliable way to receive money from Dubai, without the delays, hidden fees, or banking headaches.

Whether it’s a one-off transfer or regular payments, this 2025 guide gives you everything you need to know to get your money fast, safe, and with minimal fuss.

Table of Contents

Key Takeaways:

- The UAE ranked 16th globally for ease of doing business and remains a strong hub for cross-border payments.

- Bank transfers are ideal for large invoices that require traceability and formal records.

- For recurring payments, digital platforms with automated billing features help streamline collections.

- Multi-currency accounts reduce conversion losses when operating in GBP, EUR, or USD.

- Integrating payment tools with your accounting system saves time and improves reporting accuracy.

Best Ways to Receive Money from Dubai (2025 Edition)

1. SWIFT Transfers

If you’re receiving money from Dubai for large invoices or dealing with UAE-based corporates, SWIFT transfers are likely your default. They’re the standard for structured, high-value payments such as salaries, long-term service contracts or formal business deals.

Why Businesses Use SWIFT Transfers:

- Professional image: Many UAE companies prefer to work only with businesses that have a registered entity and a bank account.

- Traceability: Comes with MT103, a proof of payment document widely accepted for audits or customs clearance.

How to Receive Money from Dubai via SWIFT Transfers:

- Share your IBAN and SWIFT/BIC code with the sender.

- Make sure your name matches your bank account exactly.

Pros:

- Globally accepted.

- Secure and trackable.

- Works well for B2B and B2C both.

Cons:

- Higher fees for the sender ($15–50 per transfer).

- Slower settlement (1–3 days).

- Currency conversion costs can be steep.

Ideal for: Exporters, consultants, agencies, and anyone issuing formal invoices.

2. Payoneer

Payoneer is a solid option for businesses working with UAE marketplaces, suppliers or affiliate networks. It connects smoothly with platforms like Amazon.ae and others, making it easier to receive money from Dubai without chasing down bank wires or dealing with clunky payment processes.

Why Businesses Use Payoneer:

- Marketplace integration: Automates payouts from eCommerce platforms.

- Recurring billing: Works well for monthly retainers or subscriptions.

How to Receive Money from Dubai via Payoneer:

- Register a Payoneer Business account.

- Receive via their Global Payment Service in USD, EUR, AED, etc.

- Withdraw to your local business bank account.

Pros:

- AED receiving accounts are available.

- Lower fees than SWIFT transfers.

- Supports bulk payments.

Cons:

- Higher FX spread compared to Wise.

- The account approval process can take time.

Ideal for: Amazon sellers, freelancers, agencies, and affiliate marketers.

3. UAE Exchange & Al Ansari Exchange for B2B Transfers

For SMEs and micro businesses working with buyers or distributors in the UAE, traditional exchange houses like UAE Exchange and Al Ansari Exchange still get the job done. They offer straightforward options like cash-to-bank and account-to-account transfers, which can be especially useful if your clients prefer dealing in person or need a local option to send payments.

Why Businesses Use UAE Exchange & Al Ansari Exchange:

- In-market accessibility: UAE clients can easily deposit AED at exchange branches.

- B2B friendly: Senders can share receipts and confirm transfers quickly.

How to Receive Money from Dubai via UAE Exchange & Al Ansari Exchange:

- Ask your client to use UAE Exchange or Al Ansari’s corporate service.

- Share your business bank account details (IBAN, SWIFT, company name).

- Client initiates the transfer via the branch or app.

- Funds arrive in your account within 1–2 business days.

Pros:

- Fast and accessible across the UAE.

- No need for the sender to use online banking.

Cons:

- Not suited for high-value or digital-first transactions.

- Requires a local partner to physically initiate the transfer.

Ideal for: Import/export businesses, SMEs with UAE retail partners.

4. Crypto & P2P for Advanced Users

Some businesses working with UAE clients have started accepting crypto, usually USDT or BTC, and then converting it to local currency through platforms like Binance P2P. It is not the best option for newer businesses due to volatility and compliance risks, but for companies familiar with the process, it can offer fast and borderless payments without the typical banking delays.

Why Businesses Use Crypto & P2P:

- Speed: Payments settle in minutes.

- Low cost: Near-zero transaction fees.

How to Receive Money from Dubai via Crypto & P2P:

- Sender sends crypto to your wallet address.

- Sell the crypto for cash or fiat via peer-to-peer service (e.g. Binance P2P).

- Withdraw to your local bank account.

Pros:

- Borderless and censorship-resistant.

- Instant settlement.

Cons:

- Volatile asset values.

- Regulatory uncertainty.

- Not suitable for tax-deductible invoicing.

Ideal for: Tech-savvy entrepreneurs, digital nomads, and businesses without access to banking.

5. Western Union

Western Union is a widely used option for receiving money from Dubai, especially when your sender prefers cash or bank-based transfers. The sender can walk into a local agent location or use the app to send AED, and you can receive the money as a cash pickup or direct deposit, depending on your country.

While it’s not the cheapest option, Western Union works well for one-off transfers or when your client doesn’t want to deal with online platforms. It’s accessible, fast, and doesn’t require either party to have a business account or prior setup.

Why Businesses Use Western Union:

- Global reach: Available in over 200 countries and territories.

- Flexibility: Cash pickup or bank deposit options.

How to Receive Money from Dubai via Western Union:

- Ask your client to send the AED via a Western Union agent or app.

- Receive funds at a local agent or in your bank account.

Pros:

- No account setup needed.

- Cash pickup available. (Some countries require ID verification for cash pickups or impose payout limits)

- Widely accessible in Dubai and worldwide.

Cons:

- Higher fees and poor exchange rates.

- Not suitable for recurring or large B2B payments.

- No automation or invoicing features.

Ideal for: One-off client payments, non-tech-savvy senders, urgent transfers.

6. Remitly

Remitly is a fast and user-friendly way to receive money from Dubai, especially for freelancers and small businesses working with individuals. Your client in the UAE can send AED using their local bank account, debit card, or credit card. You can then receive the payment as a bank deposit or cash pickup, depending on what your country supports.

While it’s more geared toward personal transfers, Remitly can work well for smaller, one-time business payments, especially when your client wants a simple online option.

Why Businesses Use Remitly:

- Affordable: Lower transfer fees than many banks.

- Speed: Express delivery is often within minutes.

How to Receive Money from Dubai via Remitly:

- Client sends AED via the Remitly app or website.

- You choose between direct deposit or cash pickup (availability depends on your country).

Pros:

- Fast delivery.

- Simple setup for sender and receiver.

- Supports debit/credit card funding.

Cons:

- Not built for high-volume business use.

- Exchange rates vary by speed and payout option.

- No invoicing or business features.

Ideal for: Freelancers, sole traders, and one-time payments.

How to Receive Money from Dubai: Step-by-Step

- Register your business: Before anything else, make sure you have a legally registered business in your home country. This is often a requirement for setting up business accounts with payment platforms or banks.

- Open a business bank account or virtual multi-currency account: Choose an account that supports receiving AED payments and offers favourable exchange rates. Virtual accounts with AED local receiving details make it easier for UAE clients to pay.

- Choose a payment method: Depending on your business needs, you can accept money via:

- SWIFT bank transfers (ideal for high-value invoices and corporate clients).

- Local UAE payment gateways (useful for faster, localised payments).

- Global remittance platforms (good for small-to-medium transactions).

- Send a formal invoice: Issue a professional invoice with your business name, invoice number, AED amount, payment deadline, and local account details.

- Request MT103 proof (for SWIFT transfers): Ask the payer for an MT103 document as confirmation once the transfer is made. It acts as a digital receipt and can help track or resolve delays.

- Monitor compliance requirements: Ensure your invoicing and payment process follows UAE VAT rules and anti-money laundering (AML/KYC) standards. Non-compliance may delay or block funds.

- Convert AED to your home currency: Once received, you can convert the AED payment at competitive rates using your multi-currency account or through your bank.

How to Choose the Best Way to Receive Money from Dubai

Selecting the right method to receive payments from Dubai is key to maintaining profitability and smooth operations.

- Use bank transfers for large invoices: For high-value transactions like service contracts or bulk product orders, bank transfers offer traceability, formal records, and a secure paper trail.

- Automate recurring payments: Monthly retainers or SaaS subscriptions are easier to manage through platforms that support automated billing and reconciliation.

- Choose methods based on speed: Bank wires may take up to three working days. Digital wallets and local payment gateways often settle funds within hours, helping with tighter cash flow cycles.

- Use multi-currency accounts: If you receive AED but operate in USD, EUR or GBP, opt for accounts that offer competitive FX rates to avoid unnecessary currency conversion losses.

- Compare total transfer costs: Look beyond basic fees and assess the real cost per AED 1,000 received, including transfer fees, FX markups, and account costs. Lower headline fees don’t always deliver better value.

- Pick tools that integrate: The best options plug directly into your invoicing or accounting tools, reducing admin time and making reconciliation smoother.

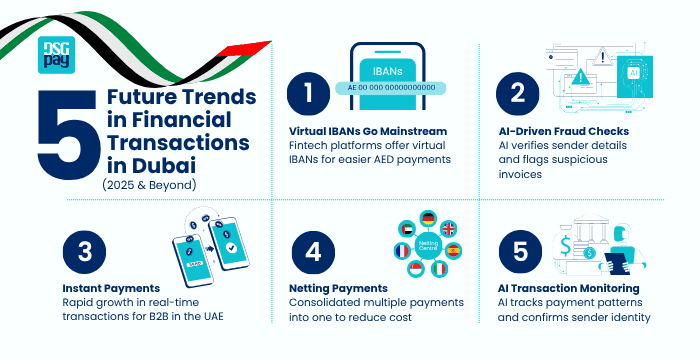

Future Trends in Financial Transactions in Dubai (2025 & Beyond)

Here’s what’s changing in how businesses receive money from Dubai:

- Virtual IBANs are going mainstream: You no longer need a UAE bank account to receive AED. Fintech platforms now offer virtual IBANs that let you get paid like a local. It is quicker, simpler and avoids unnecessary banking hurdles.

- Fraud checks are becoming smarter: Many platforms now use AI to verify sender details, flag suspicious invoices and block fake payments. It adds a layer of security when receiving funds.

- Instant payments are booming in the UAE: The Middle East saw 855 million real-time transactions last year, making it the fastest-growing region for digital payments. That number is expected to reach 3 billion by 2028, outpacing Europe and North America. Instant settlement is quickly becoming the norm for B2B transfers from Dubai.

- Settle only the final amount: If you have multiple UAE partners or suppliers, you can now net payments so that only the final balance is settled. This reduces transaction costs and currency exchange losses.

- AI is watching every transaction: AI tools run in the background to track payment patterns, confirm sender identity and catch anything suspicious. You stay protected without needing to manage it manually.

DSGPay: The Smart Way to Receive AED Payments from Dubai

If you’re looking for a reliable and flexible partner to receive payments from Dubai, DSGPay is purpose-built for modern cross-border businesses.

With support for AED, USD, EUR, and other currencies, DSGPay helps you collect payments from UAE partners quickly and with minimal fees.

Why Businesses Use DSGPay to Receive Money from Dubai:

- Local AED Collection, Global Access: Instantly receive AED through a UAE domestic transfer, no correspondent banks or delays.

- Named Virtual Accounts: Each virtual account is issued under your business name with a unique UAE IBAN, increasing trust and reducing payment friction.

- Multi-Currency Management: Hold, send, and receive funds in over 30 currencies, including AED, USD, EUR, HKD, and more.

- Fast settlements: Receive AED payments instantly for amounts up to AED 50,000. Higher-value transfers are typically credited within a few business hours, with no delays.

- Competitive FX rates: Convert AED to your currency with real-time exchange rates and no hidden markups.

- API integration: Easily connect DSGPay to your system for automated payment flows.

- Real-time tracking: Instantly monitor incoming transfers and receive payment notifications via the mobile app.

- Regulatory-ready: Built with robust AML/KYC compliance for international business use.

How to Receive Money from Dubai Using DSGPay App

- Sign up: Create your DSGPay account through the app. Add your personal or business details.

- Get a virtual AED account: Request a UAE IBAN. Acts like a local Dubai account.

- Share payment details: Give your Dubai client the DSGPay IBAN. They make a local UAE transfer.

- Receive funds: Money arrives in your DSGPay UAE virtual account, often the same day. You get notified instantly.

- Use your funds: Hold, convert or withdraw globally. Everything is managed in one app.

Concluding Thoughts on Receiving Money from Dubai

Business payments from Dubai have evolved. Traditional bank transfers no longer cut it, especially if you’re running an agency, exporting goods, or managing service contracts. The ideal payment setup now hinges on how often you get paid, what your clients expect, and how your backend operates.

DSGPay brings everything into one system: local AED collection, virtual accounts, real-time FX, API integrations, and automated reconciliation. You get faster settlements, better cash flow, and fewer payment headaches, all while keeping costs low and operations tight.

Whether you’re scaling up or just entering the UAE market, DSGPay offers the right mix of speed, reliability, and compliance.