If you shop online in foreign currencies or travel abroad, you might be paying more than you realise because of the Hong Kong credit card foreign transaction fee, which typically ranges from 1% to 2% per transaction. That means a HK$10,000 overseas spend could quietly add HK$100 – HK$300 to your bill.

Choosing the right credit card can help you balance low fees, better exchange rates, and rewards tailored to your lifestyle.

That’s why we’ve created this straightforward comparison, so you can spend smarter, whether browsing overseas websites or exploring the world.

Table of Contents

Key Takeaways

- The Hong Kong credit card foreign transaction fee generally ranges between 1% and 2% of your purchase.

- AEON Card WAKUWAKU and Standard Chartered Smart Credit Card are strong choices for lower fees.

- Exchange rate mark-ups and annual charges can impact overall costs as much as the fee itself.

- Premium cards such as the American Express Platinum Credit Card provide high-end perks but with higher fees.

- DSGPay is a smart alternative to card payments for handling large or frequent foreign transactions without incurring credit card foreign transaction fees in Hong Kong.

What Is a Hong Kong Credit Card Foreign Transaction Fee?

A Hong Kong credit card foreign transaction fee (also known as an international transaction fee) is a charge added when you use a Hong Kong-issued credit card to pay in a currency other than Hong Kong dollars (HK$).

This fee typically ranges between 1% and 2% of the transaction amount. It applies when you shop overseas or buy online from merchants based outside Hong Kong.

The fee helps cover the cost of currency conversion and the bank’s processing of international transactions. It is added as a percentage of your total spend. For example, 1.95% or 2% appears on your credit card bill.

Some credit cards waive this fee, which can help you save if you often spend in foreign currencies. Other alternatives include using debit or prepaid cards without foreign transaction fees, virtual accounts with online providers, or exchanging currency before you travel to avoid extra charges.

Hong Kong Credit Card Foreign Transaction Fee Comparison

1. AEON Card WAKUWAKU

The AEON Card WAKUWAKU is a Hong Kong credit card that offers cashback on online shopping, spending in Japan, and local dining. It comes with no annual fee and no extra overseas transaction fee from AEON, helping you avoid unnecessary Hong Kong credit card foreign transaction fee costs.

This card is a good choice for frequent travellers, online shoppers, and those who prefer contactless payments like Apple Pay or Google Pay.

Foreign transaction fees:

While AEON itself does not apply an additional foreign currency transaction fee, transactions made in foreign currencies using the AEON Card WAKUWAKU are still subject to a 1% fee charged by the card network (Mastercard, Visa, or JCB).

Who Can Apply:

- Hong Kong residents aged 18 or above.

- No minimum income required.

- New customer offers apply if you haven’t had an AEON credit card in the past 12 months.

- Apply easily through the AEON HK app.

Key Benefits:

- 6% cashback on online purchases.

- 3% cashback on spending in Japan.

- 1% cashback on local dining.

- Up to 16% welcome cashback for new customers.

- No annual fee, ever.

- Extra deals at AEON stores.

Other Fees:

- 35.02% interest on credit purchases.

- 35.86% interest on cash advances.

- Late fee: the lower of the minimum payment due or HK$300.

- Minimum repayment: all fees plus 1% of the balance (minimum HK$100).

This card is a good fit for online spending and trips to Japan, though you’ll still pay a 1% fee from the card network on foreign currency transactions.

2. Citi Cash Back Card

The Citi Cash Back Card is designed to help you earn rewards on everyday spending, both at home and abroad, while enjoying useful perks like purchase protection and welcome offers. Let’s break down what you need to know, especially when it comes to its foreign transaction fees.

Foreign Transaction Fees:

The Citi Cash Back Card charges a 1.95% fee on spending made in foreign currencies

Who Can Apply:

- Hong Kong residents aged 18 or above.

- Minimum annual income of HK$120,000.

- Must have a Hong Kong permanent ID and a local correspondence address.

- New customer offers apply if you haven’t held a Citi credit card in the past 12 months.

- Apply through Citibank or partner platforms.

Key Benefits:

- 2% cashback on local dining, hotels, online and overseas spending.

- 1% cashback on other local spending and e-wallet transactions (PayMe, Alipay, Octopus).

- First-year annual fee waiver (normal fee HK$1,800).

- Access to Citibank World Privileges in Hong Kong and abroad.

- Flexible instalment options (PayLite, FlexiBill, Quick Cash).

Other Fees:

- HK$1,800 annual fee (waived first year; future waivers possible based on spend).

- Late fee: 5% of the balance (min HK$220, max HK$350) or minimum payment due, whichever is higher.

- 4% cash advance fee (min HK$100).

3. DBS Eminent Card

If you regularly spend on dining, fitness, medical services, or sportswear, and want to earn cash rebates while enjoying premium privileges, the DBS Eminent Card could be a good fit. Just keep in mind the foreign transaction fee when using it overseas or for non-HK$ purchases, as these charges can add up.

Foreign Transaction Fees:

1.95% fee on transactions in foreign currencies. The fee is added after converting the amount to HK$.

Who Can Apply:

- Hong Kong residents aged 18 or above.

- Minimum annual income: HK$150,000 (Platinum) / HK$360,000 (Signature).

- Must have a Hong Kong permanent ID and local address.

- New customer offers apply if no DBS credit card in the past 12 months.

Key Benefits:

- 5% cashback on dining, fitness clubs, sportswear, and medical (monthly cap applies).

- 1% cashback on other retail and e-wallet spending (monthly cap applies).

- Dining and wellness discounts.

- Flexible instalment plans.

- Welcome cashback for new customers (terms apply).

Other Fees:

- Annual fee: HK$2,000 (Signature) / HK$1,800 (Platinum)

- Late fee: up to HK$300

- Cash advance fee: 4% + HK$20 admin fee

- Overlimit fee: HK$180

- Interest: 35.70% (Signature) / 34.58% (Platinum)

4. Mox Credit Card

If you want a credit card that does not require proof of income, the Mox Credit Card is a great option. Backed by Standard Chartered, HKT, PCCW and Trip.com, Mox offers a virtual card with fast online approval that can happen in just minutes without paperwork hassle.

Foreign Transaction Fees:

1.95% fee on foreign currency transactions (1% Mastercard + 0.95% Mox)

Who Can Apply:

- Hong Kong residents aged 18 or above.

- Valid Hong Kong identity card (permanent or non-permanent).

- Hong Kong residential and mailing address.

- Apply through the Mox app.

Key Benefits:

- Unlimited 2% cashback on all spending.

- 3% cashback at Hong Kong supermarkets.

- Option to earn 1 Asia Mile per HK$4 spent.

- Switch between cashback and Asia Miles rewards anytime via the app.

- No annual fee.

- FPS transfers via credit.

- Instant loan features.

- Up to 56 days’ interest-free period on eligible transactions.

Other Fees:

- 1.95% foreign exchange handling fee.

- HK$20 fee per overseas ATM withdrawal (Mastercard network).

- HK$50 card replacement fee.

- HK$350 metal card replacement fee

- HK$150 dispute charge.

- HK$25 per month for Spend Auto-Switch transactions.

5. HSBC Red Credit Card

If you’re after a credit card from a well-known international bank that gives you access to both local and global services, the HSBC Red Credit Card could be a great choice.

Issued by HSBC, this card is packed with rewarding cashback offers, whether you’re shopping online, dining out, or spending overseas. It also comes with a perpetual annual fee waiver, so you won’t have to worry about yearly charges as long as you keep the card active.

Foreign Transaction Fees:

1.95% fee on transactions in foreign currencies, including overseas merchants or online purchases outside Hong Kong.

Who Can Apply:

- Hong Kong residents aged 18 or above.

- Minimum annual income of HK$120,000.

- Hold a valid Hong Kong ID and local correspondence address.

- Apply online via HSBC’s platforms.

Key Benefits:

- Up to 4% RewardCash on online spending (first HK$10,000/month), then 1% thereafter.

- 1% RewardCash on local dining, supermarket, and designated categories, including overseas spend.

- Perpetual annual fee waiver.

- Instant virtual card activation and mobile wallet support.

- Special promo offers via HSBC Reward+ and Spend Instalment plans.

Other Fees:

- No annual fee.

- Retail APR: 35.42%; cash advance APR: 35.94%.

- Late payment fee: minimum payment due or HK$230, whichever is lower.

- Minimum payment: HK$50 plus 1% of statement balance and any fees.

- Instalment plan options from 6 to 60 months.

6. American Express Platinum Credit Card

The American Express Platinum Card is one of the most premium credit cards available in Hong Kong. While it comes with a higher annual fee, it offers exceptional value for those who can take full advantage of its extensive perks.

From luxury travel benefits and airport lounge access to generous reward points that can be redeemed for flights, shopping, and lifestyle services, this card is designed for those who want more from their everyday spending and adventures abroad.

That said, it’s still important to be mindful of the Hong Kong credit card foreign transaction fee, as even cards packed with premium benefits don’t necessarily protect you from these added costs on overseas spending.

Foreign Transaction Fees:

2% fee on foreign currency transactions (standard Hong Kong credit card foreign transaction fee for Amex)

Who Can Apply:

- Hong Kong or Macau residents aged 18 or above.

- Minimum annual income requirement: HK$ 300,000.

Key Benefits:

- Earn up to 5x Membership Rewards points per HK$1 spent during the first 3 months (capped).

- Ongoing earn rate: up to 3 points per HK$1 on all spending.

- Welcome offers: HK$300 statement credit + HK$700 upon reaching HK$10,000 spend.

- High-end travel perks: hotel credits, room upgrades, elite status, premium lounge access.

- Entertainment privileges: up to 40% off dining, Broadway Circuit ticket deals.

- Comprehensive travel insurance and purchase protection.

Other Fees:

- Annual fee: HK$2,200.

- Late payment fee: 5% of the outstanding minimum payment (HK$300 max, HK$300 min).

7. Standard Chartered Smart Credit Card

If you’re looking for a credit card that offers cashback on routine purchases with no annual fee or foreign transaction fee, the Standard Chartered Smart Credit Card is worth considering. It’s designed to reward both local and overseas purchases while keeping costs simple.

Foreign transaction fees:

The card charges no foreign transaction fees on online or overseas purchases.

Who Can Apply:

- Hong Kong residents aged 18 or above.

- Minimum annual income of HK$96,000.

- Must hold a valid Hong Kong ID and local address.

- Must be a new-to-bank cardholder (no Standard Chartered or Manhattan principal credit card in the past 6 months).

Key Benefits:

- 2% cashback on online spending.

- 1% cashback on offline spending.

- Up to 5% cashback at selected merchants such as supermarkets, convenience stores, fitness, beauty, and food.

- Perpetual annual fee waiver.

- Up to 90 days’ interest-free period on eligible transactions.

- Low-interest instalment plans on eligible purchases.

- Welcome offer with up to HK$800 cashback upon meeting spending requirements.

- FPS transfers of up to HK$40,000 monthly with fee waivers.

Other Fees:

- No annual fee.

- Retail APR is 35.70%.

- No cash advance fee.

- Late payment fee is 5% of the outstanding balance (minimum HK$220, maximum HK$350) or the minimum payment due, whichever is lower.

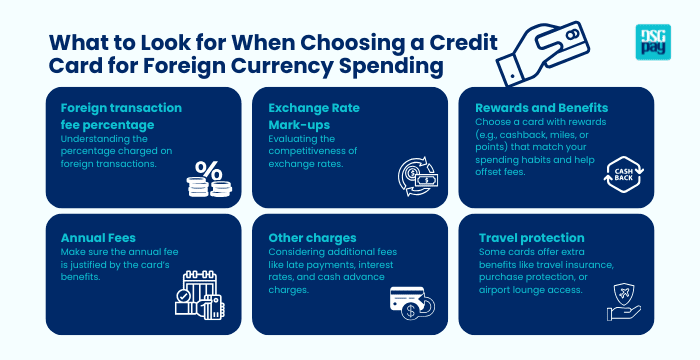

What to Consider When Choosing a Card to Minimise Hong Kong Credit Card Foreign Transaction Fee

When choosing a credit card for overseas spending or online purchases in foreign currencies, it’s important to look beyond just the Hong Kong credit card foreign transaction fee.

Here are other key factors to consider:

- Foreign transaction fee percentage: Different cards charge different rates, usually between 1% and 2%. Even small differences can add up if you regularly spend in foreign currencies.

- Exchange rate mark-ups: Some cards offer low foreign transaction fees but apply less competitive exchange rates, which can still increase your costs.

- Rewards and benefits: Consider whether the rewards, such as cashback, air miles or points, suit your spending habits and help offset the fees.

- Annual fees: Check if the card’s annual fee provides value for money through its rewards or perks, particularly if you do not spend abroad often.

- Other charges: Look at additional fees such as late payment fees, interest rates and cash advance charges, as these can affect the total cost of using the card.

- Travel protection: Some cards offer extra benefits like travel insurance, purchase protection, or airport lounge access, which may justify a slightly higher Hong Kong credit card foreign transaction fee.

By weighing up these factors, you can choose a card that helps manage your Hong Kong credit card foreign transaction fee while offering the right mix of value and convenience.

DSGPay Virtual Account: A Smart Alternative to Credit Cards for Foreign Payments

If you’re managing payments across currencies and borders, credit cards can quickly become costly and limiting.

DSGPay provides an alternative that’s tailored for modern international transactions, offering a virtual account solution that gives you greater control, faster access to funds, and the ability to transact in multiple currencies without the typical fees associated with credit cards.

Whether you’re sending funds to overseas partners, collecting payments from global clients, or simply looking for a more transparent way to handle foreign currency, DSGPay helps you manage it all in one place.

What You Get with DSGPay:

- Virtual accounts in Your Business Name

- Access named virtual accounts in 30+ currencies. Accept payments globally under your own business identity without the complexity of setting up local bank accounts.

- Send and Receive Across 30+ Countries

- Send and receive payments across major markets, including Hong Kong, Singapore, China, South Korea, Japan, Australia, the US, UK, EU, and more, all from one platform.

- Local Collection Details, Faster Payments

- Use local account numbers to collect funds in key markets across Asia, North America, and Europe, speeding up settlement and improving cash flow.

- Transparent FX with Competitive Rates

- Convert and transfer funds with clarity. Enjoy competitive exchange rates and low, transparent fees for every transaction.

- Real-Time Access to Your Funds

- Send and receive payments instantly through supported local and cross-border rails, ideal for fast-moving businesses.

- API and Mobile App Options

- Whether you need flexible integration or hands-on mobile control, DSGPay adapts to your business operations.

DSGPay gives you more control over your international payments, whether for personal use or business needs.

Conclusion: Pick the Right Card to Minimise Hong Kong Credit Card Foreign Transaction Fee

Selecting the right credit card can make a big difference in managing your Hong Kong credit card foreign transaction fee. Whether you’re after lower fees, better rewards or valuable travel perks, it’s important to consider the full package that includes annual charges, exchange rate mark-ups and additional benefits.

Cards such as the AEON Card WAKUWAKU and Standard Chartered Smart Credit Card stand out for those who want to reduce costs. On the other hand, premium cards such as the Amex Platinum offer valuable benefits but come at a higher fee.

If you’re making large or recurring international payments, a credit card may not always be the most cost-effective option. DSGPay offers a smart alternative, allowing you to send and receive payments in multiple currencies without incurring credit card foreign transaction fees, ideal for those seeking greater transparency and control over cross-border spending.